Integra LifeSciences Holdings Corporation

IART

released certain preliminary revenue results for the fourth quarter and full-year 2021 on Jan 11. Following the release, shares edged up 0.7% to close at $67.67 in the last trading session.

Integra is set to report fourth quarter and full-year 2021 full financial results on Feb 23, 2022, before market open. Management seems to be upbeat about the company’s fourth-quarter performance, especially amid the ongoing pandemic-led challenges.

Preliminary Q4 & ’21 Results

Per the preliminary announcement, Integra expects to report fourth-quarter 2021 revenues in the range of $404-$406 million, representing around a 4% year-over-year increase on a reported basis and a roughly 8% year-over-year rise on an organic basis. This revenue figure is in line with the company’s November-announced outlook and marks a sequential increase over the previous quarter. The Zacks Consensus Estimate for Integra’s fourth-quarter revenues is pegged at $403.26 million, suggesting a 3.8% rise from the year-ago reported figure.

Image Source: Zacks Investment Research

In addition, the company anticipates full-year 2021 reported revenues in the range of $1,541-$1,543 million, indicating an increase of around 12% on a reported basis and an increase of nearly 14% on an organic basis. The Zacks Consensus Estimate for Integra’s 2021 revenues is pegged at $1.54 billion, suggesting a 12.3% rise from the 2020 reported figure.

More on the News

As part of prior approval by the board of directors, Integra is planning a $125-million share repurchase, with a total authorization of up to $225 million. The company has the option to repurchase shares at its discretion, subject to fulfillment of applicable regulatory and other legal conditions.

Per management, the company’s ability to reinvest for growth and repurchase shares is representative of its strong balance sheet and commitment to create shareholder value.

2022 Update

For 2022, Integra plans to focus on product introductions, clinical research, expanding digital capabilities and international expansion, which will be supported by strategic acquisitions. The company has reaffirmed its long-term financial aspirations and remains committed to attaining a long-term organic growth target of 5-7%.

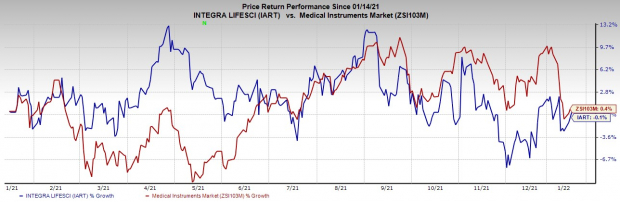

Share Price Performance

The stock has underperformed its

industry

over the past year. It has declined 0.1% against the industry’s 0.4% growth.

Zacks Rank and Key Picks

Currently, Integra carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space that investors can consider are

AMN Healthcare Services, Inc.

AMN

,

Apollo Endosurgery, Inc.

APEN

and

Patterson Companies, Inc.

PDCO

.

AMN Healthcare, carrying a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 16.2%. The company’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 19.5%, on average.

AMN Healthcare has outperformed its industry over the past year. AMN has gained 48.5% against the 54.7% industry decline.

Apollo Endosurgery, carrying a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 7%. The company‘s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 25.6%, on average. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Apollo Endosurgery has outperformed its industry in the past year. APEN has gained 83.1% versus the industry’s 0.4% rise.

Patterson Companies, sporting a Zacks Rank #2, has a long-term earnings growth rate of 9.9%. The company surpassed earnings estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 3.7%.

Patterson Companies has underperformed its industry over the past year. PDCO has declined 15.4% versus the industry’s 7.3% rise.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report