Energy Transfer

ET

announced that it has signed a 15-year power purchase agreement (PPA) with SB Energy for 120 megawatts (MW) of electricity from its Eiffel Solar project in northeast Texas. This 200 MW solar project is expected to supply clean electricity to Energy Transfer from January 2024.

Energy Transfer continues to lower emissions footprint throughout its operations, with the use of technologies such as dual drive compressors, by supporting clean electric generation projects.This is the firm’s second PPA agreement and the power purchased from this project will be utilized to meet electricity requirements in its operations throughout Texas.

The Maplewood 2 solar project in West Texas was completed earlier in April 2021. This represents the firm’s first-ever dedicated solar power purchase contract. Markedly, 28 MW clean power generated from this project will be utilized for Energy Transfer’s assets in West Texas, including three cryogenic plants in the region along with numerous compressor and pump stations.

Nearly 20% of the electrical energy currently purchased by the company comes from renewable energy sources.

Usage of Solar Energy on the Rise

Per the U.S. Energy Information Administration (EIA) forecast, utility-scale solar capacity addition is likely to be 16.2 gigawatt (GW) in 2021 and 16.6 GW in 2022. In 2020, 10.6 GW solar capacity was added. EIA also forecasts a major chunk of the solar projects to be added in Texas.

Given the increasing installation of solar projects in the United States, companies like

ReneSola Ltd

SOL

, among others, are going to benefit, since it is a fully integrated solar project developer.

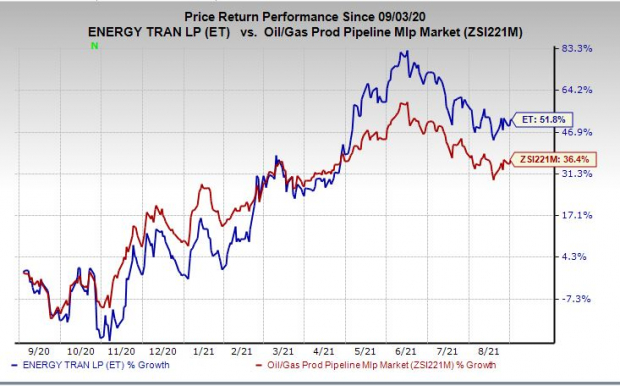

Price Performance

The units of the firm have performed better than the

industry

in the past 12 months.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The firm currently has a Zacks Rank of 3 (Hold). A couple of better-ranked stocks in the same industry include

Summit Midstream Partners LP

SMLP

and

Delek Logistics Partners LP

DKL

. Summit Midstream Partners sports a Zacks Rank of 1 (Strong Buy) while Delek Logistics has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Summit Midstream Partners and Delek Logistics Partners delivered an average surprise of 1630.2% and 5.9%, respectively, in the last four quarters.

The Zacks Consensus Earnings Estimate for Summit Midstream Partners and Delek Logistics Partners’ 2021 earnings has moved up 36.4% and 7.5%, respectively, in the past 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report