Fortress Biotech

FBIO

along with its partner company Cyprium Therapeutics announced that the two completed pivotal studies evaluating CUTX-101, its candidate for the treatment of patients with Menkes disease, achieved both primary and secondary efficacy endpoints.

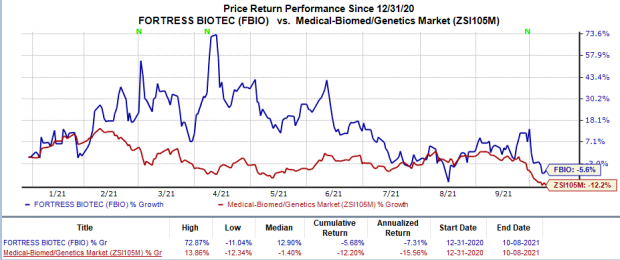

Shares of Fortress increased 1.7% on Oct 8, following the news. Yet, the company’sstock price has declined 5.7% in the year so far in comparison with the

industry

’s 12.2% decline.

Image Source: Zacks Investment Research

Both the pivotal studies evaluated the comparison of the treatment of Menkes disease between participants who were administered CUTX-101 and those who were not administered CUTX-101. The studies divided these two participant populations into two cohorts — Early Treatment (ET) i.e., patients whose treatment was initiated within four weeks of birth, and Late Treatment (LT), patients whose treatment was initiated four weeks after birth.

Data from both the studies demonstrated that treatment with CUTX-101 in both cohorts achieved a significantly greater median overall survival (OS) in comparison to participants who were not treated with CUTX-101.

The primary and secondary efficacy endpoints of both the studies were comparison of OS in patients treated with CUTX-101 against patients not treated with the drug in ET and LT cohorts, respectively. Participants administered with CUTX-101 observed a reduction in the risk of death by 79% and 75% over participants not treated with the drug in the ET & LT cohorts, respectively.

Cyprium anticipates initiating a rolling submission of the new drug application for CUTX-101 to treat Menkes disease with the FDA in fourth-quarter 2021 based on the above-mentioned positive data from the two studies.

Menkes disease is a rare disease in pediatric patients that is caused by gene mutations of copper transporter ATP7A.

Please note that CUTX-101 is an investigational subcutaneous injectable formulation of copper histidinate (CuHis) being developed by Cyprium in partnership with Sentynl Therapeutics, which is owned by the Zydus Group. While Cyprium holds the development responsibility of the drug, Sentynl will be responsible for the commercialization of the candidate, once approved by the FDA.

Zacks Rank & Stocks to Consider

Fortress Biotech currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the healthcare sector include

Horizon Therapeutics

HZNP

,

Regeneron Pharmaceuticals

REGN

and

Vertex Pharmaceuticals

VRTX

, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Horizon’s earnings per share estimates for 2021 have increased from $4.46 to $4.67 in the past 60 days. The same for 2022 has risen from $5.84 to $6.23 over the same period. The stock has rallied 55.5% in the year so far.

Regeneron’s earnings per share estimates for 2021 have increased from $53.22 to $61.41 in the past 60 days. The same for 2022 has risen from $44.11 to $46.73 over the same period. The stock has rallied 13.9% in the year so far.

Vertex’s earnings per share estimates for 2021 have increased from $12.28 to $12.37 in the past 60 days. The same for 2022 has risen from $13.02 to $13.13 over the same period.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report