Bristol-Myers Squibb Company

BMY

announced that the European Medicines Agency (“EMA”) has validated the type II variation filing for the label expansion of its CD19-directed CAR-T cell therapy, Breyanzi (lisocabtagenemaraleucel).

The application is seeking approval of Breyanzi for the treatment of diffuse large B-cell lymphoma (“DLBCL”), high-grade B-cell lymphoma, primary mediastinal large B-cell lymphoma (“PMBCL”) and follicular lymphoma grade 3B (FL3B) in adult patients who are refractory or have relapsed within 12 months of initial therapy and are candidates for haematopoietic stem cell transplant (“HSCT”).

The European Commission approved Breyanzi for treating adult patients with relapsed or refractory DLBCL, PMBCL and FL3B, following two or more lines of systemic therapy in April 2022.

The latest type II variation filing was based on data from the phase III TRANSFORM study, which investigated Breyanzi as a second-line treatment in adults with relapsed or refractory LBCL versus standard of care consisting of salvage chemotherapy followed by high-dose chemotherapy plus HSCT. Data from the same showed that treatment with Breyanzi significantly improved event-free survival — the study’s primary endpoint — as compared to standard of care.

Treatment with Breyanzi also led to clinically meaningful and statistically significant improvements in complete response rates and progression-free survival versus standard of care. Breyanzi demonstrated a well-established safety profile.

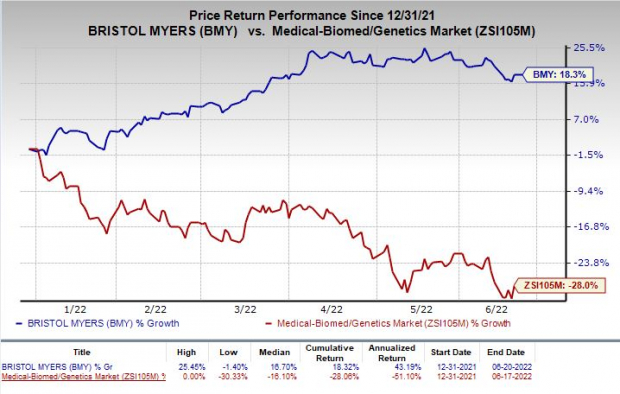

Shares of Bristol Myers have rallied 18.3% so far this year against the

industry

’s decline of 28%.

Image Source: Zacks Investment Research

Breyanzi is currently approved in the United States for the treatment of adult patients with R/R large B-cell lymphoma or LBCL after two or more lines of systemic therapy, including DLBCL not otherwise specified (including DLBCL arising from indolent lymphoma), high-grade B-cell lymphoma, PMBCL, and FL3B.

In the United States, Breyanzi is also under review for the treatment of adult patients with R/R LBCL after the failure of first-line therapy. In February 2022, the FDA granted priority review to the supplemental biologics license application of Breyanzi for this indication. A decision from the regulatory body is expected on Jun 24, 2022.

Breyanzi, one of the newer drugs of Bristol Myers, has been performing steadily since its launch. Breyanzi generated sales worth $44 million in the first quarter of 2022. A potential label expansion of the drug should boost its sales in the future quarters.

Zacks Rank & Stocks to Consider

Bristol Myers currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Aeglea BioTherapeutics’ loss per share estimates narrowed 19.4% for 2022 and 37.5% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AGLE delivered an earnings surprise of 9.47%, on average.

Precision BioSciences’ loss per share estimates narrowed 21.7% for 2022 and 31.4% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report