The biotech sector was in focus with many important pipeline and regulatory updates. Collaboration deals were also in focus.

Recap of the Week’s Most Important Stories

:

Gilead’s HIV Drug Approval

:

Gilead Sciences, Inc

.

GILD

announced that the FDA has approved

lenacapavir

in combination with other antiretroviral(s) (ARV) under the brand name Sunlenca for the treatment of HIV-1 infection in heavily treatment-experienced (HTE) adults with multi-drug-resistant (MDR) HIV-1 infection. The approval of this new, twice-yearly treatment option for adults with HIV that is not adequately controlled by their current treatment regimen will boost Gilead’s strong HIV franchise.

Sunlenca, a first-in-class, long-acting HIV capsid inhibitor, has a multi-stage mechanism of action distinguishable from other currently approved classes of antiviral agents. It is the only HIV treatment option administered twice yearly and thus will have an advantage over other existing treatments due to its less frequent dosing requirements. The FDA approval for Sunlenca is supported by data from the phase II/III CAPELLA study, which evaluated lenacapavir in combination with an optimized background regimen in people with multi-drug resistant HIV-1 who are HTE. Sunlenca has already received approval from the European Union in August 2022. Additional regulatory filings and decisions by regulatory authorities are anticipated to continue in 2023.

Gilead announced that it will

acquire

the remaining rights to GS-1811 (formerly JTX-1811) from Jounce Therapeutics. GS-1811, a potentially first-in-class immunotherapy, is designed to selectively deplete immunosuppressive tumor-infiltrating T regulatory cells in the tumor microenvironment and is currently in phase I development as a possible treatment for patients with solid tumors. Both companies amended their existing license agreement for GS-1811, which will enable Gilead to buy out any remaining contingent payments potentially due under the license agreement executed in August 2020.

As part of the transaction, certain operational obligations of the parties related to GS-1811 outlined in the license agreement have also been terminated. Gilead will be solely responsible for all further research, development and commercialization of GS-1811 globally. In exchange, Jounce will receive proceeds of $67 million for this transaction but will no longer be entitled to receive the remaining contingent payments of up to $645 million in milestones and high single-digit to mid-teens royalties based upon worldwide sales under the original license agreement.

Gilead currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Kala Surges on Regulatory Update

: Shares of clinical-stage biopharmaceutical company

Kala Pharmaceuticals, Inc

.

KALA

surged

after the company announced that the FDA has accepted an investigational new drug (IND) application for the company’s lead product candidate, KPI-012, a human mesenchymal stem cell secretome (MSC-S), initially in development for the treatment of persistent corneal epithelial defect (PCED). The company will initiate a phase IIb clinical trial of KPI-012 for PCED in the first quarter of 2023. The phase IIb study will be a multicenter, randomized, double-masked, vehicle-controlled, parallel-group study to evaluate the safety and efficacy of two doses of KPI-012 ophthalmic solution compared to vehicle when dosed topically four times per day (QID) for 56 days. Kala expects to initiate enrollment in the trial in the first quarter of next year and to report top-line data in the first quarter of 2024. The firm believes this trial could serve as the first of two pivotal trials required to support the submission of a biologics license application (BLA) to the FDA assuming the results are positive.

ProQR Soars on Collaboration With Eli Lily

: Shares of

ProQR Therapeutics N.V

PRQR

soared

after the company announced an expansion of its licensing and collaboration agreement with

Eli Lilly

LLY

. The agreement primarily focused on the discovery, development and commercialization of new genetic medicines. The original collaboration was announced in September 2021 for applying ProQR’s proprietary Axiomer RNA editing platform to target disorders of the liver and nervous system.

Under the terms of the expanded agreement, Lilly will gain access to additional targets in the central nervous system and peripheral nervous system with ProQR’s Axiomer platform. ProQR will receive $75 million consisting of an upfront payment, as well as an equity investment. Lilly will have the ability to exercise an option to further expand the partnership for a consideration of $50 million. In addition, Lilly can elect to provide ProQR with access to the company’s proprietary delivery technology for its wholly-owned pipeline.

In total, ProQR is eligible to receive up to approximately $3.75 billion in research, development and commercialization milestones, as well as tiered royalties of up to a mid-single-digit percentage on product sales.

Acer Gets FDA Nod for Drug

:

Acer Therapeutics Inc

.

ACER

announced that the FDA has approved Olpruva (sodium phenylbutyrate) for oral suspension in the United States for the treatment of certain patients living with urea cycle disorders (UCDs) involving deficiencies of carbamylphosphate synthetase (CPS), ornithine transcarbamylase (OTC), or argininosuccinic acid synthetase (AS). The drug has been developed in partnership with Relief Therapeutics Holding AG. The FDA approved Olpruva under section 505(b)(2) of the Federal Food, Drug and Cosmetic Act, a regulatory pathway that allows applicants to rely on, at least in part, third-party data for approval. Acer mentioned preclinical and clinical safety and efficacy data from the reference listed drug, Buphenyl powder, in its new drug application or NDA for Olpruva. The FDA had earlier issued a complete response letter to Acer’s NDA for Olpruva to treat patients with UCDs.

Performance

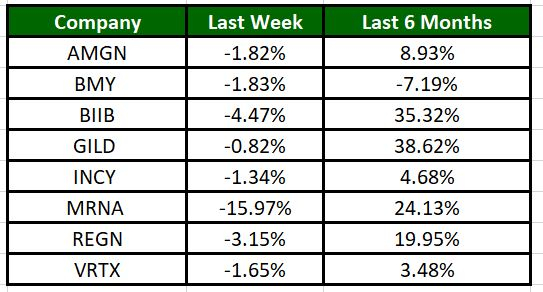

The Nasdaq Biotechnology Index has lost 3.99% in the past four trading sessions. Among the biotech giants, Moderna has lost 15.97% during the period. Over the past six months, shares of Gilead have soared 38.62%. (See the last biotech stock roundup here:

Biotech Stock Roundup: MDGL Surges on NASH Data, TRDA, RCUS Down on Updates & More

)

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for other updates.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report