AzurRx BioPharma, Inc.

AZRX

announced that it will rename itself as “First Wave BioPharma, Inc.” after the acquisition of a small biotech company, First Wave Bio, Inc.

The company acquired First Wave Bio in a stock and cash transaction valued at $229 million, which also includes potential milestone payments. The acquisition will be completed through a reverse triangular merger, according to the terms of the agreement.

Per an

Investopedia article

, in a reverse triangular merger, the acquiring company creates a new subsidiary company that purchases the target company. After purchase, the subsidiary is then absorbed by the target company.

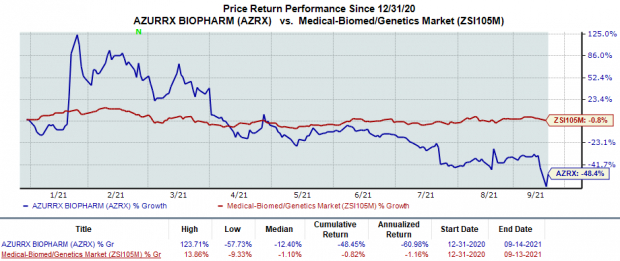

The company’s stock has plunged 48.5% so far this year in comparison with the

industry

’s 0.8% decline.

Image Source: Zacks Investment Research

Please note that First Wave Bio is a clinical-stage biotechnology company that specializes in the development of inflammatory bowel disease (“IBD”) therapies. It owns proprietary formulations of niclosamide – a small molecule drug that features anti-viral and anti-inflammatory properties designed to address multiple existing gastrointestinal (“GI”) conditions.

Per the company, the acquisition will not only expand its existing GI pipeline but also add new pipeline candidates for IBD. Following the acquisition, AzurRx’s pipeline will include three new treatments for IBD indications – ulcerative proctitis (UP) and ulcerative proctosigmoiditis (UPS), ulcerative colitis (UC), and Crohn’s disease (CD).

Following the name change, the company’s common stock will continue to trade in the NASDAQ under the ticker name “FWBI” effective Sep 23, 2021. Please note that there will be no change in its management team.

At the onset of 2021, AzurRx in-licensed exclusive global rights from First Wave Bio to develop two niclosamide therapeutic indications, one for COVID-19-related GI infections and another for immune checkpoint inhibitor-associated colitis and diarrhea in advanced-stage cancer patients.

Arena Pharmaceuticals

ARNA

is also evaluating its most advanced candidate, etrasimod, in late-stage studies for UC and CD. Also,

Theravance Biopharma

TBPH

/

Johnson and Johnson

’s

JNJ

izencitinib is being evaluated in UC and CD in separate clinical studies.

Zacks Rank

AzurRx currently carries a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report