AMC Entertainment

AMC

shares soared nearly 100% Wednesday, while fellow so-called meme stocks Bed Bath & Beyond

BBBY

and GameStop

GME

jumped 60% and 13%, respectively. Despite these huge gains the broader market was far more subdued with all three major U.S. indexes up marginally on the day.

The big meme moves occurred on another low volume day following the long Memorial Day weekend. The trading volume will likely remain far below average as summer begins and people start vacationing again. More cities around the U.S. are starting to reopen nearly completely amid the successful coronavirus vaccine push.

The economic boom, coupled with the Fed’s easy money policies, supply chain setbacks, government checks, and other factors have all contributed to rising prices that brought out inflation fears after April’s 4.2% CPI figure was released. Clearly, rising prices must be monitored and Wall Street will be watching the Fed closely.

But the central bank has continued to remain firm that inflation will be “transitory.” Investors should also know that even if the Fed is forced to raise rates, yields will likely remain historically low, extending

there is no alternative

investing. For example, the 10-year U.S. Treasury yield has moved slightly above 3% only a few times in the last decade, after remaining well above the threshold in the pre-financial crisis world—it has hovered around 1.6% for much of the past three months.

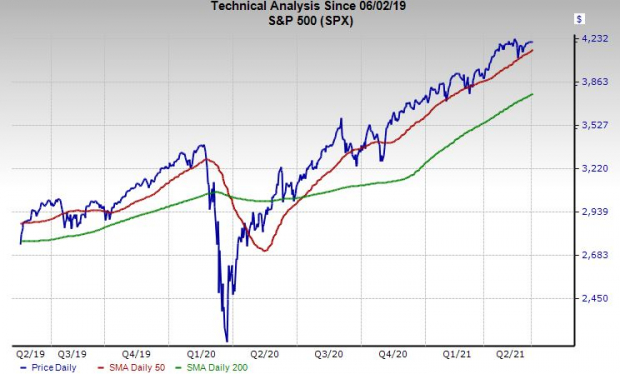

The current backdrop and the constantly improving earnings picture, provides clarity as to why the bulls pushed the S&P 500 back up near its records and have the tech-heavy Nasdaq above its 50-day morning average. And the benchmark index is up around 25% from its pre-pandemic levels last February, which paints a far less overheated picture compared to its over 80% run off the March lows.

With this in mind, investors might want to consider adding growth focused stocks to their portfolios that are still trading below their highs, even as the meme stocks soar once again…

Image Source: Zacks Investment Research

GrowGeneration Corp.

GRWG

GrowGeneration one of the biggest hydroponics suppliers in the U.S., with over 50 retail and distribution centers. The company sells everything from organic nutrients and advanced lighting technology to “state of the art hydroponics equipment used by commercial and home growers.” The hydroponics space stands to benefit from the broader legal marijuana boom in the U.S. no matter which of the actual growers like Tilray

TLRY

or Canopy Growth

CGC

takes more market share down the road.

The strength of the hydroponics space that also supports indoor farming/gardening more broadly is a big reason why Scotts MiracleGro

SMG

shares have been on such a big run. GRWG beat our Q1 estimates in early May and raised its FY21 outlook. GrowGeneration’s sales soared 173%, with comps up 51%.

Looking ahead, Zacks estimates call for GRWG’s FY21 revenue to climb another 139% to $462 million, which would come on top of FY20’s 143% top-line expansion. Meanwhile, its adjusted full-year earnings are expected to climb 364% from $0.11 to $0.51 a share.

GRWG’s consensus earnings estimates have climbed since its report to help it land a Zacks Rank #2 (Buy) right now, alongside an “A” grade for Growth in our Style Scores system. Plus, all six brokerage recommendations Zacks has for the stock are “Strong Buys” and it’s part of a space that sits in the top 8% of our over 250 industries.

Image Source: Zacks Investment Research

GrowGeneration stock has soared 540% in the last year. But the stock has cooled down significantly in 2021, up 7% to lag the S&P 500 and its industry. GrowGeneration shares popped 1.5% on Wednesday, as part of a recent run. But at $43 a share, it still trades around 30% below its February records and it sits near neutral RSI levels right now, which could give it runway.

Wednesday’s pop was part of a larger industry climb after Amazon

AMZN

announced Tuesday that it will no longer screen prospective employees for marijuana for any positions not regulated by the Department of Transportation. The e-commerce giant also wrote in a blog post that it is “actively supporting The Marijuana Opportunity Reinvestment and Expungement Act of 2021 (MORE Act)—federal legislation that would legalize marijuana at the federal level.”

Even if the specific bill is not passed, some type of full U.S. federal legalization of marijuana for adults seems like a pretty solid bet considering that an April

Pew Research poll

showcased that 91% of U.S. adults “say either that marijuana should be legal for medical and recreational use (60%) or that it should be legal for medical use only (31%).” When federal legalization happens, the marijuana industry floodgates will likely burst open and GrowGeneration appears to be worth considering.

Micron Technology, Inc.

MU

Micron is one of the largest makers of DRAM and NAND memory chips in the world. As a quick primer, DRAM chips are featured within PCs and data centers, while NAND, or flash memory, is made for storing data and can be found in mobile phones and other devices. Unfortunately, Micron faces supply-chain worries that impact its entire industry.

The global chip shortage has some on Wall Street nervous and MU is down 12% since it hit records on April 12—closed regular trading Wednesday at $84.32 a share. Luckily, Micron has popped about 10% since May 12 to push it just above neutral RSI levels. And MU has surged 72% in the last year after it started to break out of its cyclical slump in August.

Overall, 14 of the 21 brokerage recommendations Zacks has for Micron are “Strong Buys,” with three more “Buys,” and none below a “Hold.” MU rocks an “A” grade for Momentum, as well as “Bs” for Growth and Value.

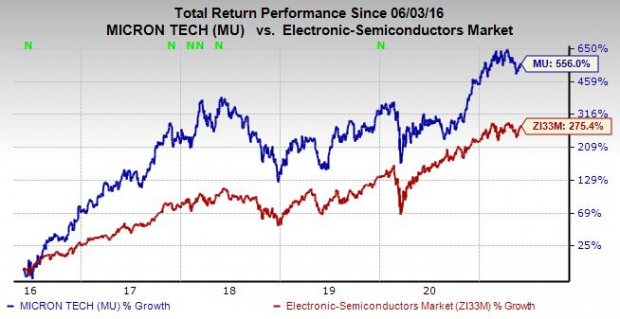

Micron has consistently traded at a big discount to the Semiconductor Industry over the last five years despite outclimbing the space, up 550% vs. 275%. Micron currently trades at a 60% discount to the industry at 8.7X forward 12-month earnings. This also represents a 40% discount to its own year-long median.

Image Source: Zacks Investment Research

Micron topped our Q2 FY21 estimates at the end of March, with sales up 30% to extend its streak of double-digit revenue growth to four straight quarters, as it bounces back from a downturn. The company’s adjusted earnings also skyrocketed and it provided strong guidance, with it set to benefits from key growth areas within tech such as 5G, AI, and data centers. CEO Sanjay Mehrotra also addressed the global chip shortage and its capital spending plans.

Zacks estimate call for MU’s fiscal 2021 revenue to jump 26% to $27 billion, with FY22 projected to climb over 32% higher. These estimates would mark a strong return to growth after two down years and see FY22 easily top FY18’s sales total ($30.4 billion) at $35.3 billion. And MU’s adjusted earnings are projected to soar 96% this year and another 103% in fiscal 2022.

Micron’s strong post-release EPS revisions activity helps it capture a Zacks Rank #2 (Buy) right now. And in the end, investors with longer-term buy-and-hold mentalities might want to consider the memory chip standout.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report