DiaMedica Therapeutics Inc.

DMAC

announced that it initiated a pivotal phase II/III study — ReMEDy2 — to evaluate its recombinant kallikrein-1 (KLK1) protein candidate, DM199, as a potential treatment of acute ischemic stroke (AIS). Data from this study will support a biologics license application for the candidate.

The study will evaluate the administration of the candidate within 24 hours of the onset of AIS symptoms compared to placebo for two primary endpoints — improvement in recovery after a stroke and prevention of stroke recurrence. The recovery from stroke will be measured by the well-established modified Rankin Scale. The company is evaluating an intravenous as well as a subcutaneous formulation of the candidate.

The study will not include participants who have undergone tissue plasminogen activator (tPA) and those with large vessel occlusions.

Data from the phase II ReMEDy study demonstrated improvement in stroke outcomes and reduction in stroke recurrence following treatment of AIS with DM199. The candidate also demonstrated an excellent safety profile in the study.

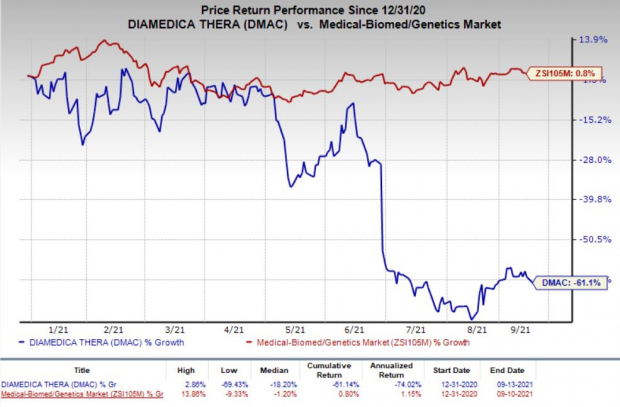

Shares of DiaMedica have declined 61.1% so far this year against the

industry

’s increase of 0.8%.

Image Source: Zacks Investment Research

The company believes that DM199 can meaningfully change the outcomes in AIS patients as it will provide flexibility of a 24-hour treatment window for this emergency compared to the currently much smaller 4.5 hours treatment window for tPA. The longer treatment window is also likely to increase the eligible patient population for DM199. Successful development DM199 can prove to be beneficial for almost 80% of patients who have suffered an AIS and have no treatment option available currently.

Per the press release, there are approximately 795,000 cases of ischemic or hemorrhagic stroke annually in the United States. Almost three-fourths of the cases are first event and the rest represents recurrent strokes. Apart from the United States, millions of strokes occurrences happen globally every year. This represents a significant opportunity for DM199, if developed successfully in the pivotal study, followed by a potential approval due to high unmet need.

Apart from AIS, DiaMedica is also evaluating the subcutaneous formulation of the candidate in the phase II REDUX study as a potential treatment for chronic kidney disease. Interim data announced in June demonstrated that treatment with DM199 led to clinically meaningful improvements in kidney function.

Meanwhile, a few other pharma/biotech companies are developing treatments for AIS which include

AbbVie

’s

ABBV

elezanumab,

Biogen

’s

BIIB

TMS-007, and

Pfizer

’s

PFE

mono-drug therapy in combination with an oral anticoagulant

Zacks Rank

DiaMedica currently carries a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report