Axsome Therapeutics, Inc.

AXSM

incurred a loss of 90 cents per share for fourth-quarter 2021, narrower than the Zacks Consensus Estimate of a loss of 99 cents but wider than the year-ago loss of 78 cents.

Axsome does not have any approved product in its portfolio currently. As a result, the company is yet to generate revenues from the same.

Quarter in Detail

Research and development expenses were $13.8 million for the quarter, down 20.7% from the year-ago period owing to the completion of a few clinical studies.

General and administrative expenses were $18.8 million, up 81.7% year over year. The significant increase was due to higher pre-commercialization activities related to the potential launch of AXS-05 and AXS-07.

As of Dec 31, 2021, Axsome had cash worth $86.5 million compared with $114.6 million on Sep 30, 2021.

Full-Year Results

For 2021, Axsome incurred a loss of $3.47 per share compared with the year-ago loss of $2.77.

2022 Guidance

Management believes that its cash balance as of December-end and term-loan facility will be enough to fund operations into 2024.

Axsome expects an increase in operating expenses on account of pipeline development and commercialization activities.

Pipeline Update

Axsome’s key pipeline candidates including AXS-05, AXS-07, AXS-12 and AXS-14 are currently being developed for multiple central nervous system indications.

AXS-05

AXS-05, one of Axsome’s lead candidates, is being developed for treating major depressive disorder (“MDD”), treatment-resistant depression (“TRD”), smoking cessation and agitation associated with Alzheimer’s disease (“AD”).

The company’s new drug application (“NDA”) seeking approval for AXS-05 for MDD is under priority review with the FDA. Last year, the FDA identified deficiencies related to analytical methods in the chemistry, manufacturing, and controls section of the NDA for AXS-05. AXSM has already submitted a response to these deficiencies, which have been duly received by the FDA. Although the FDA has not identified any other inconsistencies in the NDA, it is yet to provide a timeline regarding the decision date on the NDA for AXS-05.

On its earnings call, AXSM said that since the responses filed by it are not major amendments to the NDA, it expects to receive a decision in the near future. In the meantime, Axsome has already completed creating the drug’s marketing materials and the tactical planning for its potential launch.

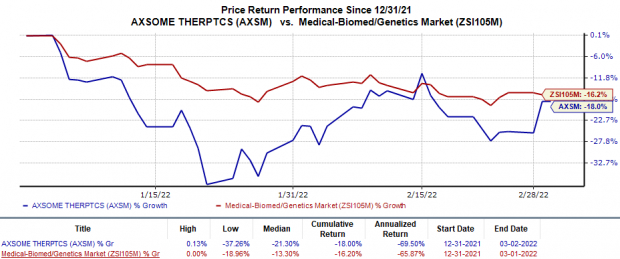

Shares of Axsome gained 10.2% on Mar 1, as investors anticipate the FDA approval of AXS-05 following the company’s advance preparations for the candidate’s commercial launch. Yet, Axsome’s stock has declined 18% so far this year compared with the

industry

’s 16.2% fall.

Image Source: Zacks Investment Research

The company is currently enrolling patients in the phase III ACCORD study evaluating the safety and efficacy of AXS-05 for treating agitation associated with AD. In the course of the study, AXSM observed lower blinded relapse events than expected. While the company expects that this observation is based on the drug’s greater-than-anticipated overall durability of effect, it would also have implications on the study’s duration. Based on these implications, AXSM plans to consult with the FDA regarding the study’s design and later on provide an update on the same.

Axsome plans to start a pivotal phase II/III study for AXS-05 as a potential treatment for smoking cessation. The timing of the initiation will be informed later this year.

Others

Another lead candidate, AXS-07, has been developed for the acute treatment of migraine. The NDA for the candidate has already been filed and is currently under review. The FDA remains on track to provide a decision on the NDA by Apr 30, 2022, including completion of the inspection of a contract manufacturing facility within the decision date. The FDA previously notified the company that it would not be able to complete the inspection before the decision date.

Axsome’s AXS-12 is being developed to treat narcolepsy, a sleep disorder characterized by excessive sleepiness. The candidate is currently enrolling patients in the phase III SYMPHONY study for the given indication. Top-line data from this study is expected in first-half 2023.

AXS-14 is the company’s candidate for the treatment of fibromyalgia. The treatment has already achieved primary endpoints in phase II and phase III studies for the management of fibromyalgia. An NDA is expected to be filed in 2023, following successful completion of manufacturing and other activities related to the candidate.

Zacks Rank & Other Stocks to Consider

Axsome currently has a Zacks Rank #2 (Buy). Other top-ranked stocks in the overall healthcare sector include

Adaptimmune Therapeutics

ADAP

,

Arbutus Biopharma

ABUS

and

Arvinas

ARVN

, each carrying a Zacks Rank #2 at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Adaptimmune Therapeutics’ loss per share estimates for 2022 have narrowed from 99 cents to 91 cents in the past 30 days. Earnings of Adaptimmune Therapeutics beat estimates in three of the last four quarters and missed the mark on a single occasion, with the average surprise being 0.9%.

Arbutus Biopharma’s loss per share estimates for 2022 have narrowed from 63 cents to 61 cents in the past 30 days. In the trailing four quarters, earnings of Arbutus Biopharma beat estimates once, missed the same twice and met the mark on another occasion, delivering an average negative surprise of 3.6%.

Arvinas’ loss per share estimates for 2022 have narrowed from $3.23 to $3.19 in the past 30 days. The same for 2023 has narrowed from $3.89 to $3.82 in the past 30 days. Earnings of Arvinas missed estimates in each of the last four quarters, with the average negative surprise being 47.9%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report