Shares of

BioMarin Pharmaceutical Inc.

BMRN

were down 7.2% on May 31 after management decided to delay the re-submission of the biologics license application (BLA) for its investigational gene-therapy candidate valoctocogene roxaparvovec or valrox to treat adults with severe hemophilia A.

Per management, the BLA was earlier planned to be re-filed in June 2022. The process will now be completed by September-end. This decision by management is based on the FDA’s request for additional information and analyses of data on the candidate. The BLA will be supported by a two-year follow-up safety and efficacy data from the phase III GENEr8-1 study. The regulatory agency has not requested any additional pre-clinical and/or clinical studies.

BioMarin reported a six-year and a five-year post-treatment follow-up of the 6e13 vg/kg and 4e13 vg/kg cohorts from the open-label phase I/II study on valoctocogene roxaparvovec, which showed a consistent and a durable bleed control following a one-time treatment with the said candidate.

In the 6e13 vg/kg dose cohort, patients administered with valrox achieved a mean cumulative annualized bleed rate (ABR) reduction of 95% and a Factor VIII use reduction of 96% through six years. In the 4e13 vg/kg dose cohort, patients treated with valrox achieved a mean cumulative ABR reduction of 91% and a Factor VIII use reduction of 93% through five years.

Data from all these studies indicates that a one-time treatment with this gene-therapy candidate generated a sustained hemostatic efficacy. A potential approval of the candidate is expected to change the treatment paradigm.

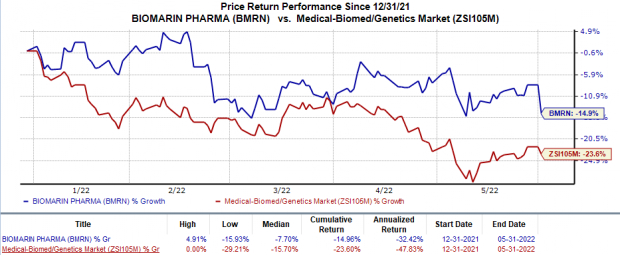

Shares of BioMarin have declined 15% in the year-to-date period compared with the

industry

’s 23.6% decrease.

Image Source: Zacks Investment Research

BioMarin has already submitted a regulatory filing with the European Medicines Agency (EMA) seeking approval for valrox in hempphilia A, which is currently undergoing review. A recommendation from the EMA’s Committee for Medicinal Products for Human Use (CHMP) is expected by mid-2022.

BMRN had previously submitted a BLA in 2019 for valoctocogene roxaparvovec to address hemophilia A. However, the FDA issued a complete response letter (CRL) to the BLA ahead of the PDUFA date in August 2020. This was due to the regulatory agency’s dissatisfaction with the available data. As a result, it asked for a two-year follow-up info on the annualized bleed rates from the GENEr8-1 study only to provide additional evidence of a durable effect.

Zacks Rank & Stocks to Consider

BioMarin currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same sector are

Abeona Therapeutics

ABEO

,

Aeglea BioTherapeutics

AGLE

and

Sesen Bio

SESN

. While Sesen Bio currently sports a Zacks Rank #1 (Strong Buy), both Abeona Therapeutics and Aeglea BioTherapeutics carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 31 cents in the past 30 days. Shares of SESN have decreased 24.8% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, SESN delivered an earnings surprise of 100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 33 cents to 28 cents in the past 30 days. The same for 2023 has narrowed from 15 cents to 13 cents in the same time frame. Shares of ABEO have plunged 50.1% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and met the same on the remaining two occasions, the average negative surprise being 8.2%. In the last reported quarter, ABEO missed on earnings by 25%.

Aeglea BioTherapeutics’ loss per share estimates for 2022 have narrowed from $1.43 to $1.16 in the past 30 days. The same for 2023 has narrowed from $1.49 to $1.04 in the past 30 days. Shares of AGLE have plunged 66.7% year to date.

Earnings of Aeglea BioTherapeutics beat estimates in two of the last four quarters and missed the mark on the other two occasions, the average surprise being 9.5%. In the last reported quarter, AGLE witnessed a negative earnings surprise of 5.7%.

How to Profit from the Hot Electric Vehicle Industry

Global electric car sales in 2021 more than doubled their 2020 numbers. And today, the electric vehicle (EV) technology and very nature of the business is changing quickly. The next push for future technologies is happening now and investors who get in early could see exceptional profits.

See Zacks’ Top Stocks to Profit from the EV Revolution >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report