Revenue Up 53% Year-Over-Year 1.5:1 Product Book-to-Bill Ratio & Total Cash Grows to $49.5 Million

VAN NUYS, CA / ACCESSWIRE / April 12, 2021 / Capstone Turbine Corporation (www.capstoneturbine.com) (NASDAQ:CPST) (“Capstone” or the “Company”), the world’s leading manufacturer of clean technology microturbine energy systems, announced today that its unaudited preliminary financial results for the fourth quarter ended March 31, 2021, indicate preliminary revenues of $17.8 million, up 53% from $11.6 million in the year-ago quarter, which marked the beginning of the global COVID-19 pandemic.

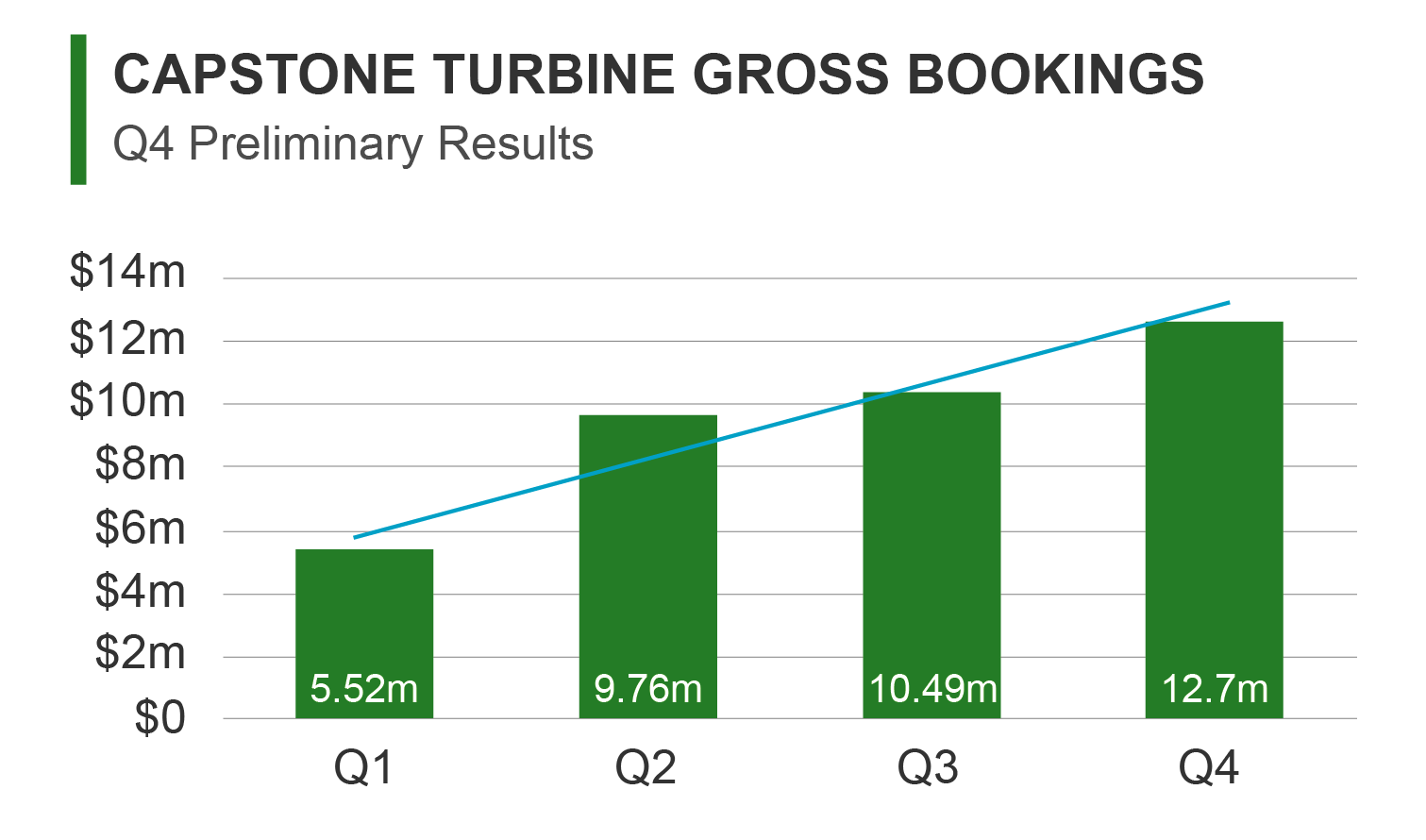

On a preliminary basis, Capstone’s gross product book-to-bill ratio increased sequentially to 1.5:1, up from 0.9:1 in the prior quarter, primarily as a result of the general economic recovery as well as through the combined efforts of the Capstone Solutions Direct Sales organization. Preliminary new gross product bookings in the fourth quarter ended March 31, 2021 were $12.7 million, an increase of 21% from $10.5 million in the third quarter ended December 31, 2020, and an increase of 30% from $9.8 million in the second quarter ended September 30, 2020.

“We are seeing positive developments in our top-line revenue growth as we execute against our strategic Revenue Growth Strategy, which is a six-element initiative designed to drive increased top-line annual revenue,” said Darren Jamison, President and Chief Executive Officer of Capstone Turbine. “I expect the new Biden administration will create even more positive momentum toward green initiatives, generally and for companies like Capstone specifically. Biden’s pending infrastructure bill will most likely contain a green building and sustainability element. Along with expected government initiatives, sustainability is also a driving force behind today’s consumer and investor decision-making process, which in turn is a motivating factor for corporations to reevaluate their responsibility to reduce carbon footprints and push Environmental, Social and Governance (ESG) initiatives,” added Mr. Jamison.

Total cash on hand increased to $49.5 million at March 31, 2021, up from $32.0 million at December 31, 2020, and $15.1 million at March 31, 2020. Cash improved during the quarter primarily due to the issuance of approximately 1.2 million shares of the Company’s Common Stock under its at-the-market offering, generating net proceeds of approximately $14.5 million, along with the continued efforts of tightened working capital management. In addition, during the quarter ended March 31, 2021, the Company received a legal settlement in the amount of $5.0 million arising out of claims pursued in confidential arbitration with a former strategic parts supplier. Legal expenses incurred as a result of this matter totaled approximately $0.3 million for the three months ended March 31, 2021, and $0.7 million for the fiscal year ended March 31, 2021.

“The settlement proceeds will provide Capstone with additional resources to continue to improve customer system reliability and the performance of some of our fielded C200 and C1000 products affected by the sub-optimal parts from the former supplier,” said Eric Hencken, Capstone’s Chief Financial Officer. “With our improved liquidity this quarter, we have much greater flexibility to execute on our growth strategy, in addition to increasing customer confidence in our Company’s ability to become a long-term energy partner,” concluded Mr. Hencken.

Capstone further announced that it is establishing a reserve, expected to be in the amount of approximately $5.0 million, to replace high-risk parts in fielded units affected by sub-optimal parts initially provided by the former strategic parts supplier. The reserve will create a non-recurring impact on warranty expense during the fourth quarter ending March 31, 2021, and will be offset by the non-recurring impact of the $5.0 million settlement to be recorded as other income. Both items, as well as the related legal expenses, are considered non-recurring and will be excluded from Capstone’s non-GAAP presentation of adjusted EBITDA in connection with Capstone’s release of full operating results for the fourth quarter and full-year ended March 31, 2021.

Caution Regarding Preliminary Unaudited Results

The financial data as of, and for the quarter ended, March 31, 2021, presented in this release is preliminary and is based upon the most current information available to management. The Company’s actual results and financial condition may differ from this preliminary financial data due to the completion of year-end closing procedures, audit-related and other adjustments and other developments. Furthermore, the Company’s independent registered public accounting firm has not audited, reviewed or performed other procedures with respect to such preliminary financial data, and an audit, review or other procedures could result in changes to the preliminary data presented. This preliminary financial data should not be viewed as a substitute for full financial statements prepared in accordance with GAAP and is not necessarily indicative of the results to be achieved for any future period.

About Capstone Turbine Corporation

Capstone Turbine Corporation (www.capstoneturbine.com) (NASDAQ:CPST) is the world’s leading producer of highly efficient, low-emission, resilient microturbine energy systems. Capstone microturbines serve multiple vertical markets worldwide, including natural resources, energy efficiency, renewable energy, critical power supply, transportation and microgrids. Capstone offers a comprehensive product lineup via our direct sales team, as well as our global distribution network. Capstone provides scalable solutions from 30 kWs to 10 MWs that operate on a variety of fuels and are the ideal solution for today’s multi-technology distributed power generation projects.

For customers with limited capital or short-term needs, Capstone offers rental systems; for more information, contact: rentals@capstoneturbine.com. To date, Capstone has shipped nearly 10,000 units to 83 countries and in FY20, saved customers an estimated $219 million in annual energy costs and 368,000 tons of carbon.

For more information about the Company, please visit www.capstoneturbine.com. Follow Capstone Turbine on Twitter, LinkedIn, Instagram, Facebook and YouTube.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, including statements regarding expectations for green initiatives and execution on the Company’s growth strategy and other statements regarding the Company’s expectations, beliefs, plans, intentions, and strategies of the Company. The Company has tried to identify these forward-looking statements by using words such as “expect,” “anticipate,” “believe,” “could,” “should,” “estimate,” “intend,” “may,” “will,” “plan,” “goal” and similar terms and phrases, but such words, terms and phrases are not the exclusive means of identifying such statements. Actual results, performance and achievements could differ materially from those expressed in, or implied by, these forward-looking statements due to a variety of risks, uncertainties and other factors, including, but not limited to, the following: the ongoing effects of the COVID-19 pandemic; the availability of credit and compliance with the agreements governing the Company’s indebtedness; the Company’s ability to develop new products and enhance existing products; product quality issues, including the adequacy of reserves therefor and warranty cost exposure; intense competition; financial performance of the oil and natural gas industry and other general business, industry and economic conditions; the Company’s ability to adequately protect its intellectual property rights; and the impact of pending or threatened litigation. For a detailed discussion of factors that could affect the Company’s future operating results, please see the Company’s filings with the Securities and Exchange Commission, including the disclosures under “Risk Factors” in those filings. Except as expressly required by the federal securities laws, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, changed circumstances or future events or for any other reason.

“Capstone” and “Capstone Microturbine” are registered trademarks of Capstone Turbine Corporation. All other trademarks mentioned are the property of their respective owners.

CONTACT:

Capstone Turbine Corporation

Investor and investment media inquiries:

818-407-3628

ir@capstoneturbine.com

SOURCE: Capstone Turbine Corporation

View source version on accesswire.com:

https://www.accesswire.com/639901/Capstone-Turbine-Reports-Certain-Preliminary-Unaudited-4th-Quarter-Results