Earthstone Energy, Inc.

ESTE

recently acquired working interests in oil and gas-producing Eagle Ford assets from four different sellers. The stock has jumped 8.5% since the announcement of the acquisition on Jun 14.

The bolt-on acquisition has an effective date of Apr 1. The company paid a discounted price of $48 million in cash for the transaction from cash available on hand and borrowing under the revolving credit facility. As of Mar 31, 2021, it only had $1.4 million in cash and $136.6 million of undrawn borrowing capacity. Long-term debt was $223.4 million.

The low-cost assets are operated by the company itself, wherein net production is around 1,150 barrels of oil equivalent per day. Of the total production volumes, 89% is estimated to be crude oil. Production decline rate is low at the site. Associated reserves at the site are around 3.4 million barrels of oil equivalent. The move is expected to boost its footprint in the Eagle Ford Shale.

This marks the third acquisition in 2021 by the company, post the buyouts of Tracker, announced in April, and Independence Resources Management, closed in January. The latest acquisition will likely boost oil weightage in Earthstone’s portfolio. Given the fact that oil price has surged to more than the $70 per barrel mark, the latest acquisition can position the company for massive cash gains.

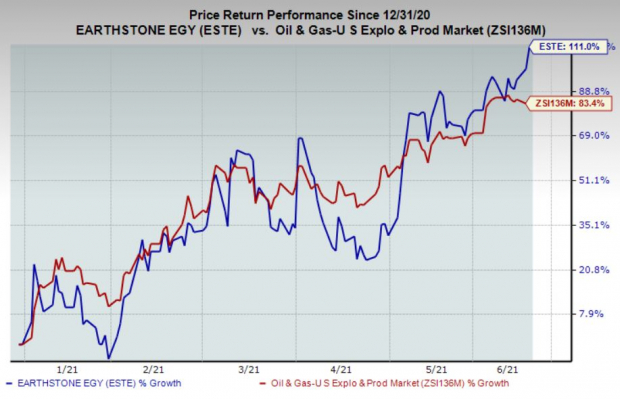

Price Performance

The company’s shares have jumped 111% in the year-to-date period compared with 83.4% rise of the

industry

it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

The company currently carries a Zacks Rank #2 (Buy). Other top-ranked players in the energy space include

PDC Energy, Inc.

PDCE

,

Pembina Pipeline Corporation

PBA

and

PHX Minerals Inc.

PHX

, each having a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

PDC Energy’s earnings for 2021 are expected to jump 123.7% year over year.

Pembina Pipeline’s bottom line for 2021 is expected to rise 37.4% year over year.

PHX Minerals’ bottom line for 2021 is expected to surge 140% year over year.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report