TG Therapeutics, Inc.

TGTX

announced that the FDA has extended the review period of its biologics licensing applications (BLA), seeking approval for ublituximab as a potential treatment for patients with relapsing forms of multiple sclerosis (RMS).

Following this three-month extension, the new PDUFA action date for ublituximab stands as Dec 28, 2022, from the previous action date of Sep 28, 2022, set by the FDA.

Post this announcement, shares of TG Therapeutics fell 14.5% on May 31. The decline was likely as investors were not happy with the extension of the review period.

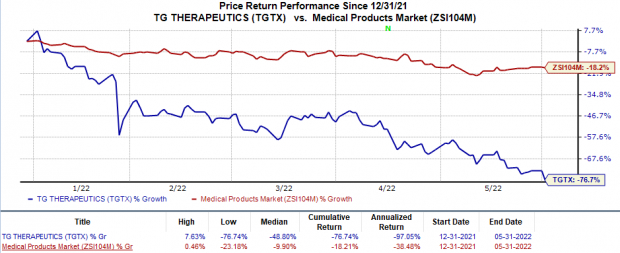

Shares of TGTX have plunged 76.7% in the year-to-date period compared with the

industry

’s 18.2% decline.

Image Source: Zacks Investment Research

The delay is on account of the additional data submitted by TG Therapeutics on the FDA’s request during the ongoing review of ublituximab. Per the regulatory body, the information submitted by TGTX constitutes a major amendment to the data filed in its earlier BLA. The information comprised an integration and summary of certain clinical information, previously provided to the FDA.

The BLA filing is based on data from the two phase III studies, ULTIMATE I and ULTIMATE II, which evaluated the safety and efficacy of ublituximab against

Sanofi

’s

SNY

Aubagio (teriflunomide) in participants suffering RMS.

Both ULTIMATE I and ULTIMATE II studies achieved their primary endpoint, indicating that patients treated with ublituximab showed a statistically significant reduction in the annualized relapse rate (ARR) compared to patients treated with Sanofi’s teriflunomide over a 96-week period.

Aubagio is a blockbuster drug acquired by Sanofi upon buying Genzyme Corporation. The drug is approved by the FDA for treating RMS. During the first quarter of 2022, SNY’s Aubagio sales declined 6.6%, hurt by lower sales in the U.S. market due to competitive launches and pricing pressure.

A potential FDA approval of TG Therapeutics’ ublituximab will provide a new option to patients with RMS, which can be administered in a one-hour infusion every six months after receiving the first dose of ublituximab.

Following the FDA’s decision to withdraw the regulatory nod granted to TGTX’s sole marketed drug Ukoniq (umbralisib) effective May 31, 2022, TG Therapeutics has no approved product in its portfolio.

Ukoniq had received an FDA approval under the accelerated pathway in February 2021 for treating relapsed/refractory marginal zone lymphoma (MZL) and follicular lymphoma (FL). The regulatory agency’s decision to withdraw the approval granted to Ukoniq is based on TG Therapeutics’ voluntary decision to withdraw the drug from sale.

The above decision was taken by TGTX after an updated data from a phase III UNITY CLL study demonstrated an increasing imbalance in the secondary efficacy endpoint of overall survival. The UNITY CLL study evaluated a combination of ublituximab and Ukoniq in patients with both treatment-naïve and relapsed or refractory chronic lymphocytic leukemia (CLL).

Based on the above data, TG Therapeutics also withdrew the previously filed biologics license application (BLA)/supplemental new drug application (sNDA) seeking approval for the ublituximab-Ukoniq combo to treat adult patients with CLL and small lymphocytic lymphoma (SLL).

Zacks Rank & Stocks to Consider

TG Therapeutics currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same sector are

Aeglea BioTherapeutics

AGLE

and

Sesen Bio

SESN

. While Sesen Bio currently sports a Zacks Rank #1 (Strong Buy), Aeglea BioTherapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 31 cents in the past 30 days. Shares of SESN have declined 24.8% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, SESN delivered an earnings surprise of 100%.

Aeglea BioTherapeutics’ loss per share estimates for 2022 have narrowed from $1.43 to $1.16 in the past 30 days. The same for 2023 has narrowed from $1.49 to $1.04 in the same period. Shares of AGLE have plunged 66.7% year to date.

Earnings of Aeglea BioTherapeutics beat estimates in two of the last four quarters and missed the mark on the remaining two occasions, the average surprise being 9.5%. In the last reported quarter, AGLE witnessed a negative earnings surprise of 5.7%.

How to Profit from the Hot Electric Vehicle Industry

Global electric car sales in 2021 more than doubled their 2020 numbers. And today, the electric vehicle (EV) technology and very nature of the business is changing quickly. The next push for future technologies is happening now and investors who get in early could see exceptional profits.

See Zacks’ Top Stocks to Profit from the EV Revolution >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report