Genocea Biosciences, Inc.

GNCA

announced that it has initiated a phase I/IIa TiTAN study on its investigational neoantigen-targeted T-Cell therapy, GEN-011, by dosing the first patient in the study.

We remind investors that in September 2020, the FDA accepted the investigational new drug application for GEN-011 allowing it to initiate the phase I/IIa study in patients who have failed standard-of-care checkpoint inhibitor therapy. The study aims at evaluating the drug’s safety, promoting T cell proliferation and persistence as well as boosting clinical activity.

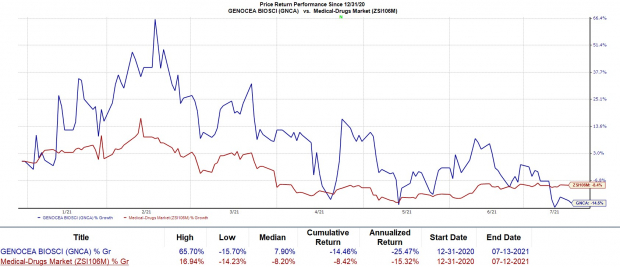

Shares of Genocea have declined 14.5% so far this year in comparison with the

industry

’s 8.4% decline.

Image Source: Zacks Investment Research

The TiTAN study will evaluate two dosing regimens of GEN-011 — a repeated lower dose regimen without lymphodepletion and a single high dose administration of GEN-011 after lymphodepletion. Both groups will receive interleukin-2 after GEN-011 dosing to maximize the tumor-killing potential of the infused cells. The company expects to report top-line data from the study in fourth-quarter 2021 or first-quarter 2022.

Genocea aims to develop immunotherapies for cancer patients by identifying the right tumor targets. To achieve this mission, the company has developed a proprietary ATLAS platform to optimize antigen selection and comprehensively profile antigens on the patient’s tumor. Using ATLAS, GEN-011 employs better targeting to select optimal neoantigen targets that drive anti-tumor immune responses and avoid immunosuppressive Inhibigens.

In addition to GEN-011, the company is also undergoing phase I/IIa study for an investigational neoantigen vaccine, GEN-009. It is also researching on several indications wherein ATLAS can optimize antigen selection for therapies.

Zacks Rank & Stocks to Consider

Genocea currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the drug sector include

Addex Therapeutics

ADXN

,

Catalent

CTLT

and

Translate Bio

TBIO

. While Catalent holds a Zacks Rank #1 (Strong Buy), both Addex and Translate Bio currently carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Addex’s loss estimates for 2021 have narrowed from $2.79 to $2.34 per share in the past 60 days while that of 2022 has decreased from $2.98 to $2.51 over the same period.

Catalent’s earnings estimates for 2021 have increased from $2.90 to $2.94 per share in the past 60 days while that of 2022 has risen from $3.37 to $3.49 over the same period. The stock has risen 8.9% in the year so far.

Translate Bio’s loss estimates for 2021 have narrowed from $0.41 to $0.27 per share in the past 60 days. The stock has risen 60% in the year so far.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report