Earthstone Energy Inc.

ESTE

announced the completion of its previously-announced acquisition of operated oil and gas-producing assets in the Midland Basin from Tracker Resource Development. The company also acquired related well-bore interests in some of the Tracker-operated producing wells from Sequel Energy Group LLC.

The transaction is valued at $126.5 million, including $81.6 million in cash and 6.2 million shares of Class A common stock of Earthstone. The company expects the acquisition to result in an increase in the production by 5,800-6,000 barrels of oil equivalent per day (boe/d) in the second half of 2021.

Following this, Earthstone announced an update to its production guidance for 2021. The company increased its 2021 production guidance by 19% to 23,500-24,250 boe/d. It revised its 2021 capital budget to $130-$140 million to include a second rig.

Earthstone also presented an estimate of mid-year 2021 proved reserves. It provided preliminary production results and operational updates for the second quarter of 2021. Adjusted for the closing of the Tracker acquisition, the company estimated total proved reserves of 133.6 million boe, with a corresponding PV-10 value of $1,677 million.

As of Jun 30, 2021, the company had an estimated cash balance of $500,000 and total liquidity of $249.5 million on a combined basis. It had long-term debt of $301 million outstanding under its credit facility, with a borrowing base of $550 million.

For second-quarter 2021, Earthstone expects oil and gas sales volumes of 22,716 boe/d, suggesting an increase of 12% from first-quarter reported volumes. Average daily sales volumes are expected to be 25,500-27,000 boe/d. The company’s capital expenditure is expected to be $22.8 million and $32.6 million for the second quarter and the first half of 2021, respectively. Earthstone completed three gross wells on the Hamman 45 pad in Midland County in the Jo Mill, Lower Spraberry and Wolfcamp B zones.

In Midland County, Earthstone expects to complete and turn to sales the recently-drilled 4-well Pearl Jam pad in the third quarter of 2021. In August, the company plans to deploy its second rig, beginning in Upton County. With the addition of the second rig, it will continue to develop its increasing drilling inventory, mainly impacting production volumes in 2022 and beyond.

Company Profile & Price Performance

Headquartered in Denver, CO, Earthstone is an independent oil and gas exploration and production company.

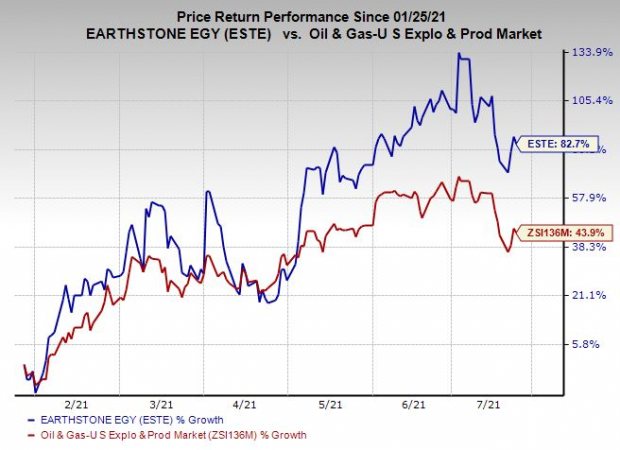

Shares of the company have outperformed the

industry

in the past six months. The stock has gained 82.7% compared with the industry’s 43.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Earthstone currently carries a Zack Rank #2 (Buy).

Some other top-ranked players in the energy space are

Callon Petroleum Company

CPE

,

Devon Energy Corporation

DVN

, and

Penn Virginia Corporation

PVAC

, each currently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Callon’s earnings for 2021 are expected to rise 55.1% year over year.

Devon’s earnings for 2021 are expected to grow 32.6% year over year.

Penn Virginia’s earnings for 2021 are expected to increase 49.2% year over year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report