Enphase Energy, Inc.

ENPH

recently revealed its buyout of SolarLeadFactory LLC, which provides high-quality leads to solar installers.

This acquisition would help Enphase achieve its aim of building a digital platform for installers by incorporating tools to design, permit, install, monitor, and maintain solar and battery systems.

Benefits of the Acquisition

Though the rate of solar installations is rising significantly across the globe, a major challenge that solar installers face is identifying their customers. A key way for installers to reach out to prospective customers is through solar lead generation.

However, such lead generations can push up expenses for customers.

The acquisition of SolarLeadFactory will help Enphase’s network of installers to increase lead volumes and conversion rates, thereby reducing their customer acquisition costs. Considering the fact that customer acquisition costs are high in the United States, this should attract more installers to get connected with Enphase Energy, thereby boosting its operating results.

Moreover, such cost effectiveness resulting from Enphase’s latest buyout would bolster installation rates in the U.S. solar market, thereby promoting growth in this space.

Enphase’s Prospects in the United States

The U.S. solar market installed a record 23.6 gigawatts-direct current (GW) of solar capacity in 2021, reflecting an annual improvement of 19%, as stated by the Solar Energy Industries Association (SEIA). As projected by the U.S. Energy Information Administration (EIA), utility-scale solar generating capacity in the United States is forecast to grow by 21.5 GW in 2022.

This certainly sets the stage for a significant number of solar installations in the country. Keeping in mind the benefits that Enphase Energy will derive from SolarLeadFactory, such an installation growth should result in a greater number of installers connecting with Enphase.

In fact, to expand its footprint in the U.S. solar market, Enphase has been lately taking many initiatives like the SolarLeadFactory purchase. For instance, in January 2022, the company clinched a partnership agreement with Semper Solaris, with an aim to boost the deployment of the Enphase Energy System in California.

Peer Moves

To reap the benefits of the growing U.S. solar market, other solar players are also making significant efforts.

For example,

SolarEdge Technologies

SEDG

strengthened its presence in the United States by launching its SolarEdge Energy Bank residential battery and SolarEdge Energy Hub inverter with enhanced backup power in October 2021.

The long-term earnings growth rate of SolarEdge stands at 23%. The Zacks Consensus Estimate for SEDG’s 2022 earnings implies an improvement of 44.1% from the prior year’s figure. Shares of SolarEdge have returned 10.6% to its investors in the past year.

In January 2022,

First Solar

FSLR

inked a deal with Boston’s Swift Current Energy to supply 1.2 GWdc of its advanced, ultra-low carbon thin-film photovoltaic (PV) solar modules. With Swift Current having a growing pipeline of over 6 GW of planned renewable assets across North America, such a deal paves the way for FSLR to supply more of its modules in the future.

The long-term earnings growth rate of First Solar stands at 9.5%. The company delivered a four-quarter average earnings surprise of 26.49%. Shares of First Solar have returned 7.2% to its investors in the past month.

For

ReneSola

SOL

the United States continues to be a large and lucrative market. As of Sep 30, 2021, the company had mid-to-late-stage projects of 464 MW in the United States.

The Zacks Consensus Estimate for SOL’s 2022 earnings implies an improvement of 166.7% from the prior-year’s estimated figure. The company has a four-quarter average earnings surprise of 127.50%.

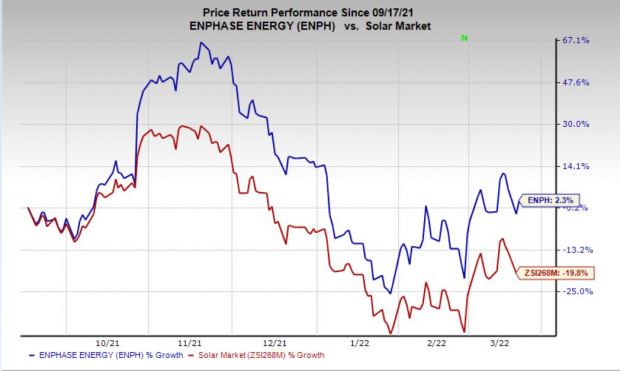

Price Movement

In the past six months, shares of Enphase Energy have gained 2.3% against the

industry

’s decline of 19.8%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report