Cassava

Sciences’

SAVA

stock rose 12.7% on Monday after it provided a clinical update on its Alzheimer’s disease candidate, a small molecule oral drug simufilam.

The company announced that it has completed enrollment of 150 patients in its open-label study of simufilam, which was initiated last year.

In February 2021, Cassava Sciences announced encouraging interim data from the open label study. Both cognition and behaviour scores of patients improved following six months of treatment with simufilam, with no safety issue observed. Safety and cognition data for the first 50 participants to complete nine months of treatment with simufilam from the open label study is expected to be presented at the 2021 Alzheimer’s Association International Conference in July.

Importantly, Cassava Sciences maintained its plan to initiate two pivotal phase III studies to evaluate simufilam for mild-to-moderate AD dementia in the second half of 2021. The company announced that it has selected Premier Research International as its clinical research organization (CRO) to help conduct the phase III studies on simufilam.

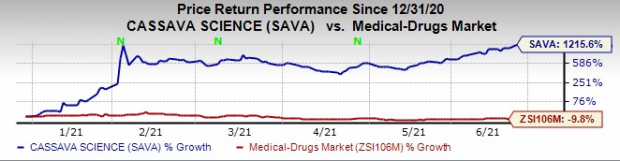

The company’s stock has skyrocketed 1215.6% this year so far against the

industry

’s decrease of 9.6%.

Image Source: Zacks Investment Research

Overall, the Alzheimer’s disease market has been attracting a lot of interest after the FDA, earlier this month, granted accelerated approval to

Biogen

BIIB

and its partner Eisai’s controversial treatment for Alzheimer’s disease, Aduhelm (aducanumab).

Aduhelm has been approved to reduce the accumulation of amyloid beta plaques, a sticky protein, in the brain, which is believed to lead to progression of Alzheimer’s disease.

However, the controversial FDA decision has generated several headlines. Interestingly, the FDA approved Aduhelm despite an FDA advisory committee voting against its approval in November last year due to mixed outcomes data from ENGAGE and EMERGE phase III studies.

The FDA approval has faced a lot of criticism as some analysts believe the drug was not backed by strong evidence of efficacy. Aduhelm also comes with a hefty price tag of $56,000 a year, which has been widely condemned.

However, another group of analysts cheered the drug’s approval despite questionable study results because of the drug’s ability to remove amyloid from the brain and its potential to provide meaningful benefit in preventing progression of this disease.

In fact, the approval of Aduhelm not only boosted Biogen’s stock but also those of

Eli Lilly

LLY

, Cassava and

Annovis Bio

ANVS

as these companies also have AD candidates in their portfolio. The FDA approval of Aduhelm improves the likelihood that these companies will also gain approval for their Alzheimer’s candidates which boosted their stock’s the day Aduhelm was approved.

Cassava Sciences currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report