Imagine a world where windows think for themselves, automatically adjusting their transparency to block out heat on a summer day or to reduce glare while driving.

Picture rearview mirrors replaced by AI cameras that warn drivers of potential hazards in real time and airplane cabins that adjust shading to save energy while maximizing comfort.

These aren’t futuristic dreams—they’re happening right now, powered by groundbreaking technology.

At the center of this revolution is a company most people haven’t even heard of yet.

While the headlines are filled with stories about AI giants like NVIDIA, this under-the-radar innovator is quietly changing the way we interact with light and energy.

This company’s story begins with groundbreaking light and vision technology that’s quietly transforming major industries.

Using advanced materials, they transform transparent materials like glass into smart and dynamic surfaces at the push of a button.

This isn’t just clever engineering; it’s real-world applications that improve comfort, save energy, and enhance safety.

And they’re not just dabbling in one industry.

This company is also revolutionizing transportation safety with AI-powered Advanced Driver Assistance Systems (ADAS).

By replacing traditional mirrors with real-time AI-enabled cameras, these systems improve visibility and fleet efficiency in commercial vehicles, eliminate blind spots, and provide instant hazard warnings—making roads safer for everyone.

This company is making waves with over 1,000 customers including some of the world’s leading brands spanning automotive, aeronautics, and architecture in over 30 countries globally,¹

This isn’t the future—it’s happening right now.

Introducing Gauzy Ltd. (NASDAQ:GAUZ), a vertically integrated leader in light and vision control technologies with 145 issued patents and 23 more pending worldwide.²

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

From Cockpits to Skylines: The Impact

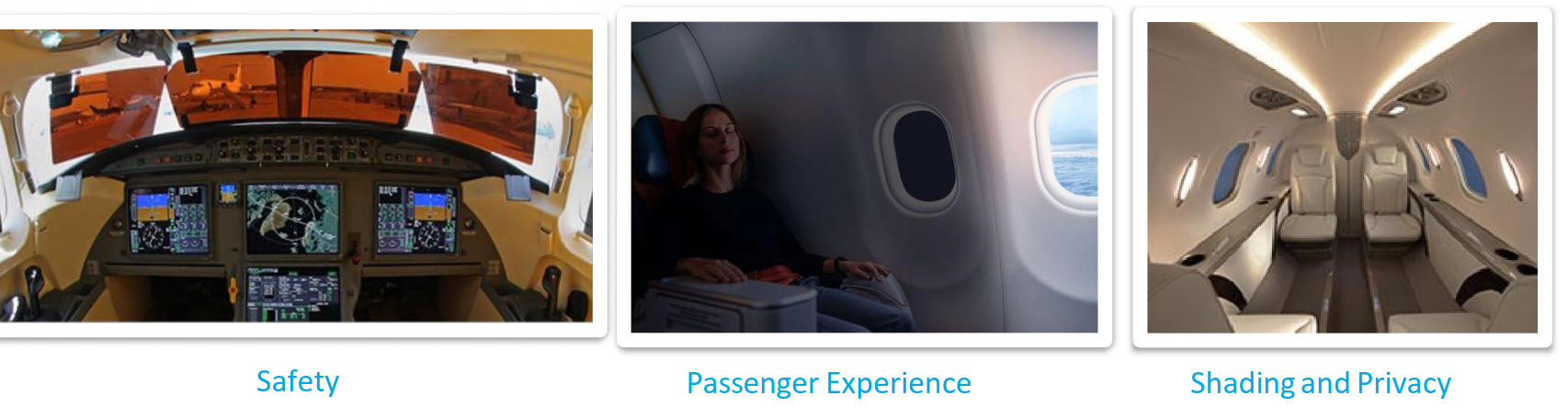

Take a closer look at the skies. Almost every time you fly, there’s a 95% chance³ the cockpit shading system was made by this company.

That’s right—they own the cockpit shading market, working with aviation giants like Boeing.

Their technology doesn’t just make life easier for pilots; it’s also expected to generate $240 million in revenue over the next decade.⁴

On the ground, their partnerships include automotive titans like Hyundai and Ferrari.

These brands don’t just trust anyone—they choose partners that bring innovation to the table.

From enabling augmented reality windshields that project navigation information directly onto the glass⁵ to sunroofs that adjust their tint to keep passengers comfortable, Gauzy Ltd. (NASDAQ:GAUZ) is making cars smarter and safer.

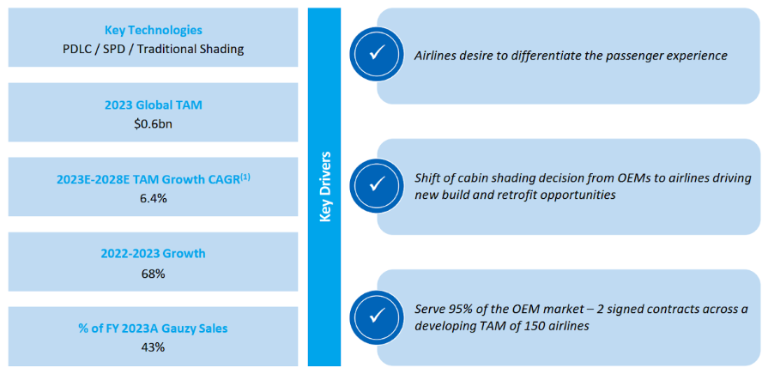

And then there are the buildings. Their smart glass is featured in iconic structures like National Geographic’s headquarters and Wix’s offices. Architects love their products because they combine aesthetics with sustainability, cutting energy costs by up to 20%.⁶

This isn’t just technology for the sake of technology—it’s innovation that’s making a tangible difference in people’s lives.

Gauzy Ltd. (NASDAQ:GAUZ): The Hidden Gem in a $124 Billion Industry

Gauzy Ltd. (NASDAQ:GAUZ) isn’t a household name—yet. But with its groundbreaking LCG® Smart Glass technologies , this company is quietly redefining how industries use glass.

From electronically dimmable aircraft windows to smart glass sunroofs in vehicles and facades for buildings to life-saving AI-powered cameras on the road, Gauzy Ltd. (NASDAQ:GAUZ) has embedded its innovations into products that touch millions of lives.

The numbers tell the story:

- 2023 Revenue: $77.98 million⁷—a 59% jump from $49.03 million in 2022.

- Market Cap: $193 million as of January 6, giving investors a rare opportunity to buy into a leader in the smart glass market.

- Share Price: Currently trading at $10.36.

And 2024 is looking to be a record-breaking year for Gauzy Ltd. (NASDAQ:GAUZ), with revenues projected to surpass $100 million.⁸

Not to mention the company’s revenue backlog of $38.3 million⁹ and several new multi-million dollar deals— like a contract to supply 50,000 EVs annually¹⁰ and $240 million in aeronautics commitments over the next decade.¹¹

This isn’t just a company on the rise—it’s a leader in a market that’s expected to reach $124 billion by 2028, at an impressive compound annual growth rate (CAGR) of 22.8%.¹²

Press Releases

What Makes Gauzy (NASDAQ:GAUZ) Stand Out Amongst Its Peers

Smart glass is no longer a niche product—it’s a key growth sector, driven by demand in automotive, architecture, and aviation.

And Gauzy Ltd. (NASDAQ:GAUZ) isn’t your typical smart glass technology company. It’s a global innovator.

Gauzy’s (NASDAQ:GAUZ) edge lies in its diverse applications of Light Control Glass (LCG®). Imagine glass that adjusts itself to reduce glare, create privacy, improve visibility, and save energy—all on its own.

In the real world, this means:

- Pilots experience safer, glare-free flights.

- Drivers benefit from sunroofs that automatically adjust to the perfect tint.

- Office workers enjoy better natural lighting while their building saves energy.

These aren’t futuristic promises—they’re real-world solutions already making an impact.

- Cutting-Edge Automotive Solutions

Gauzy’s (NASDAQ:GAUZ) Smart-Vision® Camera Monitor System replaces traditional mirrors in commercial vehicles with high-definition camera systems, improving safety and reducing blind spots.

That’s not all – Gauzy’s (NASDAQ:GAUZ) Suspended Particle Device (SPD) and Liquid Crystal (LC) technologies power advanced sunroofs and windows, dynamically adjusting transparency for energy efficiency and passenger comfort.

Major automotive giants like BMW, Ferrari, Ford Trucks, and Daimler rely on Gauzy’s innovations to enhance both safety and luxury.

- Dominating Aviation:

With a 95% market share in cockpit shading, Gauzy Ltd. (NASDAQ:GAUZ) is a Top Tier 1 vendor that dominates the skies. These systems, trusted by Boeing, Bombardier, and many others, are projected to generate $240 million in revenue over the next decade.¹³

- Greener Buildings with Smarter Glass:

In architecture, Gauzy Ltd. (NASDAQ:GAUZ) partners with iconic brands like National Geographic and Wix. In buildings, its smart glass dynamically adjusts to block out light, which can reduce energy consumption by 20%,¹⁴ meeting the global demand for sustainable solutions.¹⁵

- Safety Tech Leadership

Gauzy’s (NASDAQ:GAUZ) Smart-Vision® Advanced Driver Assistance Systems (ADAS) is transforming public transit. Already deployed in over 80 cities around the world including Paris, London, Brisbane and New York, this technology replaces side mirrors with high-definition cameras and interior displays, reducing blind spots and enhancing driver awareness.

The company’s partnership with Yutong, the world’s largest bus OEM, is a major milestone. Gauzy Ltd. (NASDAQ:GAUZ) recorded a 250% year-over-year increase in ADAS orders from Yutong in Q3 2024,¹⁶ further solidifying its position as a key supplier of advanced transportation safety solutions.

In fact, Gauzy’s Smart-Vision® CMS just earned Yutong’s Outstanding Supplier Award, with systems enhancing safety and efficiency on 25+ bus models worldwide.17

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Why We Think Gauzy Ltd. (NASDAQ:GAUZ) Is Undervalued

Despite its impressive growth and partnerships, Gauzy Ltd. (NASDAQ:GAUZ) remains significantly undervalued.

As of January 6, 2025, Gauzy Ltd. (NASDAQ: GAUZ) closed at $10.36 per share. This valuation positions the company’s market capitalization at approximately $193 million.

Here’s why investors are paying attention:

- Strong Analyst Support: Recent coverage includes four “Buy” ratings, with analysts citing Gauzy’s (NASDAQ:GAUZ) dominance in aviation and growing presence in automotive and architectural markets.

- Year-Over-Year Growth: Gauzy continues to deliver strong YoY revenue growth, driven by increasing adoption of its technologies across markets with large Total Addressable Markets (TAMs) and products that are rapidly becoming industry standards.¹⁸

- Float and Share Structure: With a manageable float of approximately 18.6 million shares, Gauzy Ltd. (NASDAQ:GAUZ) is well-positioned for potential share price appreciation as demand for its stock grows.

The Big Brands That Trust Gauzy Ltd. (NASDAQ:GAUZ)

From public buses to cutting-edge aircraft, Gauzy Ltd. (NASDAQ:GAUZ) has secured partnerships with some of the world’s biggest names:

- BMW and Ferrari use its technologies in their vehicles to enhance safety and style.

- Boeing, Bombardier, HondaJet and many more rely on its LCG® Smart Glass and cabin shading solutions to improve visibility and comfort.¹⁹

- Yutong, the worlds largest bus manufacturer, and Ford Trucks, a leading OEM, rely on Gauzy Ltd. (NASDAQ:GAUZ) as a key supplier for advanced transportation safety solutions.²⁰

- Architectural landmarks like the National Geographic headquarters showcase its dynamic smart glass.

These partnerships don’t just validate Gauzy’s technologies—they underscore its potential to dominate the $124 billion global smart glass market²¹ AND the global ADAS market, which is projected to reach $86 billion by 2029.²²

Visionary Leadership Driving Innovation

Behind every great company is a great team, and Gauzy Ltd. (NASDAQ:GAUZ) is no exception.

Together, they’ve built a company that’s not just leading—it’s redefining what’s possible in light and vision control.

The Bottom Line: Why Gauzy Ltd. (NASDAQ:GAUZ) is the Next Big AI Play

This is more than a story about smart glass technology and AI-powered cameras for public vehicles—it’s about transforming industries.

From safer cars, trucks and buses to more efficient airplanes to greener buildings, Gauzy Ltd. (NASDAQ:GAUZ) is at the forefront of a revolution in how we interact with light and transparency.

For investors, the combination of undervalued stock, industry dominance, and cutting-edge smart tech solutions makes Gauzy Ltd. (NASDAQ:GAUZ) one of the most compelling opportunities in the market today.

The AI renaissance is here, the smart glass revolution is unfolding and Gauzy Ltd. (NASDAQ:GAUZ) is leading the way.

With groundbreaking AI-driven innovations, partnerships with global giants, and a rapidly growing market presence.

Learn why analysts are calling Gauzy Ltd. (NASDAQ:GAUZ) a “must-watch” company and how its patented technologies are reshaping industries like automotive, architecture, and aviation.

Eyal PesoCo-Founder and CEO

Eyal PesoCo-Founder and CEO Adrian LoferCo-Founder and Chief Technology Officer

Adrian LoferCo-Founder and Chief Technology Officer