BeiGene, Ltd.

BGNE

announced that the FDA has accepted the biologics license application (“BLA”) for its anti-PD-1 antibody, tislelizumab, as a treatment for patients with unresectable recurrent locally advanced or metastatic esophageal squamous cell carcinoma (“ESCC”), following prior systemic therapy. A decision from the regulatory body is expected on Jul 12, 2022.

The BLA was based on data from the open-label, multicenter phase III RATIONALE 302 study, which evaluated the safety and efficacy of tislelizumab as compared to investigator’s choice chemotherapy as a second-line treatment for patients with advanced/metastatic ESCC.

The BLA also included safety data from patients who received tislelizumab as a monotherapy across a broad clinical program. The BLA was filed in collaboration with

Novartis

NVS

.

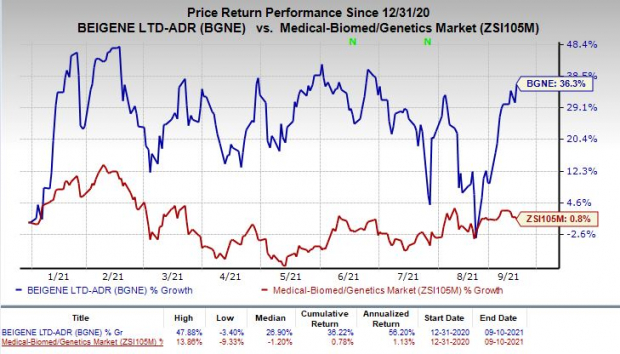

Shares of BeiGene were up in pre-market trading on Monday. In fact, the stock has rallied 36.3% so far this year compared with the

industry

’s rise of 0.8%.

Image Source: Zacks Investment Research

We remind investors that, in January 2021, Novartis

entered

into a strategic collaboration agreement with BeiGene, following which the former in-licensed tislelizumab in major markets outside of China. The above-mentioned BLA is the first regulatory filing for tislelizumab outside Chinese territory.

Per the company, tislelizumab is an anti-PD-1 monoclonal antibody specifically designed to minimize binding to FcγR on macrophages. It is approved in China for five oncological indications. Tislelizumab is also under review as a treatment for patients with locally advanced or metastatic ESCC who have disease progression following first-line standard chemotherapy, or are intolerant to the same, in China.

BeiGene currently markets three internally discovered oncology products — BTK inhibitor, Brukinsa (zanubrutinib), in the United States, Canada and China; anti-PD-1 antibody, tislelizumab, in China; and PARP inhibitor, pamiparib, also in China.

Zacks Rank & Stocks to Consider

BeiGene currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the biotech sector include

Spero Therapeutics, Inc.

SPRO

and

Corvus Pharmaceuticals, Inc.

CRVS

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Spero Therapeutics’ loss per share estimates have narrowed 8.2% for 2021 and 10.6% for 2022, over the past 60 days.

Corvus Pharmaceuticals’ loss per share estimates have narrowed 24.4% for 2021 and 21.4% for 2022, over the past 60 days.

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report