Cybin Inc.

CYBN

announced that it has received a received a “may proceed letter” and a clearance of the investigational new drug (“IND”) application from the FDA to begin a phase I/IIa study evaluating its pipeline candidate, CYB003.

The IND application has been cleared to evaluate Cybin’s proprietary deuterated psilocybin analog, CYB003, for the potential treatment of major depressive disorder (“MDD”). The company plans to begin recruiting patients immediately for the I/IIa study. Safety and pharmacokinetic data from the same are expected in the fourth quarter of 2022.

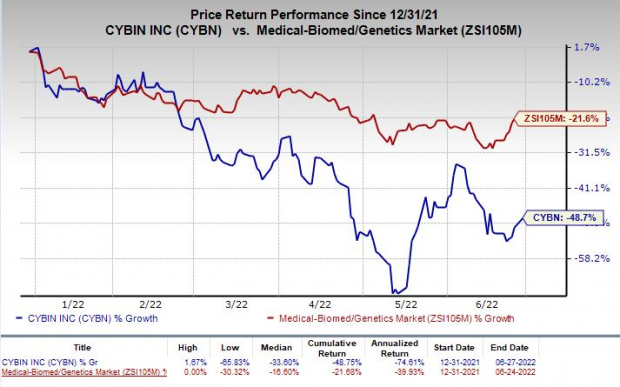

Shares of Cybin were up 4.7% on Monday following the announcement of the news. The stock has plunged 48.7% so far this year compared with the

industry

’s decline of 21.6%.

Image Source: Zacks Investment Research

Per the company, the phase I/IIa study on CYB003 will be the first time that a novel psilocybin analog is investigated for the treatment of MDD.

Earlier this month, Cybin received approval from the United States Institutional Review Board for its first-in-human phase I/IIa study evaluating CYB003 for treating MDD.

The double-blind, placebo-controlled study will investigate people with moderate to severe MDD.

In May 2022, Cybin submitted the IND for the phase I/IIa study evaluating CYB003 for treating MDD.

This apart, Cybin is looking to accelerate the clinical development of another candidate, CYB004, for the potential treatment of anxiety disorders through the planned acquisition of a phase I study from Entheon Biomedical Corp.

Cybin has no approved product in its portfolio at the moment. Therefore, successful development of its pipeline candidates remains a key focus for the company.

Zacks Rank & Stocks to Consider

Cybin currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Precision BioSciences, Inc.

DTIL

, all carrying the same Zacks Rank #2 at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Aeglea BioTherapeutics’ loss per share estimates narrowed 19.4% for 2022 and 37.5% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AGLE delivered an earnings surprise of 9.47%, on average.

Precision BioSciences’ loss per share estimates narrowed 26.2% for 2022 and 42.6% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report