Entasis

ETTX

announced positive top-line data from the phase III ATTACK study evaluating its investigational intravenous (IV) drug, sulbactam-durlobactam (“SUL-DUR”), in patients having infections caused by Acinetobacter baumannii.

The ATTACK study evaluated the efficacy and safety of SUL-DUR in comparison with colistin in carbapenem-resistant Acinetobacter (“CRAB”) patients in 17 countries. The study met the primary endpoint of 28-day all-cause mortality in CRAB patients, demonstrating statistical non-inferiority over colistin.

Entasis also reported that participants administered SUL-DUR exhibited a favorable safety profile over colistin including a statistically significant reduction in nephrotoxicity.

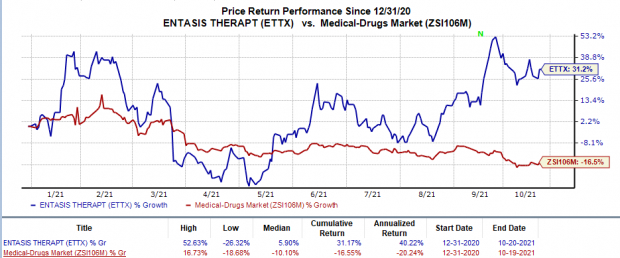

Shares gained 4.2% on Oct 19. In fact, the stock has rallied 31.2% so far this year against the

industry

’s 16.6% decline.

Image Source: Zacks Investment Research

Please note that SUL-DUR is a combination of sulbactam and durlobactam, an IV β-lactam antibiotic and a novel broad-spectrum IV β-lactamase inhibitor, respectively, developed to treat infections caused by Acinetobacter baumannii, including CRAB.

The company has also partnered with

Zai Lab

ZLAB

to develop and commercialize the drug in Australia along with multiple Asian countries including mainland China as well as Japan.

We inform investors that Acinetobacter is a gram-negative pathogen that infects critically ill patients. While the pathogen causes severe pneumonia and bloodstream infections, it can also infect the skin and urinary tract. The infections caused by Acinetobacter also develop multidrug resistance.

Currently, there are limited treatment options for people suffering from Acinetobacter. Per company estimates, more than 300,000 hospital-treated CRAB infections exist annually across the United States, Europe, the Middle East and China. Potential approval and successful commercialization of the drug would boost revenue prospects for the company in the long term. It anticipates the submission of a new drug application with the FDA in mid-2022.

Zacks Rank & Stocks to Consider

Entasis currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the same sector are

Enanta Pharmaceuticals

ENTA

and

Xencor

XNCR

. While Xencor currently sports a Zacks Rank #1 (Strong Buy), Enata carries a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Enata’s earnings per share estimates for 2021 have narrowed from $4.32 to $3.88 in the past 60 days. The same for 2022 has narrowed from $6.24 to $4.73 over the same period. The stock has surged 65.8% in the year so far.

Xencor’s earnings per share estimates for 2021 have narrowed from $0.75 to $0.33 in the past 60 days. The same for 2022 has narrowed from $3.14 to $2.92 over the same period.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report