Boston Scientific Corporation

BSX

recently announced its entry into a definitive agreement to acquire

Apollo Endosurgery, Inc.

APEN

. The latest buyout is expected to expand Boston Scientific’s endoluminal surgery (ELS) portfolio and add differentiated technologies for endobariatric procedures.

The transaction, which is expected to be completed in the first half of 2023, subject to the satisfaction of customary closing conditions, is likely to have an immaterial impact on Boston Scientific’s adjusted earnings per share (EPS) in 2023 but accretive thereafter. The impact on GAAP EPS is expected to be less accretive or more dilutive, as the case may be, due to amortization expense and acquisition-related net charges.

Apollo Endosurgery’s endoscopic suturing system franchise includes its OverStitch Endoscopic Suturing System, OverStitch Sx Endoscopic Suturing System and X-Tack Endoscopic HeliX Tacking System.

The latest buyout is expected to be a significant addition to Boston Scientific’s Endoscopy business, thereby strengthening its foothold in the new adjacency it is entering, the endobariatric market.

Rationale Behind the Acquisition

The Apollo Endosurgery product portfolio includes devices used during ELS procedures to close gastrointestinal defects, manage gastrointestinal complications and aid in weight loss for patients suffering from obesity. ELS provides a less-invasive option unlike open and laparoscopic surgery for patients with diseases in the gastrointestinal tract or morbid obesity. It also provides the possibility of faster recovery and minimizes the risks of surgical complications.

In July 2022, Apollo Endosurgery received the FDA de novo clearance for its Apollo ESG, Apollo ESG Sx, Apollo REVISE and Apollo REVISE Sx Systems, the first devices authorized by the FDA for endoscopic sleeve gastroplasty and endoscopic bariatric revision procedures. The company’s endobariatric portfolio also includes the Orbera Intragastric Balloon for endoscopic weight management.

Per Boston Scientific’s management, the company expects to expand its global capabilities in ELS with the differentiated products of Apollo Endosurgery. Management also believes that the acquisition will likely enable it to enter the new adjacency of the endobariatric market and deliver strong, continued growth across its business. The company is currently aiming to tap into the emerging field of ELS, which is a core focus of its Endoscopy business.

Industry Prospects

Per a report by Research and Markets published on Business Wire

, the global endoluminal suturing devices market is anticipated to reach $152.3 million by 2028 at a CAGR of 12% between 2022 and 2028. Factors like the growing demand for weight loss procedures, higher adoption of endoluminal practices as a well-known technique to accelerate the weight reduction process and the rising prevalence of chronic diseases resulting from an increase in unhealthy lifestyles are likely to drive the market.

Given the market potential, the latest acquisition is likely to provide a significant boost to Boston Scientific’s business globally.

Notable Development in Endoscopy Business

Last month, Boston Scientific announced its third-quarter 2022 results, where it registered better-than-expected revenues. The company also registered a year-over-year improvement in organic sales, indicating a strong rebound in the legacy business amid several macroeconomic issues. Its Endoscopy business also registered a robust uptick in the quarter both on a reported and organic basis.

Price Performance

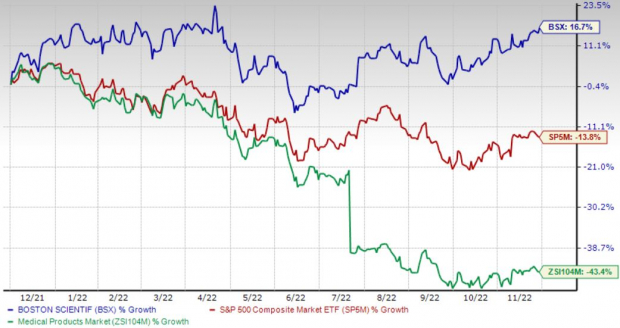

Shares of the company have gained 16.7% in the past year against the

industry

’s 43.5% decline and the S&P 500’s 13.9% fall.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Boston Scientific carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the broader medical space are

AMN Healthcare Services, Inc.

AMN

and

ShockWave Medical, Inc.

SWAV

.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has gained 9.5% against the

industry

’s 28.8% decline in the past year.

ShockWave Medical, carrying a Zacks Rank #2 at present, has an estimated growth rate of 21.2% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 146.1%.

ShockWave Medical has gained 47% against the

industry

’s 23.8% decline over the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report