Emergent BioSolutions Inc.

EBS

reported third-quarter 2021 loss of 36 cents per share against the Zacks Consensus Estimate of earnings of $2.03. In the year-ago quarter, the company had reported earnings of $2.19 per share. Lower revenues led to the significant decline in net income.

Revenues in the reported quarter were $329 million, down 15% from the prior-year period. Higher sles of Narcan nasal spray and smallpox vaccine was more than offset by the loss of sales from the anthrax vaccine and lower CDMO segment revenues in the quarter. The top line significantly missed the Zacks Consensus Estimate of $454.2 million.

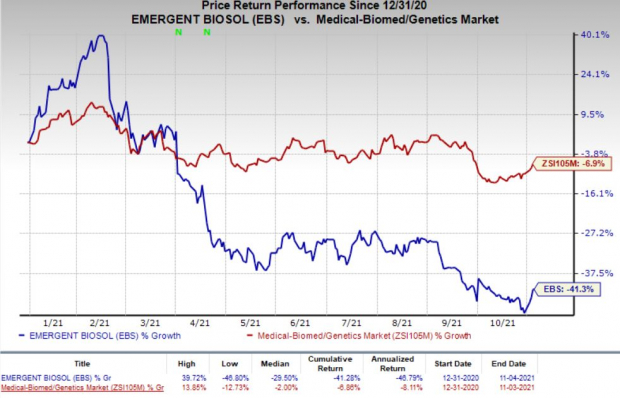

Shares of Emergent declined 14.5% during after-hours trading on Nov 4, following the lower-than-expected third-quarter results. In fact, the company’s shares have declined 41.3% so far this year compared with the

industry

’s decrease of 6.9%.

Image Source: Zacks Investment Research

Quarter in Detail

Total product sales increased 34% from the year-ago quarter to $270.5 million, driven by strong sales of the Narcan nasal spray and the smallpox vaccine.

Narcan (naloxone HCl) nasal spray added $133.3 million to product sales, reflecting an increase of 50% year over year, driven primarily by growth in the U.S. and Canadian markets.

Sales of anthrax vaccines (BioThrax and AV7909) were $15.6 million in the reported quarter, down 79% year over year. The decrease in sales of anthrax vaccines was due to unfavorable timing of deliveries to the U.S. government.

Emergent reported sales of $80.7 million for its smallpox vaccine, ACAM2000, compared with $1 million in the year-ago quarter. The increase in small pox sales was driven by the option exercise by the U.S. government in July 2021. The option exercise will also drive ACAM2000 sales in the fourth quarter.

Other product sales were up 6% year over year to $40.9 million.

Revenues from contracts and grants decreased 35% year over year to $16.9 million.

CDMO services revenues jumped more than 112% year over year to $112.6 million. The increase was on the back of contributions for services provided to partners engaged in developing COVID-19 vaccines or therapy, especially

J&J

JNJ

. However, the growth in CDMO services was more than offset by the reversal of CDMO lease revenues of $86.0 million, following the reclassification of the public-private partnership with the Biomedical Advanced Research and Development Authority (BARDA) as a lease. The reclassification reduces the total contract value realized under the 2020 task order to $470.9 million from $650.8 million.

The company reported adjusted EBITDA of a loss of $3.3 million in the reported quarter, against earnings of $168.1 million in the prior-year quarter.

Updates 2021 Guidance

Emergent lowered the upper end of its previous revenue guidance for 2021 from the range of $1.7-$1.9 billion to $1.7-$1.8 billion, especially reflecting the impact of the reclassification of the CDMO agreement with the BARDA. The Zacks Consensus Estimate for total revenues stands at $1.79 billion.

The company lowered the CDMO services revenue guidance and now expects it to be between $600 million and $650 million compared with the previous range of $765-$875 million. The company also lowered its guidance for sales of anthrax vaccines to $250-$260 million from $280-$310 million previously.

However, the company has raised the revenues guidance for Narcan nasal spray and smallpox vaccine. It now expects Narcan revenues to be in the range of $400-$420 million compared with the previously guided range of $305-$325 million. Revenues from the smallpox vaccine are expected to be between $200 million and $220 million, up from $185-$205 million expected previously.

Emergent also anticipates lower adjusted net income within $315-$350 million, compared with the previous expectation of $395-$470 million. Adjusted EBITDA is anticipated in the range of $500-$550 million, down from $620-$720 million expected previously.

Zacks Rank & Stock to Consider

Emergent currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the biotech sector are

Vertex Pharmaceuticals

VRTX

and

ADMA Biologics

ADMA

, both carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Earnings per share estimates for Vertex have moved up from $12.37 to $12.43 for 2021 and from $13.13 to $13.21 for 2022 in the past 30 days. The company delivered an earnings surprise of 8.00%, on average, in the last four quarters.

The bottom-line estimates for ADMA Biologics have narrowed from a loss of 59 cents to 58 cents for 2021 and from a loss of 34 cents to 32 cents for 2022 in the past 30 days.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report