Enphase Energy, Inc.

ENPH

recently announced that homeowners in Florida have been increasingly adopting the Enphase Energy System as they seek energy independence and stable power amid destructive natural disasters.

Going forward, Enphase may continue to witness the increased adoption of its products in Florida as the region boasts solid solar deployment growth prospects and capacity expansion in residential battery storage. These may allow Enphase to solidify its presence in the market.

Enphase’s Growth Plans

Enphase’s industry-leading products allow the company to expand its footprint globally. As of Sep 30, 2022, more than 52 million microinverters were shipped, while approximately 2.7 million Enphase residential and commercial systems were deployed in more than 145 countries.

Moreover, ENPH’s focus on strategically growing its business through the introduction of new and innovative products adds to its long-term growth trajectory. Enphase began piloting its latest IQ8 microinverter in North America in the third quarter of 2021. Since then, the launch has significantly expanded the revenue growth prospects of the company.

In November 2022, it launched its IQ8 microinverter in international markets by successfully introducing it in France and the Netherlands. Enphase expects to begin the shipments of IQ8 microinverters in the rest of Europe in the first half of 2023. The company also expects to introduce IQ8 microinverters in Austria in the fourth quarter of 2022.

ENPH is planning to open a manufacturing line in Romania in the first quarter of 2023. The new manufacturing plant in Romania will increase Enphase’s global production capacity to six million micros per quarter.

Globally, the upbeat solar market trends exemplify immense opportunities for Enphase to capitalize on solid demand through strategic capacity expansion and by growing its product portfolio to meet the needs of the dynamic solar market.

Growth Prospects

The latest report from the Energy Information Administration implies that 22% of the U.S. electricity generation in 2022 and 24% in 2023 will be renewable sources. This signifies an increase from 20% of the U.S. electricity generation in 2020 from renewable sources. The report entails solar and wind sources to contribute to most of the increase in renewable capacity addition in two years.

Such growth prospects are likely to benefit Enphase with an impressive portfolio of products and an established position in the U.S. solar market. Other solar players that stand to benefit from the increased demand are

First Solar

FSLR

,

SunPower

SPWR

and

ReneSola

SOL

.

First Solar is the largest U.S. solar module manufacturer. It is expanding its manufacturing capacity by 6.6 GW by constructing its third manufacturing facility in the United States.

First Solar boasts a long-term earnings growth rate of 52.6%. Shares of FSLR have increased 65% in the past year.

SunPower is one of the most forward-integrated solar companies, having more than a decade of experience in designing, manufacturing and supplying large-scale solar systems. The company continues to witness growth in residential and commercial markets.

The Zacks Consensus Estimate for SunPower’s 2022 earnings suggests a growth rate of a solid 371.4% from the prior-year reported figure. SPWR has returned 5.6% to its investors in the past year.

ReneSola continues to expand in the United States. As of Sep 30, 2022, the company had IPP projects of nearly 24 MW in the United States.

The Zacks Consensus Estimate for ReneSola’s 2022 sales indicates an improvement of 9.5% over the prior-year reported figure. The Zacks Consensus Estimate for SOL’s 2023 earnings has been revised upward by 13.8% in the past 60 days.

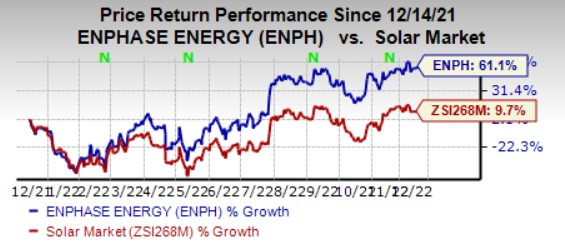

Price Movement

In the past year, shares of Enphase Energy have surged 61.1% compared with the

industry

’s growth of 9.7%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report