Axsome Therapeutics, Inc.

AXSM

announced that it has entered into a definitive agreement with

Jazz Pharmaceuticals

JAZZ

to acquire the latter’s new sleep drug, Sunosi (solriamfetol).

The drug is approved as a treatment to improve wakefulness and reduce excessive daytime sleepiness in adults with narcolepsy or obstructive sleep apnea. Sunosi is currently marketed in the United States, Europe and several other countries.

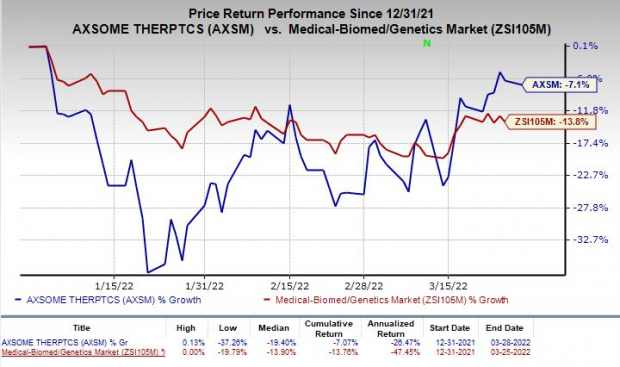

Shares of Axsome have lost 7.1% so far this year compared with the

industry

’s decline of 13.8%.

Image Source: Zacks Investment Research

Axsome will make an upfront payment of $53 million to Jazz to acquire worldwide commercial, development/manufacturing and intellectual property rights to Sunosi, except for certain Asian markets, from the latter. Jazz is entitled to receive high single-digit royalty on U.S. net sales of Sunosi in the current indication and mid-single-digit royalty on Sunosi net sales in future indications.

In 2014, Jazz had acquired worldwide rights to Sunosi from Aerial Biopharma, excluding certain Asian markets. The commitments of Jazz toward Aerial as well as SK Biopharmaceuticals, which retains Sunosi’s rights in 12 Asian markets, will also be taken care of by Axsome.

The above transaction is expected to close in the second quarter of 2022, subject to customary closing conditions in the United States. Axsome plans to finance the transaction through its existing $300-million term loan facility with Hercules Capital, Inc.

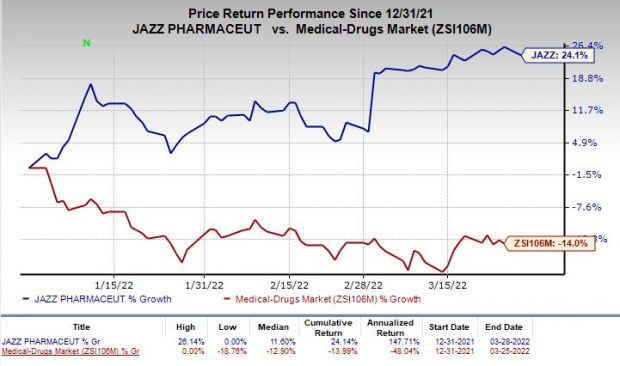

Shares of Jazz have rallied 24.1% so far this year against the

industry

’s decline of 14%.

Image Source: Zacks Investment Research

Axsome currently does not have any approved product in its portfolio. Hence, as soon as the acquisition of Sunosi closes, it will immediately transform the company into a revenue generating entity.

One of Axsome’s lead candidates, AXS-05, has been developed for treating major depressive disorder (“MDD”), treatment-resistant depression, smoking cessation and agitation associated with Alzheimer’s disease. An NDA for AXS-05 to treat MDD is under review with the FDA.

Axsome’s another lead candidate, AXS-07, has been developed for the acute treatment of migraine. An NDA for AXS-07 for the acute treatment of migraine is under review. A decision from the FDA is expected by April-end in 2022.

Given Axsome’s expertise in developing treatments for central nervous system disorders, the acquisition of Sunosi looks highly synergistic with the company’s potential commercialization of AXS-05 for depression and AXS-07 for migraine.

The deal with Jazz for Sunosi will surely strengthen Axsome’s industry-leading neuroscience portfolio. Sunosi generated sales worth $57.9 million in 2021, reflecting a significant increase year over year. A potential label expansion into other indications, such as psychiatry and neurology, will boost the drug’s sales further and drive growth for Axsome in 2022 and beyond.

Zacks Rank & Stocks to Consider

Both Axsome and Jazz currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the drug/biotech sector are

Assertio Holdings, Inc.

ASRT

and

Vertex Pharmaceuticals Incorporated

VRTX

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Assertio’s earnings estimates have been revised 75% upward for 2022 over the past 60 days. The ASRT stock has increased 25.6% year to date.

Earnings of Assertio surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions.

Vertex’s earnings estimates have been revised 8.7% upward for 2022 over the past 60 days. The VRTX stock has increased 16.4% year to date.

Earnings of Vertex surpassed estimates in each of the trailing four quarters.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free.Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report