Intellia Therapeutics

NTLA

incurred a loss of $1.09 per share for fourth-quarter 2021, wider than the year-ago loss of 69 cents and the Zacks Consensus Estimate of a loss of 91 cents.

Intellia’s total revenues, which comprise collaboration revenues, came in at $12.9 million for the fourth quarter compared with $6.6 million reported in the year-ago period. The top line also beat the Zacks Consensus Estimate of $9.6 million.

The significant year-over-year increase in revenues was on account of revenues of $5.8 million recorded by the company from its joint venture with AvenCell.

Quarter in Detail

For the reported quarter, research and development expenses were $71.2 million, up 86.1% from the year-ago figure due to increased costs for developing the company’s lead programs.

General and administrative expenses also surged 105.4% year over year to $22.1 million due to higher employee-related costs.

As of Dec 31, 2021, NTLA had cash, cash equivalents and marketable securities of $1,086 million compared with $1,148.7 million on Sep 30, 2021.

Full-Year Results

For 2021, Intellia generated revenues of $33.1 million, reflecting a significant year-over-year decline from the year-ago figure of $58 million.

For the same period, the company reported earnings of $3.78 per share versus the year-ago loss of $2.40.

Pipeline Updates

Intellia remains focused on developing curative therapeutics using the CRISPR/Cas9 technology. The company is evaluating its lead in-vivo genome-editing candidate, NTLA-2001, in a two-part phase I study for treating transthyretin amyloidosis with polyneuropathy. The company plans to present interim data from part 1 of the study on Feb 28 and start part 2 in first-quarter 2022.

Shares of Intellia were up 9.3% on Thursday, probably as investors expect positive updates from this study.

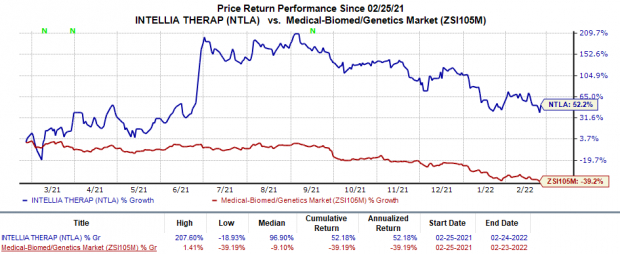

NTLA has risen 52.2% in the past year against the

industry

’s 39.2% decline.

Image Source: Zacks Investment Research

Please note that NTLA-2001 is part of Intellia’s co-development and co-promotion agreement with

Regeneron Pharmaceuticals

REGN

. While NTLA is the lead party for NTLA-2001, Regeneron shares 25% of the development costs and commercial profits. Both Intellia and Regeneron are also developing therapies for hemophilia A and B.

Intellia initiated a phase I/II study evaluating another pipeline candidate NTLA-2002 for the treatment of hereditary angioedema (“HAE”) in December 2021. NTLA-2002 aims to prevent HAE attacks by suppressing plasma kallikrein activity. Interim data from the study is expected in second-half 2022.

NTLA-5001 is the company’s first wholly-owned ex-vivo genome editing candidate for the treatment of cancer. In fourth-quarter 2021, Intellia started patient screening in a phase I/IIa study evaluating NTLA-5001 in adults with persistent or recurrent AML who have previously received first-line therapy.

Alongside its Q4 earnings release, Intellia announced that it nominated two new CRISPR-based development candidates to enter clinical studies. NTLA nominated NTLA-2003, an in-vivo candidate, for the treatment of alpha-1 antitrypsin deficiency (AATD)-associated liver disease. Intellia also nominated its first ex-vivo allogenic CAR-T therapy NTLA-6001 for the treatment of CD30-expressing hematologic cancers. NTLA is advancing both the candidates toward an IND filing so as to initiate clinical studies.

The company is also expanding its pipeline with acquisitions and collaborations. Earlier this month, NTLA acquired a closely-held Rewrite Therapeutics to expand its gene-editing technology platforms and partnered with ONK Therapeutics to develop new therapies for cancer. Last month, NTLA announced a partnership with Kyverna Therapeutics to develop an allogeneic CD19 CAR T-cell therapy to treat a variety of B-cell-mediated auto-immune diseases.

Zacks Rank & Stocks to Consider

Intellia currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include

Arbutus Biopharma

ABUS

and

Vertex Pharmaceuticals

VRTX

, each carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Arbutus Biopharma’s loss per share estimates for 2022 have narrowed from 63 cents to 61 cents in the past 30 days. Earnings of ABUS beat estimates in one of the last four quarters, met the mark once and missed the same on the other two occasions, delivering a negative surprise of 3.6%, on average.

Vertex Pharmaceuticals’ earnings per share estimates for 2022 have increased from $13.35 to $14.33 in the past 30 days. The same for 2023 has risen from $14.12 to $15.31 in the past 30 days. Shares of VRTX have risen 8.1% in the past year.

Earnings of Vertex Pharmaceuticals beat estimates in each of the last four quarters, with the average being 10%.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report