BioCryst Pharmaceuticals’

BCRX

stock was down almost 38% on Friday following its announcement of pausing enrolment in clinical studies for its pipeline candidate, BCX9930

BCX9930 is a BioCryst Pharmaceuticals’ oral Factor D inhibitor being evaluated in several studies for the treatment of complement-mediated diseases. It is in the pivotal development for paroxysmal nocturnal hemoglobinuria (PNH). A proof-of-concept study is also ongoing to evaluate oral BCX9930 (500 mg twice daily) in three renal complement-mediated diseases, C3 glomerulopathy (C3G), IgA nephropathy (IgAN) and primary membranous nephropathy (PMN).

BioCryst Pharmaceuticals said it will not enroll new patients in the REDEEM-1, REDEEM-2 studies for PNH or RENEW clinical studies on BCX9930 as it is investigating rising serum creatinine levels seen in some patients. However, patients already enrolled in these studies are continuing to receive the drug.

Enrolment in the REDEEM-1 and REDEEM-2 studies began in January 2022 and November 2021, respectively. While REDEEM-2 is evaluating the efficacy and safety of BCX9930 (500 mg twice daily) as monotherapy in PNH patients not currently receiving complement inhibitor therapy, REDEEM-1 involves PNH patients with an inadequate response to a C5 inhibitor. The RENEW program is a proof-of-concept basket study evaluating BCX9930 in patients with C3G, IgAN and PMN.

BCX9930 enjoys Orphan Drug and Fast Track designations from the FDA for the treatment of PNH.

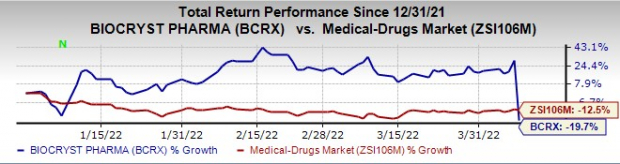

This year so far, BioCryst Pharmaceuticals’ shares have declined 19.7% compared with the

industry

’s decrease of 12.5%.

Image Source: Zacks Investment Research

BioCryst Pharmaceuticals’ other key pipeline candidates are BCX9250, an ALK-2 inhibitor for the treatment of fibrodysplasia ossificans progressiva, and galidesivir, a potential treatment for Marburg virus disease and Yellow Fever. The company’s hereditary angioedema drug Orladeyo is marketed in the United States, the European Union and some other countries.

Zacks Rank & Stocks to Consider

BioCryst Pharmaceuticals currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the drug sector are

Baudax Bio

BXRX

,

Assertio Holdings

ASRT

and

Collegium Pharmaceutical

COLL

, each carrying a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The consensus estimate for Baudax Bio’s bottom line has narrowed from a loss of $15.73 to a loss of $2.91 per share, while that for 2023 has narrowed from a loss of $10.49 per share to a loss of 66 cents over the past 60 days. Baudax Bio’s stock has declined 76.7% this year so far.

Baudax Bio beat estimates in one of the last three quarters, missed in one and reported in-line results in one, with the average surprise being a negative 6.82%.

Assertio Holdings’ stock has surged 56.9% this year so far.

The Zacks Consensus Estimate for Assertio Holdings’ 2022 bottom line has increased from 20 cents per share to 35 cents over the past 60 days. Assertio Holdings beat estimates in two of the last four quarters while missing in the other two, with the average surprise being 20.83%.

Collegium Pharmaceutical’s stock has risen 9.8% this year so far. The Zacks Consensus Estimate for earnings for Collegium Pharmaceutical has increased from $3.79 to $5.59 per share, while that for 2023 has risen from $4.79 per share to $7.44 per share over the past 60 days.

Collegium Pharmaceutical missed estimates in three of the last four quarters, with the average negative surprise being 57.6%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report