Celldex Therapeutics

CLDX

announced that it has initiated dosing in a phase II study to evaluate its lead pipeline candidate, barzolvolimab (CDX-0159), as a potential treatment for patients with chronic spontaneous urticaria (CSU).

The mid-stage study will evaluate three doses — 75 mg every 4 weeks, 150 mg every 4 weeks or 300 mg every 8 weeks — of the antibody candidate versus placebo during the initial 16 weeks of the placebo-controlled treatment phase. Patients will then enter an active treatment phase that will continue for 36 weeks.

In this phase, patients receiving the lowest dose during the placebo-controlled treatment phase will be dosed with either of the two higher doses. The remaining patients will continue to receive the same regimen that was administered during the initial 16 weeks of the study. Following the completion of the first two phases of treatment, the study will continue to evaluate the patients for another 24 weeks for follow-up data. The study is evaluating a subcutaneous formulation of the candidate.

The primary endpoint of the phase II study evaluating barzolvolimab in CSU patients is mean change in UAS7, a scale to measure the severity of CSU from baseline to week 12.

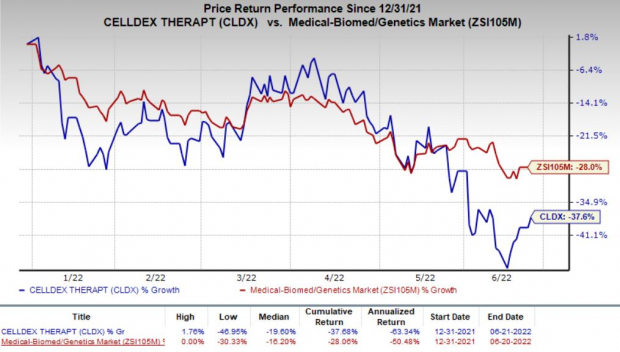

Shares of Celldex closed 3.5% higher on Jun 21 following the news. However, the company’s shares have declined 37.6% so far this year compared with the

industry

’s decrease of 28%.

Image Source: Zacks Investment Research

As a requirement to start the mid-stage study, Celldex initiated a phase I study last year to evaluate the subcutaneous formulation of barzolvolimab. The early-stage study has been designed with four cohorts to evaluate four doses — 50 mg, 150 mg, 300 mg, and 600 mg — of subcutaneous CDX-0159 in healthy volunteers primarily for safety and tolerability. The study’s secondary endpoints include pharmacokinetics, pharmacodynamics, and immunogenicity.

The study is part of Celldex’s chronic urticaria program under which it is also evaluating barzolvolimab in patients with chronic inducible urticaria (CIU). The company plans to start dosing in another phase II study that will evaluate barzolvolimab for treating CIU.

Last year, Celldex announced data from a phase Ib study that demonstrated that the intravenous administration of single-dose barzolvolimab led to a 95% complete response rate in CIU patients.

A phase Ib study is also evaluating barzolvolimab in CSU patients who are refractory to antihistamines. The study is evaluating 0.5, 1.5 and 3 mg/kg doses of the candidate.

Celldex is planning to initiate a phase II study to evaluate barzolvolimab in patients with eosinophilic esophagitis in the fourth quarter of 2022. The company is also evaluating the candidate in a phase Ib study as a potential treatment for prurigo nodularis.

Apart from barzolvolimab, Celldex has two early-stage candidates — CDX-1140 and CDX-527 — targeting oncology indications, especially solid tumors.

Zacks Rank & Stocks to Consider

Celldex currently has a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Some better-ranked biotech stocks are

Alkermes

ALKS

,

Sesen Bio

SESN

and

Anavex Life Sciences

AVXL

. While Alkermes and Sesen sport a Zacks Rank #1, Anavex carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Alkermes’ 2022 loss per share has narrowed from 10 cents to 3 cents in the past 60 days. Shares of ALKS have risen 18.9% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.48%.

The Zacks Consensus Estimate for Sesen Bio’s 2022 loss has narrowed from 33 cents to 32 cents per share in the past 60 days. Shares of SESN have gained 8.8% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.94%.

The Zacks Consensus Estimate for Anavex’s 2022 loss has narrowed from 91 cents to 85 cents per share in the past 60 days. Shares of AVXL have declined 47.5% in the year-to-date period.

Earnings of Anavex beat estimates in two of the last four quarters and missed the mark twice, the average surprise being 0.48%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report