Shares of

Enanta Pharmaceuticals

ENTA

were down 15.1% in after-hours trading on Wednesday (May 18) after management announced top-line data from the phase IIb RSVP study, which evaluated its potent N-protein inhibitor candidate EDP-938 against placebo in otherwise healthy adults with community-acquired Respiratory Syncytial Virus (RSV).

Though EDP-398 demonstrated a favorable safety profile and was well-tolerated by the study participants, the RSVP study failed to achieve its primary endpoint of reduction in total symptom score (TSS) compared to placebo. The study also did not achieve any secondary endpoint.

However, the study did achieve a statistically significant difference in the number of subjects achieving undetectable RSV RNA at the end of treatment with EDP-938.

Per Enanta, the RSVP study is currently the only study that achieved a statistically significant antiviral effect in otherwise healthy adults with community-acquired RSV.

Based on the above analysis, Enanta will continue to evaluate EDP-398 to treat RSV infections in both the ongoing and planned clinical studies. ENTA is currently enrolling patients in two mid-stage studies that are evaluating the candidate in pediatric patients and adult hematopoietic cell transplant recipients, respectively. ENTA also intends to start a phase IIb study by this year-end on the candidate in a high-risk adult population, including elderly patients.

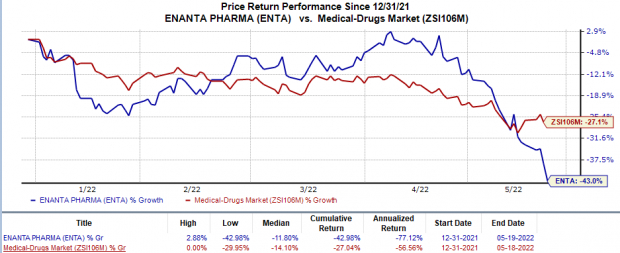

Shares of Enanta have declined 43% this year so far compared with the

industry

’s 27% fall.

Image Source: Zacks Investment Research

ENTA is also on track to start a phase I study later this year to evaluate EDP-323, an investigational oral direct-acting antiviral, designed to target RSV L-protein. Enanta plans to develop EDP-323, both as a monotherapy and in combination with other RSV drugs like EDP-398, to expand the scope of RSV treatment in broad patient groups.

Many other companies are also preparing their own pipeline candidates targeting RSV infections.

Last month,

Pfizer

PFE

announced that it entered into a definitive agreement to acquire the closely-held biotech company ReViral, which is developing therapeutics for RSV. The acquisition will add some promising RSV candidates to PFE’s portfolio, including sisunatovir, an oral therapy that showed significantly reduced viral load in a phase II RSV human challenge study in healthy adults. The same is also being evaluated in a phase II study in infants.

Another candidate is in phase I study for inhibition of RSV replication targeting the viral N protein. Pfizer believes that if these RSV candidates are successfully developed, they have the potential to generate annual revenues of more than $1.5 billion.

Pfizer is also developing its own RSV vaccine candidate PF-06928316 or RSVpreF in ongoing late-stage clinical studies.

Zacks Rank & Stocks to Consider

Enanta Pharmaceuticals currently carries a Zacks Rank #3 (Hold). Two better-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

and

Alkermes

ALKS

each of which has a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Abeona Therapeutics’ loss per share estimates for 2023 have narrowed from 15 cents to 13 cents in the past 30 days. Shares of ABEO have declined 51.8% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and met the same on the remaining two occasions, the average negative surprise being 8.2%. In the last reported quarter, Abeona Therapeutics missed on earnings by 25%.

Alkermes’ loss per share estimates for 2022 have narrowed from 13 cents to 3 cents in the past 30 days. Shares of ALKS have risen 24.1% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report