Horizon Therapeutics plc

HZNP

announced that it has enrolled the first in a phase II study evaluating its anti-ILT7 human monoclonal antibody, daxdilimab (HZN-7734), for the treatment of people with moderate to severe alopecia areata.

The open-label, proof-of-concept study will investigate daxdilimab for the treatment of alopecia areata, an autoimmune disorder that results in non-scarring hair loss. The primary endpoint of the study is to see the percent change from baseline in Severity of Alopecia Tool or SALT score at week 24.

Per the company, in the United States, more than 600,000 people live with alopecia areata. Hence, if successfully developed and upon potential approval, daxdilimab might serve an area of large unmet medical need for the above-mentioned patient population.

Apart from alopecia areata, daxdilimab is also being developed for treating other autoimmune diseases.

A phase II study, evaluating daxdilimab for treating patients with systemic lupus erythematosus, is currently underway.

Horizon also plans to initiate several phase II studies to evaluate daxdilimab for treating discoid lupus erythematosus, lupus nephritis and dermatomyositis, later in 2022.

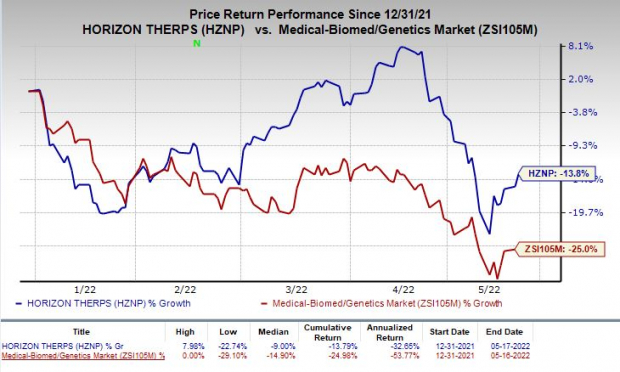

Shares of Horizon have lost 13.8% in the year so far compared with the

industry

’s decline of 25%.

Image Source: Zacks Investment Research

Horizon reports financial results under two segments — Orphan and Inflammation. The company’s portfolio of marketed drugs has been witnessing a solid uptake.

In the first quarter of 2022, the Orphan segment generated sales worth $834.4 million, significantly up on a year-over-year basis.

Sales in the Orphan segment are being driven by the strong uptake of Tepezza, as well as the continued growth of Krystexxa, Ravicti, Procysbi, Actimmune and Uplizna.

Zacks Rank & Stocks to Consider

Horizon currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the biotech sector are

Applied Therapeutics, Inc.

APLT

,

Aeglea BioTherapeutics, Inc.

AGLE

and

EyePoint Pharmaceuticals, Inc.

EYPT

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Applied Therapeutics’ loss per share has narrowed 27.1% for 2022 and 20.2% for 2023 over the past 60 days.

Earnings of Applied Therapeutics have surpassed estimates in one of the trailing four quarters, met the same once and missed the same on the other two occasions, delivering an earnings surprise of -0.67%, on average.

Aeglea BioTherapeutics’ loss per share estimates have narrowed 23.2% for 2022 and 30.6% for 2023 over the past 60 days.

Earnings of Aeglea BioTherapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions, delivering an earnings surprise of 9.47%, on average.

EyePoint Pharmaceuticals’ loss per share estimates have narrowed 8.7% for 2022 and 12.5% for 2023 over the past 60 days.

Earnings of EyePoint Pharmaceuticals have surpassed estimates in one of the trailing four quarters and missed the same on the other three occasions, delivering an earnings surprise of -5.80%, on average.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report