Celldex Therapeutics, Inc.

CLDX

announced interim data from its ongoing phase Ib study evaluating its lead pipeline candidate, barzolvolimab (also known as CDX-0159), for treating patients with moderate to severe chronic spontaneous urticaria (“CSU”) refractory to antihistamines.

Data from the study showed that treatment with multiple doses of barzolvolimab led to dose-dependent reduction in itch and hives, as measured through the urticaria activity score over seven days (UAS7) — a scale to measure the severity of CSU. It demonstrated a mean UAS7 reduction of 66.6% in all patients who were in the 1.5 mg/kg dose group at week 12 and a UAS7 reduction of 75.1% in all patients in the ongoing 3mg/kg dose group at week 8, with meaningful symptom improvements for patients.

Treatment with multiple doses of barzolvolimab also demonstrated a favorable safety profile, supporting development of barzolvolimab in a phase II study.

Despite the interim data, shares of Celldex were down 15.8% on Jul 1 following the announcement of the news on Jun 30. The interim data from the ongoing phase Ib study might have fallen short of investors’ expectations, resulting in the stock going down.

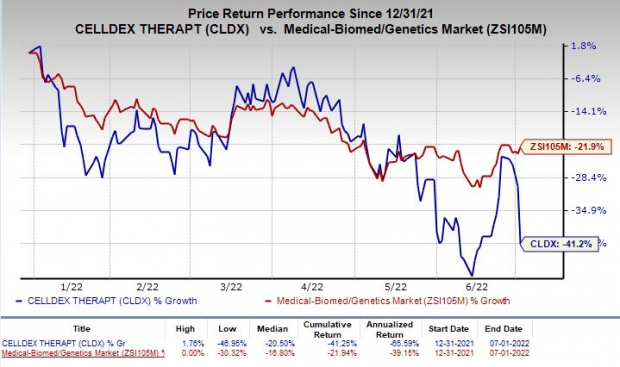

Shares of Celldex have plunged 41.2% so far this year compared with the

industry

’s decline of 21.9%.

Image Source: Zacks Investment Research

In June 2022, Celldex initiated dosing in a phase II study evaluating barzolvolimab as a potential treatment for patients with CSU.

The mid-stage study will evaluate three doses — 75 mg every four weeks, 150 mg every four weeks or 300 mg every eight weeks — of the antibody candidate versus placebo during the initial 16 weeks of the placebo-controlled treatment phase. Patients will then enter an active treatment phase for 36 weeks.

Celldex plans to start dosing in another phase II study to evaluate barzolvolimab for treating chronic inducible urticaria.

Celldex is planning to initiate a phase II study to evaluate barzolvolimab in patients with eosinophilic esophagitis in the fourth quarter of 2022. The company is also evaluating the candidate in a phase Ib study as a potential treatment for prurigo nodularis.

Celldex has no approved product in its portfolio at the moment. Therefore, successful development of its pipeline candidates remains a key focus for the company.

Zacks Rank & Stocks to Consider

Celldex currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Aeglea BioTherapeutics’ loss per share estimates narrowed 19.4% for 2022 and 37.5% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AGLE delivered an earnings surprise of 9.47%, on average.

Precision BioSciences’ loss per share estimates narrowed 26.2% for 2022 and 42.6% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report