Canadian Solar Inc.

CSIQ

recently revealed that CSI Energy Storage, part of the company’s CSI Solar subsidiary, has signed a supply agreement with United Kingdom’s (U.K.) Pulse Clean Energy. Per the terms of the agreement, CSI Energy Storage will deliver 550 megawatt-hour (MWh) of its SolBank energy storage products to Pulse Clean Energy.

CSI Energy Storage will also offer commissioning services for the products, along with long-term warranties and performance guarantees.

Benefits of the Agreement

Thanks to the declining prices of storage batteries, the energy storage market is witnessing rapidly growing demand in the United Kingdom. The energy storage market is also getting a significant boost from the U.K. government, as is evident from the more than 32 million British pound worth of funding awarded recently to projects across the nation, to develop new energy storage technologies.

Such solid funding for energy storage projects will encourage companies like Pulse Clean Energy to build more energy projects, with the company already having a pipeline of more than 2,000 MWh of grid-scale battery storage and energy optimization opportunities across the UK.

CSI Energy Storage is a notable partner of Pulse Clean Energy, having already inked a deal in May 2022. The recent expansion opportunities will also benefit Canadian Solar.

Growth Prospects

Europe’s energy storage market, which also constitutes U.K.’s energy storage projects, is expected to witness a CAGR of 16.3% in the 2023-2028 period, as projected by Mordor Intelligence.

Such a solid market growth prospect will bolster Canadian Solar’s footprint in the aforementioned market, with the solar player already having a storage project pipeline of 8,608 MWh in the Europe, Middle East and Africa (EMEA) region as of September 2022.

Other solar players with an already established business footprint in Europe should also benefit from the aforementioned market growth prospects. These are:

Enphase Energy

ENPH

: In September 2022, ENPH expanded its global relationship with renewable energy company BayWa r.e. to distribute its IQ7 family of microinverters and IQ Batteries in Germany and Benelux. Further, Enphase expects to generate its third-generation IQ battery starting in Europe and emerging markets in the second half of 2023.

Enphase’s long-term earnings growth rate is pegged at 47.3%. The Zacks Consensus Estimate for ENPH’s 2022 sales implies growth of 66.8% from the 2021 reported figure.

ReneSola

SOL

: In October 2022, ReneSola bought U.K.-based utility-scale PV and battery storage developer Emeren, which then had a pipeline of more than 2GW of solar and 500MW of storage under development. The company plans to build a total of 200 MW independent power producers assets in Europe by the end of 2023.

The Zacks Consensus Estimate for SOL’s 2022 sales implies growth of 9.5% from the 2021 reported figure. SOL delivered a four-quarter average earnings surprise of 70.84%.

JinkoSolar Holdings

JKS

: In May 2022, JinkoSolar signed its first European Energy Storage Solution (ESS) agreement with Memodo GmbH (“Memodo”). The Memodo exclusivity agreement for JinkoSolar’s ESS product portfolio will cover the D-A-CH region (Germany, Austria and Switzerland) in 2022 and 2023.

The Zacks consensus estimate for JKS’ 2022 sales suggests growth of 83.7% from the 2021 reported figure. The Zacks Consensus Estimate for JKS’ 2022 earnings indicates growth of 80% from the 2021 reported figure.

Price Movement

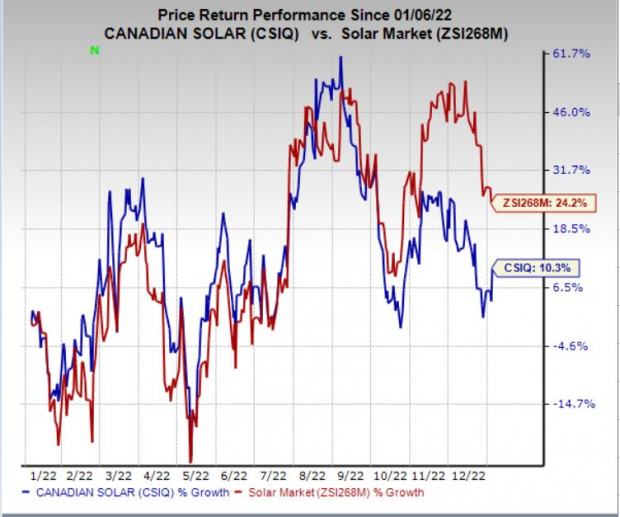

In a year, shares of Canadian Solar have gained 10.3% compared with the

industry

’s growth of 24.2%

Image Source: Zacks Investment Research

Zacks Rank

Canadian Solar currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report