BeiGene, Ltd.

BGNE

announced that the FDA has granted an accelerated approval to its marketed drug, Brukinsa (zanubrutinib), for a new indication. The drug has been approved for the treatment of relapsed or refractory (R/R) marginal zone lymphoma (“MZL”) in adult patients having received at least one anti-CD20-based regimen. This marks the third FDA approval for Brukinsa in the United States.

The latest FDA nod was based on efficacy data from two mid-stage single-arm studies that evaluated single-agent Brukinsa in patients with R/R MZL who received at least one anti-CD20-based regimen. Data from both the studies showed that treatment with Brukinsa led to a complete response rate of 20% in the given patient population. This accelerated approval is based on overall response rate.

Per the company, the new indication for Brukinsa is likely to provide a new treatment option offering meaningful benefit to patients with R/R MZL.

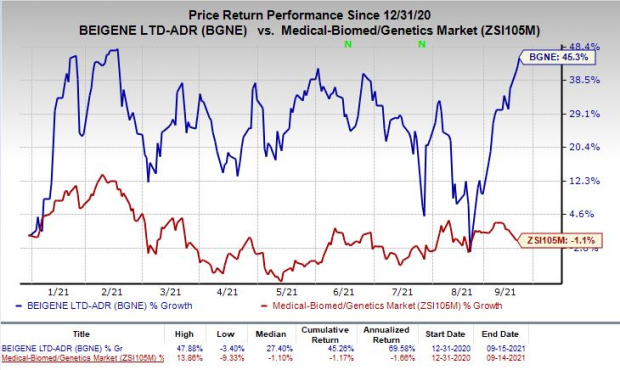

Shares of BeiGene were up 1.8% on Wednesday following the announcement of the news. In fact, the stock has rallied 45.3% so far this year against the

industry

’s decrease of 1.1%.

Image Source: Zacks Investment Research

Earlier this month, the FDA approved Brukinsa for the treatment of adult patients with Waldenström’s macroglobulinemia, a rare type of lymphoma. This marked the second FDA approval for Brukinsa in the United States.

Brukinsa is also approved in the United States for the treatment of mantle cell lymphoma in adult patients who have received at least one prior therapy. In the first six months of 2021, Brukinsa generated worldwide sales worth $64.5 million, reflecting a significant year-over-year increase.

BeiGene currently markets three internally discovered oncology products — BTK inhibitor, Brukinsa in the United States, Canada and China; anti-PD-1 antibody, tislelizumab, in China; and PARP inhibitor, pamiparib, also in China.

Earlier this week, the FDA accepted BeiGene’s biologics license application for tislelizumab as a treatment for patients with unresectable recurrent locally advanced or metastatic esophageal squamous cell carcinoma, following prior systemic therapy. A decision from the regulatory body is expected on Jul 12, 2022. The BLA was filed in collaboration with

Novartis

NVS

.

Zacks Rank & Stocks to Consider

BeiGene currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the biotech sector include

Spero Therapeutics, Inc.

SPRO

and

Corvus Pharmaceuticals, Inc.

CRVS

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Spero Therapeutics’ loss per share estimates have narrowed 8.2% for 2021 and 10.6% for 2022 over the past 60 days.

Corvus Pharmaceuticals’ loss per share estimates have narrowed 13.9% for 2021 and 7.2% for 2022 over the past 60 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report