These conditions aren’t normal. Bull runs in markets are generally accompanied by lower inflation rates. And yet, the market barely hiccupped when the Labor Department’s Consumer Price Index (CPI) for October showed a 6.2% surge in prices, on top of a 5.4% increase in September, to record the

fastest increase in inflation since 1990

.

True that some of the optimism stems from the fact that wage rates continue to increase while jobless claims continue to fall. So companies struggling with higher costs (Producers Price Index from the BLS shows an 8.6% inflation for October) because of supply chain issues and energy price increases have succeeded in passing on those higher costs to consumers. So far.

At some point though, something has to give.

Consumers won’t be flush with cash forever. In fact, some reports suggest that they will overspend this holiday season with the attitude of self-indulgence and deal with 2022 later. That could translate to slower demand next year as the higher food and sheltering costs sink in, unless job openings remain high and wages continue to rise. And this is likely to be the case, going by commentaries from companies operating in the manpower industry.

Rising vaccination rates and reducing death rates are already increasing optimism in the services sector, which should therefore come back/hold up next year. The producers side is constrained by the supply chain, which may be expected to normalize by the middle of 2022 when the construction markets are also likely to normalize. Energy prices are high on the Fed’s to-do list. So let’s see how that goes.

We basically have a couple of quarters of uncertainty, including a slight impact from the tapering of bond purchases set to begin next month. While tapering normally has a cooling effect on inflation, the Fed suspects that this time round, the increasing inflation is because of the supply chain, so it could actually have a negative impact on growth. This means that tapering will be gradual and slow.

But it still could pull some money out of riskier assets, including speculative stocks and cryptocurrencies.

So what’s the best way to play this market? We could do a couple of things. First, we could hunt for safe stocks and second, supplement these with stocks that have very high growth potential. And preferably, look at faster-growing industries to increase the odds of success.

The safest stocks are those that have an attractive growth profile, generate solid cash flows, pay a dividend and still trade at attractive valuations.

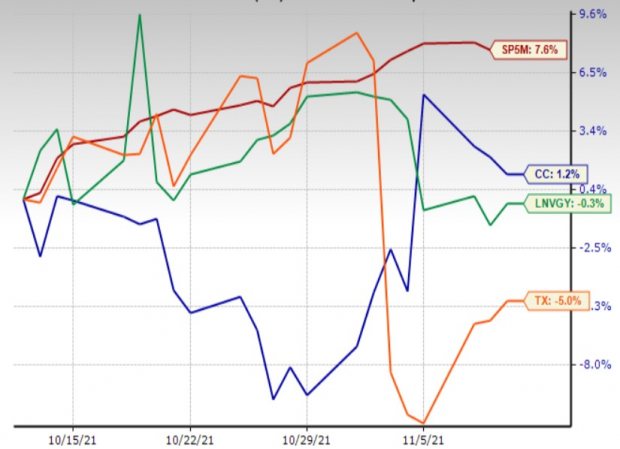

A case in point is Zacks #1 (Strong Buy) ranked Chemours

CC

, which belongs to the Chemical – Diversified industry (top 38%). The company is expected to grow 105% this year and 8% in the next. Earnings estimates for the two years are up 10% and 11%, respectively in the last 30 days. Although impacted significantly by the pandemic, cash flows are bouncing back strongly. CC also pays a dividend that yields 3.17%. However, its P/E of 7.78X, P/S of 0.85X and PEG of 0.22 indicates that the shares are undervalued.

#2 (Buy) ranked Lenovo Group

LNVGY

, which belongs to the Computer – Mini computers industry (top 27%) is expected to grow 74% this year. Although earnings growth is expected to be negative next year, the level of earnings will be well above 2020 levels. And estimates for both years continue to trend up. The company continues to generate solid cash flows with no negative impact from the pandemic; understandably so because the pandemic was actually a big positive for the PC market. Its dividend yields 5.80%. And yet, its P/E of 6.62X, P/S of 0.18X and PEG of 0.43 say that investors are discounting the company’s potential.

Ternium

TX

, which belongs to the Steel – Producers industry, has a Zacks #2 rank. Earnings are expected to grow 534% this year. Although expected to drop off next year, the estimated 2022 earnings are 4X the 2020 levels. The company has also generated solid cash flows all through the pandemic, something that should continue given the level of demand. And its dividend yields 5.16%. At the same time, its P/E of 2.13X, P/S of 0.57 and PEG of 0.12 indicates that the shares are cheap compared to the potential they offer.

Price Performance Over Past Month

Image Source: Zacks Investment Research

And the following stocks look good in terms of their growth potential in 2022-

Zacks #1 ranked Diamondback Energy

FANG

operates in the Oil and Gas – Exploration and Production – United States industry (top 4% of Zacks-ranked industries). The company is expected to grow its earnings 265% this year and 61% in the next. Estimates for the two years are up around 8% and 25% in the last 30 days.

Analysts expect Goodrich Petroleum

GDP

, which is part of the same industry, to grow 1,952% this year and 85% in the next. Estimates for the two years are up 16% and 18%, respectively in the last seven days. The shares carry a Zacks #1 rank.

Another member of the same industry, Earthstone Energy

ESTE

is currently expected to grow 150% this year and 97% in the next. In the last 30 days, the Zacks Consensus Estimate for 2021 and 2022 earnings are up 7% and 19%, respectively.

#2 (Buy) ranked Matador Resources

MTDR

, also belonging to the same industry, is expected to se earnings growth of 621% in 2021 followed by 49% growth in 2022. Its 2021 estimate is up 13% and 2022 estimate is up 25%.

Comstock Resources

CRK

of the same industry, is expected to grow 513% and 74% in 2021 and 2022, respectively. The 2021 estimate is up 16% and the 2022 estimate is up 22% in the last 30 days.

The strong growth in the current year is off a low base in 2020, when oil & gas stocks were pummeled by the hit to traveling. The sustained growth next year assumes continued growth in the economy, strong pricing and travel returning to normal.

A couple of tech stocks are also worth considering.

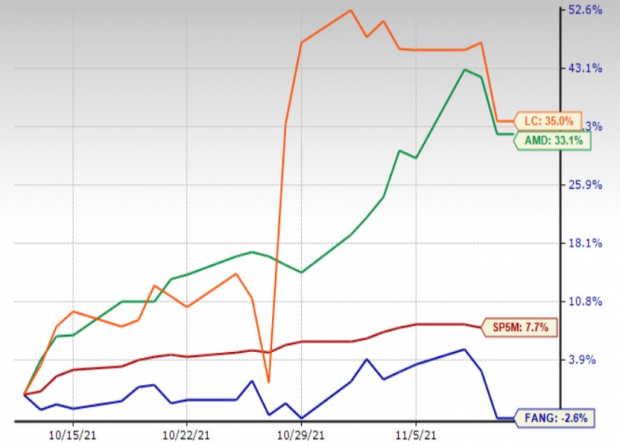

Zacks #2 ranked Advanced Micro Devices

AMD

belongs to the Electronics – Semiconductors industry (top 21%). It is currently expected to post 105% earnings growth this year and 24% growth next year. Its current year EPS is up 6% in the last 30 days while the 2022 EPS is up 7%. The strength in the business is because of its being part of a very fast-growing market, the company’s strong product portfolio and robust pipeline, as well as share gain potential.

Zacks #1 ranked LendingClub

LC

belongs to the Financial – Miscellaneous Services industry (top 26%). It is slated to grow earnings 107% to per share earnings of 11 cents this year from the $1.53 loss in 2020. Next year, it is expected to grow 1282% to $1.52, as the debilitating effect of the pandemic wears off.

Price Performance Over Past Month

Image Source: Zacks Investment Research

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report