Beam Therapeutics Inc.

BEAM

announced that the FDA has lifted its clinical hold on the investigational new drug (“IND”) application for BEAM-201 for the treatment of relapsed/refractory T-cell acute lymphoblastic leukemia (T-ALL)/T-cell lymphoblastic lymphoma (T-LL).

The company plans to provide updates on the next steps of advancement for the BEAM-201 program in 2023.

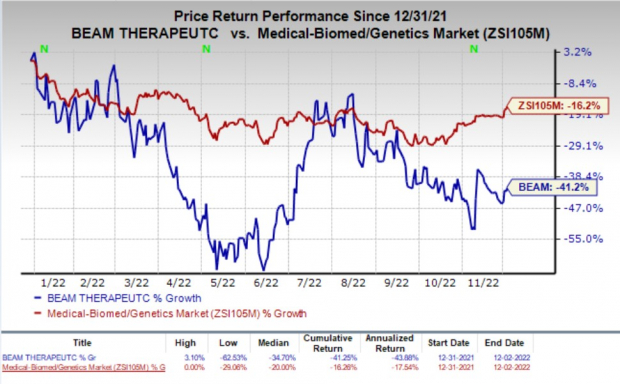

Shares of Beam were up 2.2% on Friday following the announcement of the news. The stock has plunged 41.2% so far this year compared with the

industry

’s decline of 16.2%.

Image Source: Zacks Investment Research

BEAM-201 is a potent and specific anti-CD7, allogeneic chimeric antigen receptor T-cell development candidate, which is being developed for the given indication.

We remind investors that in June 2022, Beam submitted the IND for BEAM-201 to the FDA and subsequently the regulatory body placed a clinical hold on the IND in July 2022.

Beam is engaged in developing precision genetic medicines. The company’s lead candidate BEAM-101 is being evaluated in the phase I/II BEACON study for treating patients with sickle cell disease (SCD). The study is evaluating the safety and efficacy of BEAM-101 in adult patients with severe SCD.

Last month, Beam enrolled the first patient in the BEACON study.

Beam remains focused on the development of BEAM-101 as the lead program and on bringing this medicine to SCD patients as quickly as possible.

Meanwhile, Beam has initiated IND-enabling studies for another candidate, BEAM-301, which is designed to treat glycogen storage disease 1a (GSDIa).

Beam’s portfolio currently does not have any approved products. Hence in the absence of a marketed drug, the successful development of BEAM-101 and other pipeline candidates remains in key focus for the company.

Zacks Rank & Stocks to Consider

Beam currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are

ASLAN Pharmaceuticals Limited

ASLN

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Immunocore Holdings plc

IMCR

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed 6.1% for 2022 and 5.7% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Loss per share estimates for Aeglea BioTherapeutics have narrowed 7.3% for 2022 and 13.2% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. AGLE witnessed an earnings surprise of 3.60% on average.

Loss per share estimates for Immunocore have narrowed 39.7% for 2022 and 39.4% for 2023 in the past 60 days.

Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report