Haemonetics Corporation

HAE

is well-poised for growth in coming quarters backed by strong end-market demand for NexSys PCS system with Persona technology along with the huge potential of Hemostasis Management franchise. The company’s better-than-expected results in first-quarter fiscal 2022 buoy optimism. However, economic uncertainty and stiff competition remain concerns

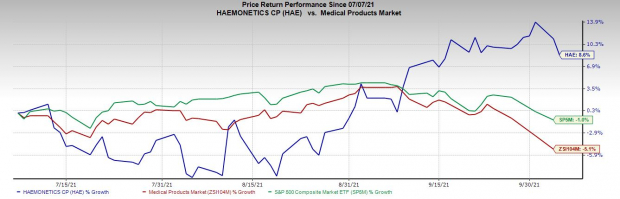

Over the past six months, the Zacks Rank #3 (Hold) stock has gained 8.6% against 5.1% fall of the

industry

and a 1% decline of the S&P 500.

The renowned medical device company has a market capitalization of $3.51 billion. The company projects 10% growth for the next five years and expects to maintain strong segmental performance. The company surpassed estimates in three of the four trailing quarters, the average surprise being 4.54%.

Let’s delve deeper

Key Growth Catalysts

Q1 Upsides:

In the first quarter of fiscal 2022, the company’s adjusted gross margin was 54.7%, up 750 basis points year over year. The improvement was driven by the addition of Vascular Closure from the acquisition of Cardiva Medical, Inc. (Cardiva), productivity savings from the Operational Excellence Program, favorable product mix, and improved operating efficiency. The recently acquired VASCADE vascular closure technology exceeded the company’s expectations with strong revenue growth in the reported quarter.

Huge Potential of Hemostasis Management Franchise:

Under the Hospital business, Hemostasis Management saw strong growth in the past few quarters. Hemostasis Management revenues rose 31% in the fiscal first quarter. The company witnessed growth in the adoption and utilization of TEG disposables and strong instrument placements in the reported quarter. In June 2021, Haemonetics entered into a definitive agreement to acquire privately-held Cardiva Medical — an industry-leading manufacturer of vascular closure systems based in Santa Clara, CA. The acquisition will enhance Haemonetics’ access in the large and growing interventional cardiology and electrophysiology markets.

Image Source: Zacks Investment Research

Potential Upsides of Plasma Franchise:

Haemonetics has been witnessing strong growth in the Plasma franchise for quite some time. In the global plasma market, Haemonetics holds 80% share approximately. It is currently witnessing plasma market growth above historic rates driven by an industry striving to double collections by 2025 and the rising demand for plasma-based medicines. The company continued to benefit from the NexSys device and NexLynk donor management software backed by increased customer adoptions.

Downsides

Economic Uncertainty:

The uncertain economic scenario continues to pose a challenge for Haemonetics. The company has been progressing with blood management solutions even though the attempt is negatively impacted by economic challenges. Moreover, a stronger dollar, causing significant currency fluctuations, has been affecting the company’s outcome over the past few quarters and no respite is expected in the near term.

Competitive Landscape:

Haemonetics operates in a very competitive environment, both for manual and automated systems, which includes companies like MAK Systems, ROTEM analyzers, Medtronic, e Fresenius, MacoPharma, and Terumo, among others. Slower-than-expected product adoption by customers, especially the American Red Cross, might reduce the company’s revenues and profit.

Estimate Trend

Over the past 60 days, the Zacks Consensus Estimate for Haemonetics’ earnings has moved down 0.4% to $2.77.

The Zacks Consensus Estimate for fiscal 2022 revenues is pegged at $2.77 billion, suggesting a 17.9% rise from the year-ago reported number.

Key Picks

A few better-ranked stocks from the broader medical space are

Alcon Inc

ALC

,

McKesson Corporation

MCK

, and

Biolase, Inc.

BIOL

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Alcon has an estimated long-term earnings growth rate of 18%.

McKesson has an estimated long-term earnings growth rate of 8%.

Biolase has a projected long-term earnings growth rate of 15%.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report