The biotech sector has been in the spotlight in the past week, with regular pipeline and regulatory updates.

Recap of the Week’s Most Important Stories

:

Regulatory and Pipeline Updates From Regeneron

:

Regeneron Pharmaceuticals, Inc

.

REGN

and partner

Sanofi

SNY

announced that the FDA has approved a label expansion of Dupixen (dupilumab) for the treatment of patients with eosinophilic esophagitis (EoE) aged 12 years and older, weighing at least 40 kg. Dupixent is under review in Europe for EoE. The approval was granted more than two months ahead of FDA’s Priority Review action date. Dupixent 300 mg weekly significantly improved signs and symptoms of eosinophilic esophagitis compared to placebo in a phase III trial, underscoring the role of type 2 inflammation in this complex disease. Dupixent is being jointly marketed by Regeneron and Sanofi under a global collaboration agreement. Sanofi records global net product sales of Dupixent while Regeneron records its share of profits/losses in connection with the global sales of the drug.

Regeneron

posted

positive results from a phase III study on Evkeeza (evinacumab). The study was evaluating Evkeeza in children aged five to 11 with homozygous familial hypercholesterolemia (HoFH). The study met its primary endpoint. Results showed that children who added investigational Evkeeza to other lipid-lowering therapies reduced their low-density lipoprotein-cholesterol (LDL-C) by 48% at week 24 on average. Children already on other lipid-lowering therapies entered the trial with dangerously high LDL-C (264 mg/dL on average), and 79% saw their LDL-C reduced by at least half at 24 weeks.

Regeneron currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

INmune Down on Regulatory Update

:

INmune Bio, Inc

.

INMB

plunged after the company announced that the FDA placed a clinical hold on their investigational new drug (IND) application to initiate its phase II study of XPro1595 in patients with Alzheimer’s Disease (AD) in the United States. The agency requested additional information on Chemistry Manufacturing and Controls (CMC) of the newly manufactured XPro1595. The regulatory body indicated that it will provide an official clinical hold letter to INmune in approximately 30 days. INmune plans to provide additional updates pending discussion with the FDA. The phase II study of XPro remains open in Australia and continues to enroll patients.

Entasis Up on Acquisition Offer From Innoviva

: Shares of

Entasis Therapeutics Holdings Inc

.

ETTX

gained

after an acquisition offer from

Innoviva, Inc

.

INVA

. Innoviva will acquire all of the outstanding shares of Entasis not already owned by it at a price of $2.20 per share in cash. Innoviva currently owns approximately 60% of the outstanding shares of Entasis common stock. The acquisition consideration values Entasis’ equity at $113 million on a fully diluted basis. The acquisition price of $2.20 per share represents a premium of 22.2% to ETTX’s closing price on May 23.

ETTX’s lead candidate sulbactam-durlobactam (SUL-DUR) is being developed to treat infections caused by Acinetobacter baumannii. A regulatory filing for SUL-DUR with the FDA to address the given indication is expected by third-quarter 2022. The transaction is expected to close in the third quarter.

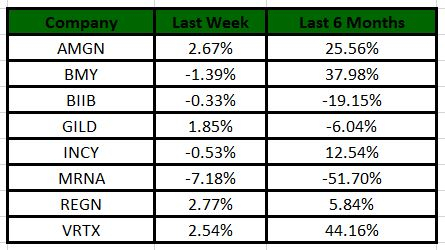

Performance

The Nasdaq Biotechnology Index has lost 1.9% in the past five trading sessions. Among the biotech giants, Moderna has declined 7.18% during the period. Over the past six months, shares of Moderna have lost 51.70%. (See the last biotech stock roundup here:

Biotech Stock Roundup: BBIO Up on BMY Deal, GILD & CMRX Offer Updates

)

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for more pipeline and regulatory updates.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report