Graybug Vision, Inc.

GRAY

announced that its board of directors is willing to conduct a comprehensive review of strategic options and alternatives focused on maximizing shareholders’ value of the company.

As a part of this strategic review, Graybug is considering a potential sale of the company apart from evaluating other alternatives like an acquisition, merger, divestiture of assets, and private placement of equity securities, among others.

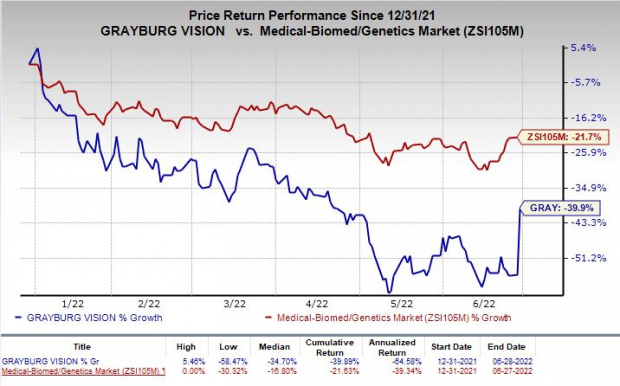

Shares of Graybug were up 35.4% on Tuesday following the announcement of the news. The stock has plunged 39.9% so far this year compared with the

industry

’s decline of 21.7%.

Image Source: Zacks Investment Research

The primary goal of the above-mentioned strategic review is to maximize shareholders’ value. The company is also looking to maximize its cash resource with several cost-containment measures.

Graybug had cash, cash equivalents, and short-term investments worth $55.3 million as of Mar 31, 2022.

Graybug is engaged in developing transformative medicines for ocular diseases. The company has a diversified portfolio of pipeline candidates that are being developed to treat vision-threatening diseases.

Graybug’s lead drug candidate, GB-102, is being developed as an intravitreal injection in early-stage studies for the treatment of wet age-related macular degeneration. The candidate is a microparticle formulation of a pan-VEGF inhibitor, Sutent (sunitinib). Also, GB-102 has the potential to benefit patients with diabetic retinopathy.

The company also boasts of a pipeline of novel gene therapies that are being developed to treat rare vision-threatening corneal and retinal diseases.

Strategic reviews and restructuring are often considered by companies as cost-cutting initiatives. However, it remains to be seen how this review of strategic alternatives helps the board of Graybug to maximize their shareholders value while leveraging its diversified pipeline.

Zacks Rank & Stocks to Consider

Graybug currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Aeglea BioTherapeutics’ loss per share estimates narrowed 19.4% for 2022 and 37.5% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AGLE delivered an earnings surprise of 9.47%, on average.

Precision BioSciences’ loss per share estimates narrowed 26.2% for 2022 and 42.6% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report