2024 will go down in history as the year AI took over.

But it’s not just about chatbots like ChatGPT or tools that create jaw-dropping images.

AI is quietly weaving itself into industries you use every single day—often in ways you’d never expect.

Some AI technology even has the ability to save lives.

Picture trucks and buses equipped with AI-powered cameras that predict danger and help avoid accidents—no mirrors required.

This isn’t science fiction—it’s happening right now in major cities across the globe.

While companies like NVIDIA grab all the headlines with their AI chips and $3 trillion market cap, not every AI winner is a household name.

Some companies have been flying under the radar, quietly working with the world’s biggest brands.

One of them is a leader in next-generation technology, serving giants like Ferrari, Boeing, BMW, and Ford Trucks.

From AI-powered cameras that replace vehicle mirrors to smart glass that’s transforming industries like aeronautics, automotive, and architecture, this company is quietly leading a technological revolution.

And the potential? Two massive markets.

The AI camera market is expected to climb from $13.59 billion in 2024 to an impressive $61.73 billion by 2032.¹

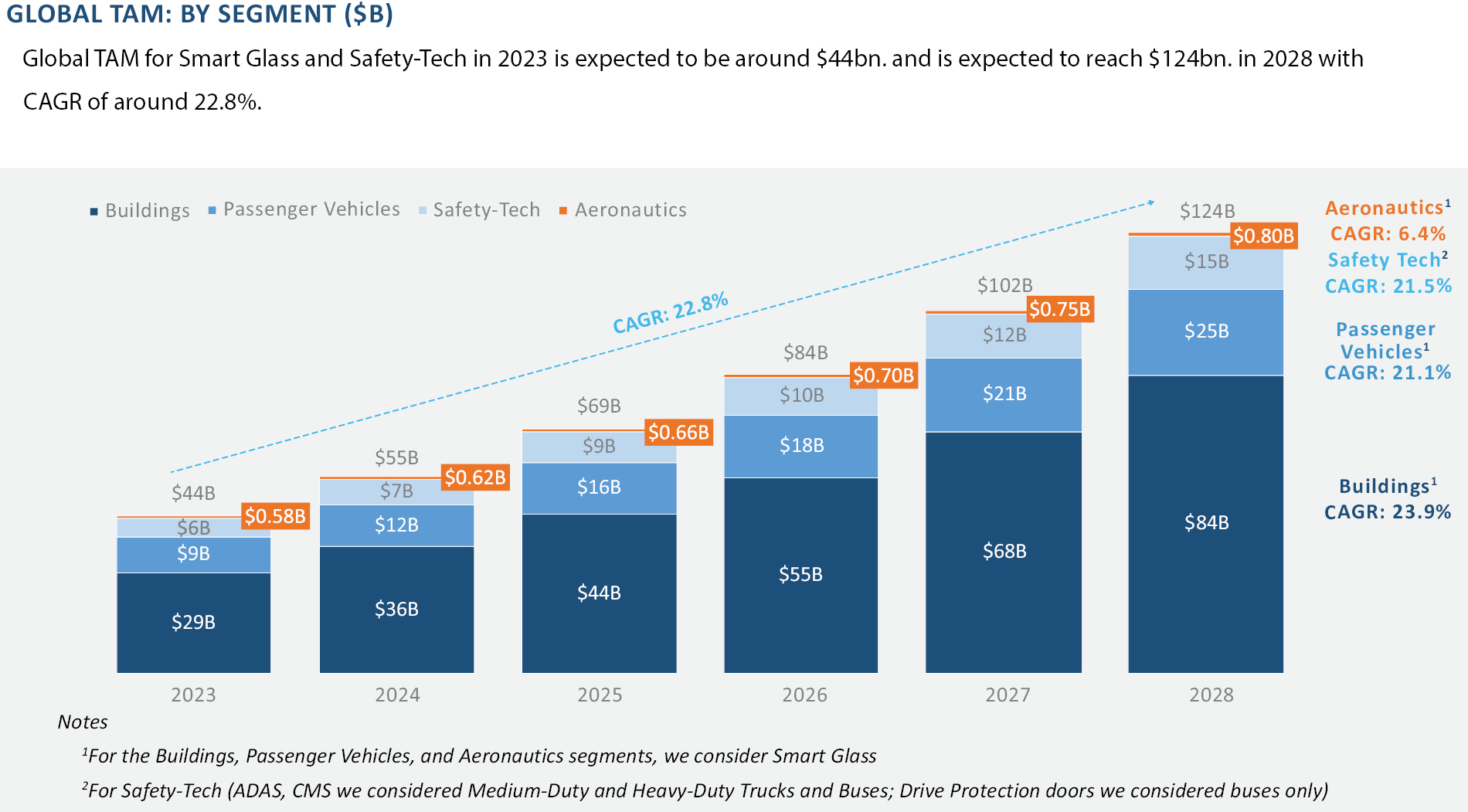

And the global smart glass market is projected to reach $124 billion, growing at a CAGR of 22.8%.²

But this isn’t just a product story. It’s about real-world impact.

Imagine displays integrated into windows, traditional mirrors replaced by smarter, more functional systems, shades in homes, offices, and hotel rooms seamlessly adapting to your needs, and AI-powered systems making buses and trucks safer and more efficient on the road.

That’s exactly what this company is building.

Investors looking for the next big breakthrough in AI and smart glass should take a closer look. This could be one of the sleepers of 2025, primed for growth while others are still catching up.

The company in focus is Gauzy Ltd. (NASDAQ:GAUZ), a fully-integrated global pioneer in light and vision control technologies, boasting an impressive portfolio of 145 issued patents and 23 more pending worldwide.³

With more than 1,000 customers, including major brands, in over 30 countries spanning automotive, aeronautics, architecture, and public transit⁴, Gauzy’s innovations are reshaping industries.

If you look closely, you’ll find Gauzy Ltd. (NASDAQ:GAUZ) everywhere.

From replacing standard windows in vehicles from automotive giants like BMW and Mercedes-Benz to delivering advanced cockpit shading and dynamic cabin window solutions in Boeing airplanes, Gauzy’s innovations are redefining the future of mobility.

Gauzy’s energy-efficient smart glass is redefining urban architecture, transforming buildings in major cities into sustainable marvels.

At the same time, the company’s safety-focused technologies, including the next-generation AI-powered Smart-Vision® Advanced Driver Assistance Systems (ADAS)⁵, leverage multi-spectral imaging and advanced machine learning to enhance fleet efficiency and visibility to proactively prevent accidents on roads worldwide.

Gauzy’s cutting-edge Smart-Vision® Camera Monitoring System (CMS) transformed public transit in cities like Paris ahead of the 2024 Olympics to provide safer roads for millions of visitors, athletes, and residents.⁶

Paris joins over 80 cities worldwide, including London, Brisbane, Lyon, and New York⁷ that have already adopted Gauzy’s Smart-Vision® CMS to make a positive impact on road safety.

Ferrari, one of the most iconic  OEMs, has selected Gauzy‘s Suspended Particle Device (SPD) Smart Glass technology for its first-ever four-seater vehicle, cementing the company’s reputation as a trusted partner to some of the world’s most prestigious brands.

OEMs, has selected Gauzy‘s Suspended Particle Device (SPD) Smart Glass technology for its first-ever four-seater vehicle, cementing the company’s reputation as a trusted partner to some of the world’s most prestigious brands.

Gauzy’s Smart-Vision® ADAS is also relied upon by Ford Trucks, a leading OEM in the truck industry, and Yutong, the world’s largest bus manufacturer. In Q3, Yutong increased its orders by 250%, driving Gauzy’s global expansion and leadership in bus safety technology.⁸

In aviation, Gauzy Ltd. (NASDAQ:GAUZ) dominates cockpit shading for commercial and business jets, achieving a 95% market share and securing deals with leaders like Boeing.

It’s really no surprise that Gauzy Ltd. (NASDAQ:GAUZ) reported revenues of $77.98 million in 2023, a significant 59% increase compared to 2022.⁹

And 2024 is expected to be a record-breaking year for Gauzy, with $72.4 million already reported for the first nine months of the year.¹⁰

But that’s just the tip of the iceberg.

With a revenue backlog of $38.3 million and several new multi-million dollar deals— including a contract to supply 50,000 EVs annually with smart glass technology¹¹ and $240 million in aeronautics commitments¹² over the next decade—Gauzy’s technology is clearly in high demand across its divisions.

Given their impressive growth and technological advancements, Gauzy Ltd. (NASDAQ:GAUZ) is a company worth watching as they continue to lead in the integration of AI and smart technologies across various industries.

Top 8 Reasons

to Pay Close Attention to Gauzy Ltd. (NASDAQ:GAUZ)

1

Rapid Revenue Growth: Gauzy’s (NASDAQ:GAUZ) revenue surged from $49M in 2022 to $77.9M in 2023, reflecting a robust growth trajectory and increasing demand.¹³

2

Strategic Partnerships: Collaborations with blue-chip companies like Boeing, Ferrari, and Ford Trucks showcase market validation and growth opportunities.

3

Diverse Industry Applications: Gauzy’s technologies are utilized across automotive, aeronautics, and architecture sectors in over 30 countries worldwide, showcasing their versatility and broad market appeal.

4

AI Integration: Leveraging AI-powered solutions in ADAS, positioning Gauzy Ltd. (NASDAQ:GAUZ) as a leader in next-gen automotive safety technology.

5

Dominant Market Position: Holds a 95% share in aeronautic cockpit shading for commercial and business jets, projected to generate $240M in revenue over the next decade.

6

Cutting-Edge Technology: Patented light-control glass (LCG®) with SPD and PDLC technologies powers dynamic shading and transparency, enhancing energy efficiency and versatility across industries.

7

Experienced Leadership: Led by Co-Founder and CEO Eyal Peso, the management team brings extensive expertise in technology and business development.

8

Positive Analyst Outlook and Institutional Support: Analysts have assigned a ‘Strong Buy’ rating to Gauzy Ltd. (NASDAQ:GAUZ), supported by institutional ownership from leading investors.¹⁴

These factors position Gauzy Ltd. as a compelling company to watch in the evolving landscape of AI and smart technologies.

Press Releases

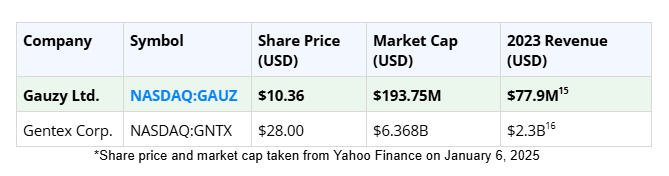

How Gauzy Ltd. Stacks Up Against its Peers

Gauzy Ltd. (NASDAQ:GAUZ) is redefining the light and vision control industry with its innovative approach, diversified applications, and deep integration into key markets.

While companies like Gentex bring strengths in specific areas, Gauzy’s comprehensive capabilities and strategic positioning in automotive, architectural, aeronautical and safety tech applications set it apart as a leader in this rapidly growing market.

Gentex dominates rear-view mirror technology and other automotive applications, $10.72 billion market.¹⁷ However, unlike Gauzy Ltd. (NASDAQ:GAUZ), offerings are primarily focused on automotive applications and lack significant penetration in the architectural market. By contrast, Gauzy’s light-control technology caters to a much broader $392.5 billion addressable market.¹⁸

Unlike Gentex’s electrochromic technology, which is limited in adaptability and compatibility across sectors, Gauzy’s LCG® solutions seamlessly integrate into multiple industries.

For example, Gauzy’s SPD smart glass offers unique benefits such as instant dimming, improved energy efficiency, and enhanced user control—features critical for automotive and architectural markets.

Additionally, Gauzy Ltd. (NASDAQ:GAUZ) holds a 95% market share for cockpit shading, an area where Gentex has no known presence. These distinctions underline Gauzy’s ability to deliver versatile, future-proof solutions across industries, positioning it as the clear leader in the light-control glass revolution.

This broad approach allows Gauzy Ltd. (NASDAQ:GAUZ) to capture opportunities in multiple markets simultaneously, mitigating risks tied to over-reliance on a single industry.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Leading the $124 Billion Smart Glass Revolution

The global smart glass market is on an upward trajectory,¹⁹ fueled by rising demand for sustainable, energy-efficient solutions across automotive, architectural, and aeronautical sectors.

At the heart of this transformation is Gauzy Ltd. (NASDAQ: GAUZ), a pioneer in light-control glass (LCG®) technologies. With a portfolio spanning several industries and partnerships with some of the world’s biggest brands, Gauzy is poised to dominate this burgeoning market.

Smart Glass: Making Surfaces Smarter

At the core of Gauzy’s smart glass offerings is its Light Control Glass (LCG®) technology, which dynamically responds to electricity and dynamically adapts to create transparency and opacity on demand.

Imagine windows that automatically switch from clear to opaque, not just for privacy but to optimize energy efficiency—reducing the need for air conditioning on hot days or heating on cold ones.

Gauzy’s advanced shading systems in aviation—a sector where it holds a 95% market share for cockpit shading²⁰—provide optimal visibility for pilots by eliminating glare and enhancing safety during flight operations. Upgrading cabin shading systems in commercial aircraft cabins is also simplified with Gauzy’s SPD and PDLC dimmable windows, which enhance passenger comfort and aircraft efficiency.

Upgrading cabin shading systems is made simple with Gauzy’s SPD dimmable windows.

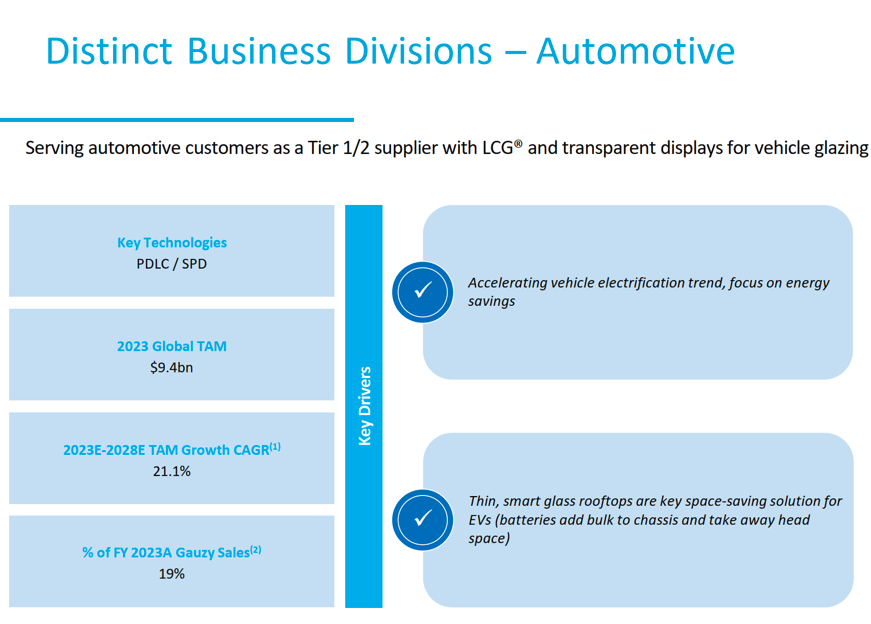

Automotive Sector

Gauzy’s (NASDAQ:GAUZ) is at the forefront of automotive innovation, partnering with industry giants like Ferrari, BMW and Daimler to create vehicles that blend luxury, functionality, and cutting-edge technology.

Gauzy is revolutionizing vehicle safety and passenger comfort with its innovative Smart-Vision® Advanced Driver Assistance Systems (ADAS) and Light Control Glass (LCG®) technologies. Their Smart-Vision® ADAS replaces traditional mirrors with high-definition AI-powered cameras and interior displays, enhancing driver visibility, reducing blind spots, and increasing safety—particularly suited for electric and hybrid vehicles.

Gauzy is revolutionizing vehicle safety and passenger comfort with its innovative Smart-Vision® Advanced Driver Assistance Systems (ADAS) and Light Control Glass (LCG®) technologies. Their Smart-Vision® ADAS replaces traditional mirrors with high-definition AI-powered cameras and interior displays, enhancing driver visibility, reducing blind spots, and increasing safety—particularly suited for electric and hybrid vehicles.

In Q3 alone, the company reported several exciting contracts including:

- Ferrari’s first four-seater vehicle takes luxury further with panoramic SPD roofs powered by Gauzy’s technology. By eliminating traditional sunshades, drivers and passengers enjoy enhanced visibility and thermal comfort without compromising the sleek design Ferrari is known for.

- Gauzy secured its largest automotive serial production agreement to supply LCG® Smart Glass for an average of 50,000 cars per year over nine years with a major European OEM.²¹

Gauzy’s (NASDAQ:GAUZ) PDLC and SPD smart glass technology was also featured in BMW’s i-Vision DEE concept car in its windshields and windows. These innovations provide a futuristic driving experience, enabling augmented reality overlays for navigation while offering unparalleled privacy and glare control.

Gauzy SPD Smart Glass x BMW iVision Dee Smart Windshield Application Highlight

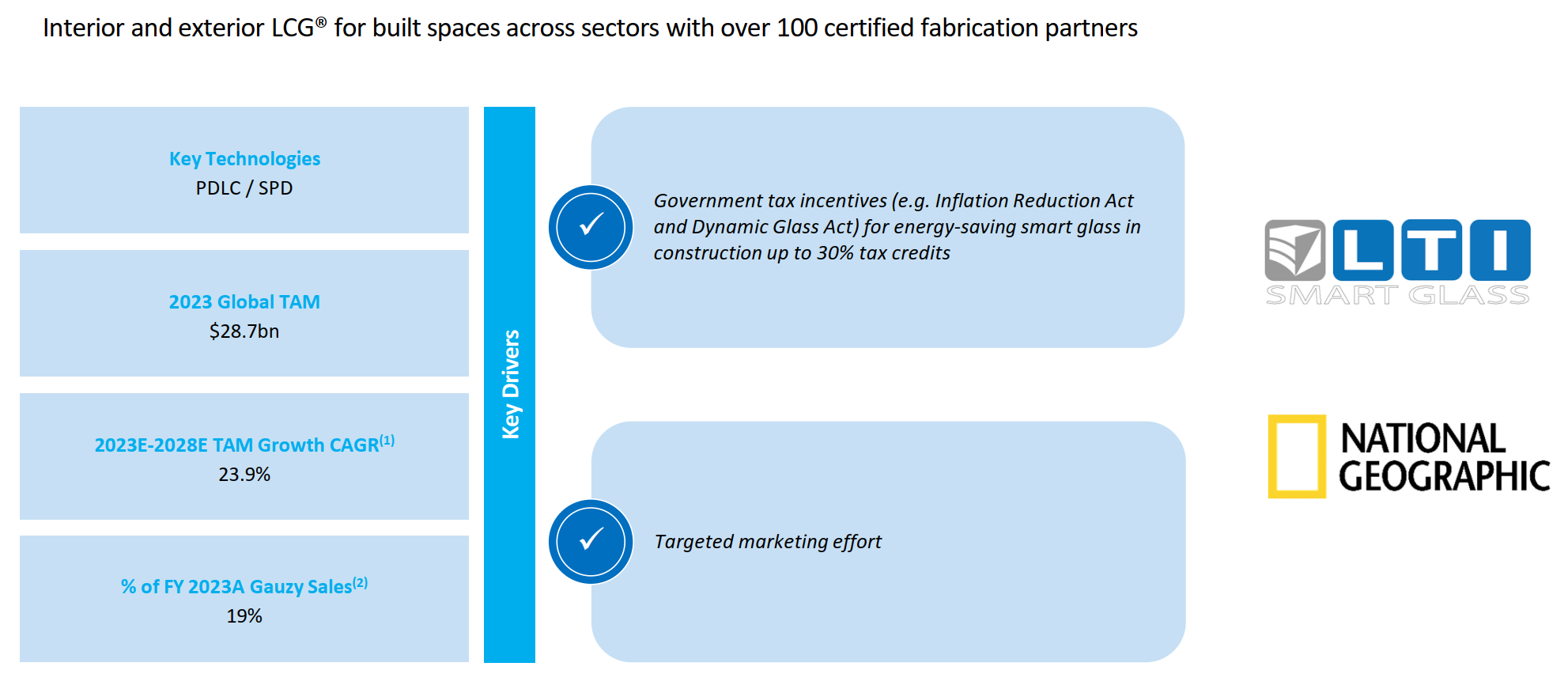

Architectural Sector

Integrated with building management systems (BMS) or controlled on demand by a user, Gauzy’s (NASDAQ:GAUZ) smart glass actively adjusts opacity to optimize natural lighting and energy use.

Flagship projects like the National Geographic headquarters, Wix’s corporate offices and a cruise ship terminal in Miami showcase how Gauzy’s innovations deliver style, sustainability, and energy efficiency.

These installations demonstrate its ability to provide dynamic transparency and energy efficiency—a key driver as the global focus on sustainable construction intensifies.

With smart glass capable of reducing energy costs by 20%, Gauzy Ltd. (NASDAQ:GAUZ) is positioned to lead as regulations on energy-efficient buildings tighten.²²

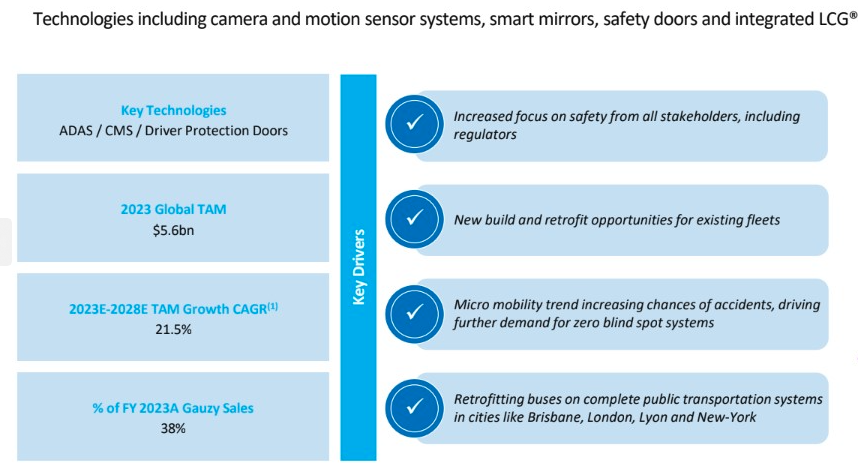

Safety Tech and Public Transit Leadership

Beyond passenger vehicles, Gauzy Ltd. (NASDAQ:GAUZ) is rapidly becoming a leader in public transit safety technology.

The company’s Smart-Vision® ADAS replaced traditional mirrors on public buses in Paris ahead of the 2024 Olympics and in New York through the CDTA transit program, revolutionizing road safety by reducing blind spots and enhancing driver awareness.

These solutions are now deployed in over 80 cities worldwide including London, Brisban, Lyon and New York with continued expansion underway.

The company’s partnership with Yutong, the world’s largest bus OEM, is another milestone.

Gauzy Ltd. (NASDAQ:GAUZ) recorded a 250% YoY increase in ADAS orders from Yutong in Q3 2024, solidifying its position as a key supplier for advanced transportation safety solutions.²³

Gauzy Ltd. (NASDAQ:GAUZ) game-changing Smart-Vision® Camera Monitor System (CMS) just earned Yutong’s prestigious Outstanding Supplier Award in Q3 2024. With systems now installed on over 25 Yutong bus models across the UK, Europe, North America, Australia, and the Middle East, Gauzy is setting new standards for road safety and fleet efficiency worldwide.²⁴

Aeronautical Sector

In aeronautics, Gauzy Ltd. (NASDAQ:GAUZ) is a Tier 1 vendor, dominating the cockpit shading market with a 95% share and securing an estimated $240 million in future revenue from clients like Boeing, Bombardier and Embraer.²⁵

In Q3 2024, a major international airline contracted Gauzy to implement LCG® Smart Glass cabin shading solutions for its Boeing 737 MAX fleet, enhancing passenger comfort and cabin aesthetics.²⁶

By focusing on scalable applications like electronically dimmable aircraft windows, Gauzy ensures its technology not only disrupts but becomes a staple in the industry.

The Smart Business Model That Propels Gauzy Forward

Gauzy Ltd. (NASDAQ:GAUZ) operates in a growing market while forging long-term contracts with industry leaders. Its technology not only enhances design but also drives energy efficiency, aligning with the global shift towards sustainability.

With its dominant aeronautical market share, strong revenue growth, and strategic partnerships, Gauzy Ltd. is emerging as a clear leader.

Whether it’s Boeing in the skies or Ferrari on the roads, the company’s ability to adapt its solutions for various applications ensures long-term market relevance and profitability.

For investors, Gauzy Ltd. (NASDAQ:GAUZ) represents a rare opportunity to gain exposure to the smart glass²⁷ and ADAS markets,²⁸ which are projected to reach $124 billion and $86 billion respectively, in the next 5 years.

Few companies in this space match Gauzy’s blend of industry dominance, revenue growth, and potential for continued expansion, which is bolstered by its big-brand collaborations.

By continuously investing in AI research, development and deployment, Gauzy Ltd. (NASDAQ:GAUZ) ensures it remains a leader in a rapidly evolving industry.

Its ability to deliver smarter, more sustainable solutions across automotive, architectural, and aeronautical markets makes it a compelling choice for investors looking to align with future-ready technologies.

Positioned for Growth: Why Gauzy Ltd. (GAUZ) Could Be the Undervalued Gem of 2025

As of January 6, 2025, Gauzy Ltd. (NASDAQ: GAUZ) closed at $10.36 per share. This valuation positions the company’s market capitalization at approximately $193 million.

Since its initial public offering (IPO) on June 6, 2024, where shares debuted at $17,²⁹ Gauzy‘s stock has experienced a decline, which presents a potential opportunity for investors, especially considering the company’s innovative strides in smart glass technology and its partnerships with industry leaders.

Institutional Ownership and Analyst Confidence

Gauzy Ltd. (NASDAQ:GAUZ) presents a potentially intriguing investment case with a solid foundation of institutional backing. Institutional shareholders collectively hold a significant stake, reflecting their confidence in the company’s long-term growth potential.

Key institutional investors include:³⁰

- Richard Driehaus: Holds 266,565 shares, representing 1.43% of the company, valued at over $2 million.

- David Costen Haley: Owns 122,695 shares, or 0.66% of the company, valued at ∼$957,000.

- Michael Price: Holds 100,000 shares, equating to 0.53% of Gauzy, with a value of ∼$780,000.

- Michael Rockefeller: Owns 44,000 shares, representing 0.24%, valued at almost $350,000.

Additionally, mutual funds have added Gauzy Ltd. (NASDAQ:GAUZ) to their portfolios:

- Driehaus Mutual Funds: With 36,103 shares (0.19%), valued at ∼$281,000.

- Brinker Capital Destinations Trust: Holding 11,709 shares (0.06%), valued at ∼$91,000.

- Federated Hermes Equity Funds: Owning 11,492 shares (0.06%), valued at ∼$90,000.

Float and Share Structure: With a manageable float of approximately 18.6 million shares,³¹ Gauzy Ltd. (NASDAQ:GAUZ) is well-positioned for potential share price appreciation as demand for its stock grows.

This institutional ownership highlights the growing interest from professional investors in Gauzy’s (NASDAQ:GAUZ) innovative business model and leadership across multiple markets.

Analyst Ratings: A Strong Buy Consensus

Analysts are bullish on Gauzy’s future, with four “Buy” ratings and no “Sell” or “Hold” ratings issued in the last three months.³²

This unanimous confidence underscores the belief that Gauzy Ltd. (NASDAQ:GAUZ) is well-positioned to capitalize on several massive markets, including the $124 billion smart glass market³³ and ADAS, which is projected to reach $86 billion by 2029³⁴ and lead in sectors like automotive, architecture, and aeronautics.³⁵

Positioned for Undervalued Growth

Gauzy Ltd. (GAUZ) combines significant institutional support, strong analyst confidence, and an affordable share price, making it an appealing opportunity for investors seeking exposure to transformative technologies like smart glass and AI-powered ADAS.

With ongoing growth in revenue, a robust pipeline of major partnerships, and leadership in key industries, Gauzy Ltd. (GAUZ) is a compelling company.

Visionary Leadership Steering Gauzy’s Path to Global Dominance

Behind Gauzy’s (NASDAQ:GAUZ) rapid rise in the smart glass industry is a team of exceptional leaders, each bringing decades of expertise, bold vision, and an unrelenting commitment to innovation. This leadership team has not only propelled Gauzy to the forefront of smart glass and ADAS technologies but also solidified its reputation as a trusted partner to some of the world’s most iconic brands.

The Leadership Advantage

What sets Gauzy Ltd. (NASDAQ:GAUZ) apart is not only the strength of its products but also the expertise of its leadership team. Their proven ability to build partnerships with top global brands and execute on ambitious growth plans makes Gauzy a compelling story for investors seeking a company leading innovation with AI and other emerging technologies.

A Clear Vision for the Future

Gauzy Ltd. (NASDAQ:GAUZ) is more than a smart glass innovator—it’s a pioneer in revolutionizing how we interact with light and transparency across industries. From buses and trucks and state-of-the-art aircraft to iconic architectural designs, Gauzy’s cutting-edge solutions are shaping the future of design and functionality.

With a diversified portfolio of global clients, including Yutong, BMW, and National Geographic, Gauzy Ltd. (NASDAQ:GAUZ) has already proven its capability to deliver innovative solutions to some of the world’s most recognizable brands.

But what truly sets Gauzy Ltd. (NASDAQ:GAUZ) apart is its integration of AI into its technologies, ensuring smarter, more efficient, and highly adaptive solutions that meet the demands of a modern world.

Its leadership team, with years of experience and visionary direction, ensures the company is positioned for sustainable growth.

With strong institutional backing, partnerships with blue-chip customers, and a growing market presence, Gauzy stands out as an undervalued play with immense potential.

Now is the time to look closely at Gauzy Ltd. (NASDAQ:GAUZ), where innovation meets opportunity.

As the market evolves, Gauzy’s solutions are not just keeping pace—they’re setting the standard. Investors who take note today could be aligning with one of tomorrow’s standout success stories.

Get Gauzy Ltd.’s (NASDAQ:GAUZ) corporate presentation right here.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

*All figures in US dollars unless otherwise stated

Eyal PesoCo-Founder and CEO

Eyal PesoCo-Founder and CEO Adrian LoferCo-Founder and Chief Technology Officer

Adrian LoferCo-Founder and Chief Technology Officer