BOSTON, Sept. 6, 2023 /PRNewswire/ — The current automotive display market is dominated by the TFT-LCD technology, and despite the rise of OLEDs in this sector, it is expected this strong presence will continue. IDTechEx’s “Automotive Displays 2024-2034: Technologies, Players, Opportunities” report provides a comprehensive coverage of this display sector, with key trends, market analysis, opportunities, and granular 10-year forecasts for display volume (number of displays) and value (US$), segmenting the industry by display type and technology.

Both LCDs and OLEDs have particular benefits and bring distinct, unique selling points to automotive displays.

OLEDs, for instance, deliver high image quality and deeper contrasts (greater dynamic range), highlighting the enhanced darker regions when compared to TFT-LCDs. OLEDs are self-emissive displays and, unlike TFT-LCDs, do not require a backlighting unit (BLU). They selectively switch off pixels when showing darker regions of an image with finer granularity, resulting in lower current consumption. TFT-LCDs achieve a similar effect with advancements in local dimming, particularly full-array local dimming (FALD). However, despite improved performance in this area, LCDs continue delivering poorer image contrasts when compared to OLEDs.

OLEDs can also be significantly more flexible and thinner than LCDs. OLEDs can be made on flexible organic substrates, giving it this important attribute. They are also self-emissive, as previously mentioned, not requiring an additional backlighting unit, making it much thinner than TFT-LCDs. Current design demands from OEMs include requesting curved displays and highly malleable centre information displays, CID (placed between the driver and front seat passenger). The rigidity seen in LCDs may impact its revenues in the future, as OEMs may require further malleability depending on the types of displays within the vehicle.

TFT-LCDs, on the other hand, have other strengths and bring other gains to automotive displays. LCDs have generally higher brightness and lifetime than OLEDs. These are essential to automotive displays, as the ambient brightness in vehicles is naturally very high, especially when sunlight is directly incident on the display panels. Displays must, therefore, be visible in the most diverse ambient lighting conditions, and a high-brightness device is necessary to always visualize information. The lifetime of the display is also a fundamental consideration to OEMs. It is important to ensure that the device has a long lifetime, as realistically, it is undesirable to constantly need to replace the display. It is ultimately a safety concern and poor branding if the display starts malfunctioning soon after purchase.

OLEDs, however, have greatly improved on this front with enhancements to both features and do not exhibit significantly poor brightness and lifetime. In fact, OLEDs used in the automotive industry often have similar brightness to LCDs.

Both LCDs and OLEDs fulfill the key requirements of automotive displays, and OLEDs have the added benefit of being significantly more flexible, thinner, and power efficient, which, given the rise in electric vehicles (EVs), is increasingly more important.

The main distinction is down to cost. TFT-LCDs are significantly more cost-effective than any other display technology and this impacts OEMs and tier 1 manufacturers. It is not by chance that the use of OLED displays is rising primarily in premium vehicles. The average profit margin in the automotive manufacturing industry is approximately 7.5%. Premium vehicles have more flexibility with the cost of displays when compared to lower-tier vehicles that have tighter restrictions. While OLEDs are competitive with the former types of vehicles, they still form a minority when considering the total number of vehicles sold in the market. OLEDs will struggle in competing with LCDs in terms of costs, and as a result, it is expected this TFT-LCD dominance will continue in the foreseeable future.

There is, however, another technology gaining traction that could impact the status quo of automotive displays. MicroLEDs are awaited by display manufacturers and automotive OEMs with great expectation, as they are predicted to surpass LCDs and OLEDs in overall performance. As the name indicates, microLEDs are microscopic LEDs that form an individual pixel. They are self-emissive, similarly to OLEDs, but the latter is considerably dimmer than the former. They also have a much higher lifetime, enhanced power efficiency, and comparable image quality and contrast. They are thinner than LCDs and exhibit higher brightness levels, and it is therefore expected this technology will dominate the automotive display sector in the future. The main hindrance delaying its successful launch is cost, technology maturity, and fabrication yields. Once these barriers are surpassed, microLEDs will dominate the space.

However, while these are the main display technologies in the market, there are other approaches considered for a wide range of display types. With the rise in autonomous vehicles, there is a trend towards adding more and larger displays in vehicles, promoting greater passenger immersiveness. TFT-LCDs are being adopted for heads-up displays (HUDs); however, there is a growing interest in using computer-generated holographic (CGH) solutions, for instance.

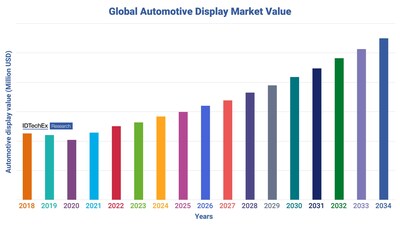

Several display types and technology innovations are expected for the next decade, and IDTechEx’s “Automotive Displays 2024-2034: Technologies, Players, Opportunities” report offers a comprehensive insight into these trends. With the shift towards greater vehicle immersiveness expected with the rise in vehicle autonomy, the market is forecasted to surpass US$ 27 billion by 2034.

IDTechEx’s report covers types of automotive displays and technologies; however, they provide a more holistic approach to analyzing the various displays. An automotive display is a lot more than its design and technology. There are several players involved that help ensure its optimal performance in vehicles, from its cover glass with low surface reflectance and impact protection, to high strength adhesives holding components together whilst enabling high visibility of the screen. Displays used in the automotive industry are required to pass stringent automotive grade testing, and all these additional components optimize the performance of these technologies. This report understands the importance of these players and attempts to tell the whole story behind an automotive display.

For more details on the automotive display market, please see the IDTechEx market report, “Automotive Displays 2024-2034: Technologies, Players, Opportunities” – visit www.IDTechEx.com/AutoDisplays for more information, including downloadable sample pages. The full portfolio of IDTechex research can be found at www.IDTechEx.com.

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

Images download:

https://www.dropbox.com/scl/fo/teh3x5pzben0kyzxtww5a/h?rlkey=fn7q7dwxe5q1j0xroks6mgxmq&dl=0

Media Contact:

Lucy Rogers

Sales and Marketing Administrator

press@IDTechEx.com

+44(0)1223 812300

Social Media Links:

Twitter: www.twitter.com/IDTechEx

LinkedIn: www.linkedin.com/company/IDTechEx

Photo: https://mma.prnewswire.com/media/2201045/global_automotive_display_IDTechEx.jpg

Logo: https://mma.prnewswire.com/media/478371/IDTechEx_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/are-oleds-and-microleds-set-to-disrupt-the-current-tft-lcd-dominance-in-the-automotive-display-sector-asks-idtechex-301917865.html

View original content:https://www.prnewswire.co.uk/news-releases/are-oleds-and-microleds-set-to-disrupt-the-current-tft-lcd-dominance-in-the-automotive-display-sector-asks-idtechex-301917865.html

Featured image: DepositPhotos © Weerapat