Henry Schein, Inc.

HSIC

recently announced a new distribution leadership structure, which seeks to mobilize the benefits of combining the management of the company’s Dental and Medical distribution businesses. The new organizational structure is likely to boost Henry Schein’s strategic goals of enhancing customer experience and operational performance.

It is to be noted that the company will continue to report quarterly sales in the categories of Dental, Medical, and Technology and Value-Added Services. The new structural changes will not result in any related restructuring expenses.

Highlights of the Structural Changes

Henry Schein noted that it will create two groups to lead the management of its Dental and Medical distribution businesses globally.

The North America Distribution Group will be led by Brad Connett as CEO. Connett, who joined the company in 1997, formerly served as the President of Henry Schein’s U.S. Medical Group. The International Distribution Group will be led by Andrea Albertini as President. Albertini, who joined the company in 2013, formerly served as President of Henry Schein’s EMEA Dental Distribution Group.

Moreover, Henry Schein plans to continue to focus on tackling customer needs by expanding its three specialty products and services businesses.

Henry Schein One, led by CEO Mike Baird, offers integrated software and services to the dental space.

Image Source: Zacks Investment Research

The Global Oral Reconstruction Group, led by Rene Willi, CEO, and Steve Boggan, Chief Commercial Officer, comprises the Camlog and BioHorizons Group as well as medentis medical. Together, these form a leading dental implant and bone regeneration products business.

The Strategic Business Units Group, led by CEO David Brous, covers manufacturing and service-based endodontic, orthodontic, and other health care businesses.

Strategic Efforts

The new organizational structure will continue to enhance the company’s exposure to faster-growing and higher-margin markets through organic growth and acquisitions. The organizational changes reflect the continued development of Henry Schein’s strategy to capitalize on the major trends in health care. The restructuring is intended to enhance customer experience and increase efficiency with an integrated offering of products, solutions, and services.

As part of the continuous operational improvement, Henry Schein has been pursuing a strategy called ‘One Distribution’ to incorporate the management of distribution businesses globally. One Distribution is intended to leverage functions, talent, processes, and systems across Henry Schein’s distribution businesses to improve customer experience and maximize efficiency and performance.

Progress With Henry Schein Business

Henry Schein’s distribution business boasts a wide global footprint with 61 distribution centers. During the second quarter, global dental consumable merchandise internal sales increased 90.5% in the second quarter compared to the prior year with solid dental consumable merchandise sales growth in the United States, Canada, Australia, New Zealand, Brazil and Asia. In Europe, the company witnessed strength in dental consumable merchandise sales in France, Germany, Austria, Belgium, The Netherlands, Italy, Poland, and the U.K. North American dental internal sales growth in local currencies was 105% compared with the prior-year figure.

Moreover, Henry Schein’s revenue growth has been consistently supported by niche acquisitions and partnerships. In June 2021, Henry Schein acquired eAssist Dental Solutions — a developer of key leading virtual dental billing outsourced services. In May 2021, Henry Schein One acquired a majority ownership in Jarvis Analytics that develops comprehensive business analytic tools to help dental practices leverage data to diagnose problems, strengthen decision-making and improve business performance.

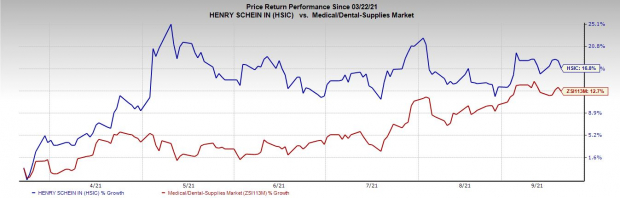

Price Performance

Shares of the company have gained 16.8% in a year’s time compared with the

industry

’s rise of 12.7%.

Zacks Rank and Other Key Picks

Currently, Henry Schein carries a Zacks Rank #2 (Buy).

A few other similar-ranked stocks from the broader medical space are

Envista Holdings Corporation

NVST

,

BellRing Brands, Inc.

BRBR

and

Biolase, Inc.

BIOL

, each carrying a Zacks Rank #2. You can see

the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Envista Holdings has an estimated long-term earnings growth rate of 27%.

BellRing Brands has an estimated long-term earnings growth rate of 29%.

Biolase has a projected long-term earnings growth rate of 15%

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report