Catalyst Pharmaceuticals, Inc.

CPRX

reported earnings of 12 cents per share in the first quarter of 2022, which miss the Zacks Consensus Estimate of 14 cents. The company had reported earnings of 7 cents in the year-ago quarter.

Adjusted earnings (adjusted for stock-based compensation, depreciation and tax provision) came in at 18 cents per share in the reported quarter compared with 11 cents a year ago.

Total revenues of $43.1 million were in line with the Zacks Consensus Estimate. Sales rose 42.7% from the year-ago quarter’s $30.2 million. The top line primarily comprised sales of Firdapse (amifampridine), the company’s first approved drug for the treatment of Lambert-Eaton myasthenic syndrome (“LEMS”), and nominal license and other revenues.

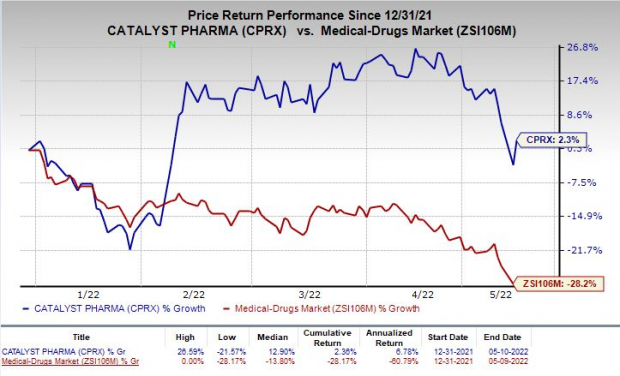

Shares of Catalyst have gained 2.3% so far this year against the

industry

’s fall of 28.2%.

Image Source: Zacks Investment Research

Quarter in Detail

Firdapse generated sales worth $43 million in the first quarter, up 42.4% year over year. License and other revenues were nominal at $0.05 million in the reported quarter.

Research and development (R&D) expenses of $3.4 million increased from $3 million reported in the year-ago quarter.

Selling, general and administrative (SG&A) expenses totaled $16.4 million, up from $12.7 million reported in the year-ago quarter.

As of Mar 31, 2022, CPRX had cash, cash equivalents and investments worth $198 million compared with $191 million as of Dec31, 2021.

2022 Guidance

Catalyst reiterated the guidance it had provided earlier this year.

For 2022, the company continues to expect total revenues in the range of $195-$205 million, suggesting a 38-45% increase from 2021. It also expects cash operating expenses for 2022 in the range of $65-$70 million.

The guidance assumes continued recovery in macro-economic and healthcare activity throughout 2022 from the COVID pandemic.

Recent Updates

The company is focused on expanding the commercialization of Firdapse in the United States. Catalyst has submitted a supplemental new drug application or sNDA to the FDA, seeking approval of Firdapse for the treatment of pediatric LEMS patients.

Last September, CPRX achieved a major milestone when it received positive decision from the Appeals Court, which supported the orphan drug designation for Firdapse granted by the FDA for LEMS. The FDA had previously approved Jacobus Pharmaceutical Company’s drug, Ruzurgi, to treat LEMS in pediatric patients, violating the orphan drug designation granted to Firdapse. The Appeals Court also denied Jacobus’ petition for rehearing its ruling and issued a mandate to the District Court to grant summary judgment in the company’s favor. The District Court granted summary judgment last month, thereby making the FDA’s approval of Ruzurgi in LEMS invalid.

The company has also received a similar favorable decision from the Canadian Federal Court, which also set aside the approval of Ruzurgi for LEMS in Canada.

Zacks Rank & Stocks to Consider

Catalyst currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the same sector include

Onconova Therapeutics, Inc.

ONTX

,

Galectin Therapeutics Inc.

GALT

and

Soleno Therapeutics, Inc.

SLNO

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Onconova Therapeutics’ loss per share estimates have narrowed 22.4% for 2022 and 18.2% for 2023 over the past 60 days.

Earnings of Onconova Therapeutics have surpassed estimates in the trailing three quarters. ONTX delivered an earnings surprise of 22.72% on average.

Galectin Therapeutics’ loss per share estimates have narrowed 44.7% for 2022 and 46.8% for 2023 over the past 60 days.

Earnings of Galectin Therapeutics have surpassed estimates in the trailing three quarters. GALT delivered an earnings surprise of 24.73% on average.

Soleno Therapeutics’ loss per share estimates have narrowed 9.1% for 2022 and 25.9% for 2023 over the past 60 days.

Earnings of Soleno Therapeutics have surpassed estimates in one of the trailing four quarters, met the same once and missed the same on the other two occasions. SLNO delivered an earnings surprise of -60.23% on average.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report