Dr. Reddy’s Laboratories Limited

RDY

reported first-quarter fiscal 2022 earnings of 46 cents per American Depositary Share, compared with 47 cents in the year-ago quarter.

However, revenues grew 11% year over year to $662 million.

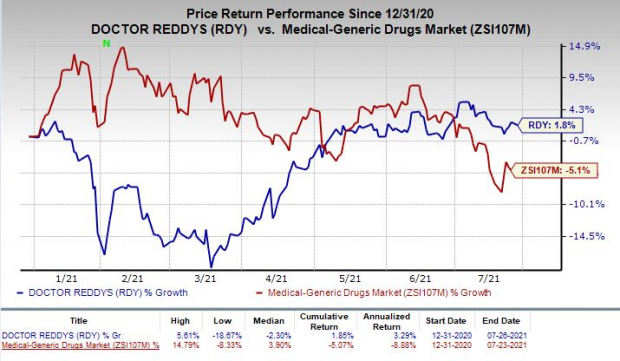

So far this year, shares of the company have rallied 1.8% against the

industry

’s decrease of 5.1%.

Image Source: Zacks Investment Research

Quarter in Detail

Dr. Reddy’s reports revenues under three segments — Global Generics; Pharmaceutical Services & Active Ingredients (“PSAI”); and Proprietary Products and Others.

Global Generics revenues were INR 41.1 billion, up 17% year over year, in the fiscal first quarter. Growth was led by branded markets (India and emerging markets) and Europe.

The company launched six products in North America, including Sapropterin Dihydrochloride Powder, Albendazole Tablets, Ertapenem Injection and Icosapent Ethyl Capsules in the United States, and two products in Canada.

PSAI revenues were INR 7.5 billion, down 12% from the year-ago quarter.

Revenues in the Proprietary Products segment came in at INR 541 million, down 1% year over year.

Research and development expenses surged 14% year over year to $61 million. The company is undertaking the development of products pertaining to COVID-19-related drugs.

Selling, general and administrative expenses were $202 million, up 18% year over year due to incremental costs post integration of the acquired divisions from Wockhardt and increased marketing expenses.

As of Jun 30, cumulatively, 93 generic filings were pending approval from the FDA (90 abbreviated New Drug Applications [ANDAs] and three new drug applications). Of these 93 ANDAs, 47 are Para IVs and 24 have first-to-file status.

Our Take

In first-quarter fiscal 2022, Dr. Reddy’s top line registered year-over-year growth while the bottom line declined slightly on a year-over-year basis.

The company continues to face price erosion, especially in the North America generics market, which is adversely impacting sales.

Zacks Rank & Stocks to Consider

Dr. Reddy’s currently has a Zacks Rank #3 (Hold). Better-ranked stocks in the healthcare sector include

Repligen Corporation

RGEN

,

Corcept Therapeutics Incorporated

CORT

and

Nabriva Therapeutics plc

NBRV

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Repligen’s earnings estimates have been revised 2.3% and 1.6% upward for 2021 and 2022, respectively, over the past 60 days. The stock has rallied 7.5% year to date.

Corcept’s earnings estimates have been revised 2.5% upward for 2021 and 3.1% upward for 2022 over the past 60 days.

Nabriva Therapeutics’ loss per share estimates have narrowed 10.1% for 2021 and 24.1% for 2022 over the past 60 days.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report