F-star Therapeutics, Inc.

FSTX

announced that it has signed a definitive agreement with invoX Pharma, a wholly-owned subsidiary of China-based Sino Biopharmaceutical, wherein the latter will acquire all the issued and outstanding shares of the former in an all-cash transaction value of $7.12 per share.

Following the acquisition, FSTX’s equity stake will be valued at $161 million. The acquisition price of $7.12 per share represents a premium of 11.6% to F-star’s closing price on Jun 23.

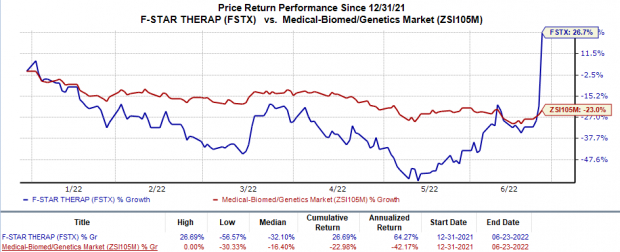

Shares of F-star Therapeutics rose 59.8% on Jun 23, following the deal announcement. The stock has risen 26.7% in the year so far against the

industry

’s 23% decline.

Image Source: Zacks Investment Research

Though F-star has no marketed drug in its portfolio, it is evaluating multiple pipeline candidates across clinical studies that have been developed using its proprietary antibody discovery platform. This technology pioneers the use of tetravalent (2+2) bispecific antibodies that enable the simultaneous targeting of two different antigens and a unique set of pharmacology to deliver focused, potent and safe immune activation in the tumor microenvironment.

F-star Therapeutics is currently evaluating four clinical programs in its pipeline. The most advanced candidate in the company’s pipeline is FS118, a dual checkpoint inhibitor targeting PD-L1 and LAG-3. The candidate is currently being evaluated in a phase II proof-of-concept study for treating head & neck cancer as well as non-small cell lung cancer (NSCLC) and diffuse large B-cell lymphoma (DLBCL).

The other three candidates, namely FS222 (A CD137 stimulator and PD-L1 inhibitor), FS120 (a conditional OX40/CD137 dual agonist) and SB11285 (a STING agonist) are being evaluated in early-stage studies targeting multiple oncology indications.

Per invoX, the acquisition of F-star Therapeutics will help expand Sino Biopharmaceutical’s R&D platform outside of China. invoX has a core focus on developing therapeutics, targeting oncology and respiratory indications. F-star’s proprietary platform is expected to complement Sino Biopharmaceutical’s existing R&D platforms and pipeline outside of China.

The acquisition deal was unanimously approved by the board of directors of both companies. The transaction, expected to be completed by second-half 2022, is subject to customary closing conditions and clearance from the regulatory authorities.

Zacks Rank & Stock to Consider

F-star Therapeutics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

,

Alkermes

ALKS

and

Sesen Bio

SESN

. While Alkermes and Sesen Bio each sport a Zacks Rank #1 (Strong Buy) at present, Abeona Therapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Estimates for Sesen Bio’s 2022 bottom line have declined from a loss of 33 cents to 32 cents in the past 60 days. Shares of Sesen Bio have risen 1.2% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark once, with the average surprise being 69.9%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 100%.

Estimates for Alkermes’ 2022 bottom line have narrowed from a loss of 10 cents to 3 cents in the past 60 days. Shares of Alkermes have risen 27.1% year to date.

Earnings of Alkermes beat estimates in each of the trailing four quarters, with the average surprise being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Estimates for Abeona Therapeutics’ 2022 bottom line have narrowed from a loss of 33 cents to 31 cents in the past 30 days. Shares of Abeona Therapeutics have plunged 44.6% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and matched the same twice, with the average negative surprise being 8.2%. In the last reported quarter, Abeona Therapeutics missed earnings estimates by 25%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report