Daré Bioscience

DARE

announced that it has initiated a phase I/II study to evaluate its investigational proprietary formulation, DARE-VVA1, for non-hormonal treatment of moderate to severe vulvar and vaginal atrophy (“VVA”), an inflammation of the vaginal epithelium resulting from a reduction in estrogen levels.

DARE-VVA1 is a novel formulation of tamoxifen designed for intravaginal administration to exert an estrogen-like response on vaginal cytology for the treatment of VVA. Unlike other VVA treatments that are predominantly based on estrogen, DARE-VVA1 offers treatment to VVA without the use of estrogen.

VVA is a common condition in postmenopausal women and women with hormone receptor-positive (“HR+”) breast cancer. It is marked by vaginal dryness, itching, burning and painful intercourse.

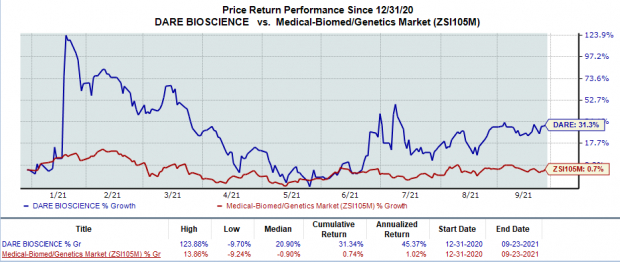

The stock has rallied 31.3% so far this year in comparison with the

industry

’s 0.7% rise.

Image Source: Zacks Investment Research

The phase I/II study will evaluate the safety, tolerability, pharmacokinetics (“PK”) and pharmacodynamics (“PD”) of DARE-VVA1 in 40 postmenopausal participants with moderate to severe VVA. The study will randomize the patients into five equal treatment groups, i.e., four different doses of the therapy, namely 1 mg, 5 mg, 10 mg, and 20 mg, and placebo.

The primary endpoints include assessing the safety and tolerability of vaginal administration of the therapy including assessment of the therapy’s plasma PK after intravaginal application. Secondary endpoints include evaluation of the therapy’s preliminary efficacy and PD in terms of most bothersome symptoms, and changes in vaginal cytology and pH.

Per the company, approximately 10% of women living in the United States develop breast cancer. Moreover, VVA is commonly found in 42-70% of postmenopausal breast cancer patients. If approved, DARE-VVA1 will be the first therapy for the treatment of VVA for women with HR+ breast cancer.

Zacks Rank & Stocks to Consider

Daré Bioscience currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same sector include

Regeneron Pharmaceuticals

REGN

,

Repligen Corporation

RGEN

and

Vertex Pharmaceuticals

VRTX

. While Regeneron and Repligen each carry a Zacks Rank #1 (Strong Buy) at present, Vertex holds a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Regeneron’s earnings per share estimates for 2021 have increased from $49.91 to $59.80 in the past 60 days. The same for 2022 has risen from $40.91 to $46.72 over the same period. The stock has rallied 33.8% in the year so far.

Repligen’s earnings per share estimates for 2021 have increased from $2.26 to $2.76 in the past 60 days. The same for 2022 has risen from $2.57 to $3.03 over the same period. The stock has rallied 69.2% in the year so far.

Vertex’s earnings per share estimates for 2021 have increased from $11.22 to $12.37 in the past 60 days. The same for 2022 has risen from $12.24 to $13.13 over the same period.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out

Zacks’ Marijuana Moneymakers

:

An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report