Chemed Corporation

CHE

has been gaining from strength in both VITAS and Roto-Rooter segments. Sequential growth in hospital-directed admissions and nursing home admissions within the VITAS arm appears promising. Furthermore, a good solvency position buoys optimism for the stock. Yet, pandemic-led disruptions and seasonality of the business raise apprehension.

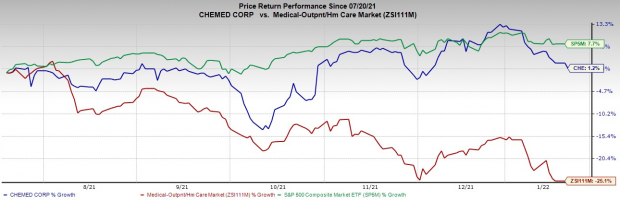

Over the past six months, the Zacks Rank #3 (Hold) stock has gained 1.2% against a 25.1% decline of the

industry

and a 7.7% rise of the S&P 500.

The renowned hospice care provider has a market capitalization of $7.37 billion. Chemed’s earnings surpassed estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 5.6%.

Over the past five years, Chemed’s earnings grew 22.2%, way ahead of the industry and S&P 500’s 17.3% and 2.8% increase, respectively. The company projects 7.7% growth for the next five years compared with the industry and the S&P 500’s projected growth rate of 20.2% and 11.9%, respectively.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors at Play

VITAS Prospects Bright:

Chemed’s VITAS segment has been registering robust performance over the last few quarters. Total VITAS admissions in the third quarter came at 17,598, registering a 4.5% increase from the second quarter. The company also saw a 2% increase in hospital-directed admissions, a 16.3% rise in total home-based pre-admit admissions, an 8.9% spike in nursing home admissions and a 5% increase in assisted living facility admissions, on a sequential basis. Chemed’s updated guidance suggests a sequential improvement in senior housing base patients in the fourth quarter and acceleration in senior housing admissions in 2022, further raising optimism surrounding the stock.

Roto-Rooter Continues to Expand:

We are upbeat about Chemed’s Roto-Rooter segment, which is currently the leading provider of plumbing, drain cleaning service and water restoration in the United States. On a year-over-year basis, Roto-Rooter’s revenues rose 15.7% for the third quarter. Total branch commercial revenues improved 10% while Roto-Rooter branch residential revenues registered 17.2% growth for the reported quarter. Management believes Roto-Rooter is well positioned for post-pandemic growth and anticipates continued expansion of the segment’s market share.

Strong Solvency:

Chemed exited the third quarter with cash and cash equivalents of $28.7 million and no long-term debt. This is suggestive of the fact that Chemed’s solvency level is pretty promising.

Downsides

Pandemic Causes Revenue Erosion:

The COVID-19 pandemic continues to impact senior housing occupancy, according to data released by the National Investment Center for Seniors Housing & Care. In this regard, pandemic-led disruptions to senior housing occupancy and hospice referrals continued to challenge Chemed’s VITAS segment in the third quarter.

Seasonality Headwinds:

A substantial portion of VITAS admissions and revenues are concentrated only within the state of Florida, as retirees often tend to relocate to the state during winter months. Further, Roto-Rooter’s revenues and operating results are impacted by weather patterns across the United States.

Tough Competition:

Chemed faces significant competition in the sewer, drain and pipe cleaning, and plumbing repair markets. The VITAS arm also competes with a large number of organizations on the basis of its ability to deliver quality, responsive services.

Estimate Trend

Over the past 90 days, the Zacks Consensus Estimate for Chemed’s 2021 earnings has moved 4.2% north to $19.14.

The Zacks Consensus Estimate for the company’s 2021 revenues is pegged at $2.14 billion, suggesting a 3.0% rise from the 2020 reported number.

Key Picks

Some better-ranked stocks in the broader medical space include

Baxter International Inc.

BAX

,

Hologic, Inc.

HOLX

and

Apollo Endosurgery, Inc.

APEN

.

Baxter, currently carrying a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 9.5%. Baxter’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 10.2%, on average. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Baxter has outperformed the industry over the past year. BAX has gained 7.9% against a 12.8% decline of the industry in the said period.

Hologic, holding a Zacks Rank #1 at present, has a long-term earnings growth rate of 7.4%. The company surpassed earnings estimates in three of the trailing four quarters and missed on another occasion, delivering an average surprise of 29.2%.

Hologic has declined 10.1%, underperforming the industry’s 8.1% drop over the past year.

Apollo Endosurgery, presently carrying a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 7%. Apollo Endosurgery’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 25.6%, on average.

Apollo Endosurgery has outperformed the industry in the past year. APEN has gained 43.5% versus the industry’s 8.1% fall in the said period.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.3% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report