Canadian Solar Inc.

CSIQ

recently commenced mass production of its new 54-cell format solar module, named CS6R-MS, and delivered the first batch of the same in March 2022. The module is especially suitable for residential, commercial and industrial rooftop solar systems.

CS6R-MS Module’s Attributes

Canadian Solar’s CS6R-MS module has a power generation capacity of up to 420 watts (W) and boasts an efficiency of up to 21.5%. This module offers 5~10 W higher power and around 0.5% higher module efficiency than the similar format PERC modules available in the market. It is also compatible with the most common photovoltaic inverters.

Moreover, its light weight, small size and aesthetic design make it all the more appealing from the perspective of homogenous appearance. Also, this module has won Level 1 certification according to the latest IEC 63126 standard, which indicates that it is safe and durable for electricity generation, even under harsh rooftop operating conditions.

Canadian Solar’s Prospects in Global Solar Market

With more and more corporates along with governments across the globe rapidly adopting renewables as their preferred choice to generate electricity, the growth prospects of solar companies like Canadian Solar remains impressive, with solar being one of the top forerunning alternative energy sources.

According to a report from Fortune Business Insights, the global solar power market is expected to grow from $184.03 billion in 2021 to $293.18 billion in 2028, at a CAGR of 6.9%.

The availaibility of Canadian Solar’s CS6R-MS in the market will strengthen the company’s position in the global solar market, backed by its safety, durability and effectiveness, as discussed above.

Canadian Solar is developing a CS6R module with HJT cells and expects to start its commercial delivery this April. CS6R has a module efficiency of up to 22.5% and a power output of up to 440 W.

The fact that these new modules of CSIQ come with improved energy yield and have the capability of reducing the levelized cost of energy (LCOE) of residential, commercial, and industrial rooftop solar systems, demand for them should be solid once shipment starts. This in turn should boost Canadian Solar’s top-line performance in the coming quarters.

Peer Moves

Like CSIQ, other solar players are also making efforts to reap the benefits of the growing global solar market.

For instance,

First Solar

FSLR

announced plans for opening new factories in India and Ohia to produce its next generation of solar panels. The company aims to take its production capacity to 16 GWdc in 2024.

Impressively, FSLR boasts a long-term earnings growth rate of 9.5%. The company has a four-quarter average earnings surprise of 26.49%.

ReneSola

SOL

is currently expanding its business rapidly worldwide. As of Sep 30, 2021, the company completed 850 megawatts (MW) of projects and had 173 MW of projects in operation.

The company has a four-quarter average earnings surprise of 127.50%. The Zacks Consensus Estimate for 2022 earnings implies an improvement of 39% from the 2021 reported figure.

SunPower

SPWR

added 17,000 customers during fourth-quarter 2021, bringing its total customer base to 407,000, led by higher demand in residential solar, dealer expansion and positive policy tailwinds. Moreover, the company continued to witness a solid year-over-year increase in new home installations for which it boasts a record pipeline of 66,000 customers as it entered 2022, reflecting over 40% year-over-year increase.

The company has a four-quarter average earnings surprise of 8.33%. The Zacks Consensus Estimate for 2022 earnings indicates an improvement of 428.6% from the 2021 reported figure.

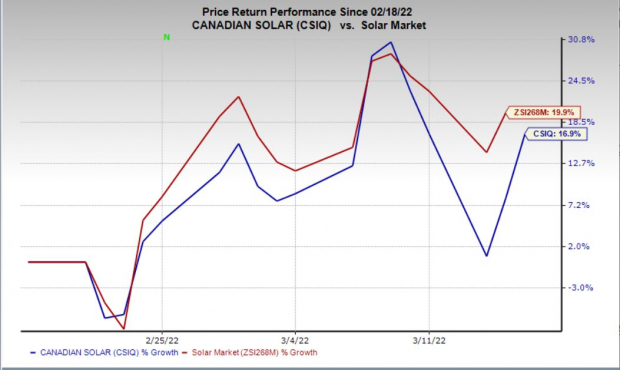

Price Movement

In a month, shares of Canadian Solar have rallied 16.9% compared with the

industry

’s growth of 19.9%.

Image Source: Zacks Investment Research

Zacks Rank

Canadian Solar currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report