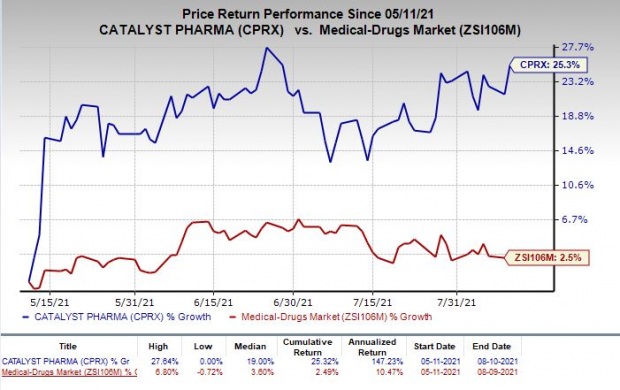

Shares of

Catalyst Pharmaceuticals, Inc.

CPRX

have rallied 25.3% in the past three months compared with the

industry

’s rise of 2.5%.

Image Source: Zacks Investment Research

The company has made rapid progress with its lead drug, Firdapse (amifampridine), in this time frame. The drug is approved in the United States and Europe for the treatment of adult patients with Lambert-Eaton myasthenic syndrome (“LEMS”), an ultra-rare disease. The drug has witnessed solid uptake so far since its launch.

Apart from LEMS, Catalyst is working on developing Firdapse for other indications. A proof-of-concept study on Firdapse to treat hereditary neuropathy with liability to pressure palsies is scheduled to start shortly.

Firdapse is currently being evaluated in various studies for the treatment of MuSK-MG and myasthenia gravis. Development of the long-acting formulation, Firdapse, also remains on track. The company is focused on expanding the commercialization of Firdapse in the United States.

Firdapse generated sales worth $63.8 million, up 8.7% year over year during the first half of 2021. The drug is also being studied for other rare neuromuscular indications, which upon potential approval, can boost its sales and drive the stock further in the days ahead.

In June 2021, Catalyst entered into an exclusive license-and-supply agreement with DyDo Pharma to develop/commercialize Firdapse for the treatment of LEMS in Japan. The drug has already received an Orphan Drug designation in the country for the said indication.

We remind investors that in January 2021, Catalyst had stated that its exploratory study, SMA-001, to evaluate the safety and efficacy of Firdapse in ambulatory patients with Spinal Muscular Atrophy (“SMA”) Type 3, met the primary endpoint of a statistically significant difference for the Hammersmith Functional Motor Scale Expanded. The secondary endpoints were not statistically significant. Clinically, however, the effect was modest. Thus, Catalyst decided not to pursue the SMA Type 3 indication further. Such setbacks are detrimental for the stock.

Presently, Catalyst is solely dependent on Firdapse for revenues. The company’s pipeline also lacks any other promising candidate, which is a woe. Competition in the target market remains an overhang for Catalyst.

Zacks Rank & Stocks to Consider

Catalyst currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the same sector include

Galmed Pharmaceuticals Ltd.

GLMD

,

Relmada Therapeutics, Inc.

RLMD

and

Larimar Therapeutics, Inc.

LRMR

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Galmed Pharmaceuticals’ loss per share estimates have narrowed 3.2% for 2021 and 4.9% for 2022 over the past 60 days.

Relmada Therapeutics’ loss per share estimates have narrowed 0.3% for 2021 and 0.8% for 2022 over the past 60 days.

Larimar Therapeutics’ loss per share estimates have narrowed 16.9% for 2021 and 3.5% for 2022 over the past 60 days.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released

Century of Biology: 7 Biotech Stocks to Buy Right Now

to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report