GrowGeneration Corp.

GRWG

announced opening a new hydroponic garden center in Jackson, MS, to serve the developing Mississippi market. The new store will mark its first location in the city and the company’s 64th store location in the United States. The new store will open on Jun 27, 2022.

GrowGeneration has also signed two store leases in North Chesterfield, VA and Hazelwood, MO, which will strengthen the company’s footprint in new and emerging markets. These stores are expected to be opened in the second half of the current year, taking the number of states the company operates to 16. These new stores will help growers with vertical farming demonstrations and educational support to set up and maintain state-of-the-art grow operations that will support them maximize their investments in vertical farming.

The new 40,000-square feet Mississippi store will help capture the Southeast’s emerging markets. Like Oklahoma, Mississippi is an ideal market for GrowGeneration’s one-stop shop as it provides unlimited medical cultivation licenses and new and existing cultivators seed to harvest solutions.

GrowGeneration opened more than 9,000 licensed farms in Oklahoma City in the past three years since the city legalized medical cannabis production. The number has exceeded the licensed farms in California — the world’s largest legal cannabis market. The company’s core growth strategy is to expand the number of its retail garden centers throughout North America.

In first-quarter 2022 earnings call, the company updated its current year financial guidance. GrowGeneration expects revenues between $340 million and $400 million in 2022. The company had earlier provided guidance of $415-$445 million. Full-year adjusted EBITDA guidance is expected to be within $10 million, down from the prior range of $30-$35 million. GRWG expects to open 10-15 stores this year. The company trimmed its target from the earlier planned 15-20 locations. The move supports its intention to refrain from building new stores in states where it already has a physical retail presence.

GrowGeneration’s earnings and revenues in the March-end quarter were impacted by weakness in the cannabis industry. Comparable store sales in the quarter slumped 35.5% from the prior year’s levels at its 48 retail locations and e-commerce operations.

The company anticipates the ongoing revenue and gross profit headwinds to intensify in the second quarter. Despite the weak demand faced by the industry currently, GRWG believes that the long-term prospect of hydroponics remains intact.

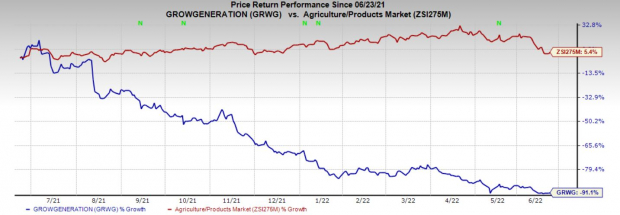

Price Performance

GrowGeneration’s shares have fallen 91.1% in the past year against the

industry

’s growth of 5.4%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

GrowGeneration currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are

Allegheny Technologies Inc.

ATI

,

Nutrien Ltd.

NTR

and

Albemarle Corporation

ALB

, each flaunting a Zacks Rank #1 (Strong Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Allegheny has a projected earnings growth rate of 869.2% for the current year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 27.3% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 128.9%, on average. ATI has gained around 15.6% in a year.

Nutrien has a projected earnings growth rate of 163.2% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 27.5% upward in the past 60 days.

Nutrien’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average being 5.8%. NTR has gained 42.9% in a year.

Albemarle has a projected earnings growth rate of 203.7% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 100.4% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 22.5%. ALB has gained 46.5% in a year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report