Airbnb (NASDAQ:ABNB) is gearing up to announce its third-quarter 2023 results on November 1, and the expectations are running high. The company anticipates third-quarter revenues ranging between $3.3 billion and $3.4 billion, indicating a year-over-year growth of 14-18% on a reported basis.

The Zacks Consensus Estimate for Airbnb’s third-quarter revenue stands at $3.37 billion, signifying a robust 16.9% increase compared to the figure reported in the same period last year. As for earnings, the Zacks Consensus Estimate is $2.06 per share, suggesting a growth of 15.1% from the year-ago figures. It’s noteworthy that Airbnb has consistently outperformed the Zacks Consensus Estimate for earnings in the past four quarters, with an impressive average beat of 52.6%.

Here’s a closer look at the factors shaping Airbnb’s third-quarter performance:

- Strong Momentum in Nights and Experiences Booked: Airbnb’s third-quarter results are expected to benefit from a robust uptick in Nights and Experiences booked, particularly in the Asia-Pacific region. The Zacks Consensus Estimate for Nights and Experiences Booked stands at 113 million, indicating a 13% growth from the previous year’s figures.

- Growing Average Daily Rate: Factors such as foreign exchange fluctuations, a shift in the mix towards larger homes, and geographic mix are likely to have driven an increase in the Average Daily Rate, which, in turn, should positively impact the quarterly performance.

- Cross-Border Nights Booked: The demand for international travel has been on the rise, resulting in increased Cross-border nights booked, which is expected to be a boon for Airbnb’s third-quarter performance.

- Strong Supply Growth: Airbnb is likely to have witnessed robust supply growth in the quarter under review, owing to increasing travel demand, heightened awareness around hosting, and the introduction of new tools for hosts. Additionally, an uptick in new active listings, driven by reduced fees for extended stays and monthly discounts, is expected to have been another contributing factor.

- Gross Booking Value (GBV) Growth: All these favorable dynamics are projected to have fueled growth in gross booking value (GBV) in the third quarter. The Zacks Consensus Estimate for GBV is at $17.97 billion, marking a 15.2% increase from the figure reported in the year-ago quarter.

Despite these positive factors, Airbnb faces ongoing intense competition in the online travel market, which might have posed a challenge in the third quarter. Moreover, the company could have grappled with macroeconomic challenges that have been on the rise.

As we approach the earnings release date, the market will be keenly watching to see if Airbnb can continue its streak of surpassing expectations and navigate through the competitive and macroeconomic headwinds to maintain its growth trajectory.

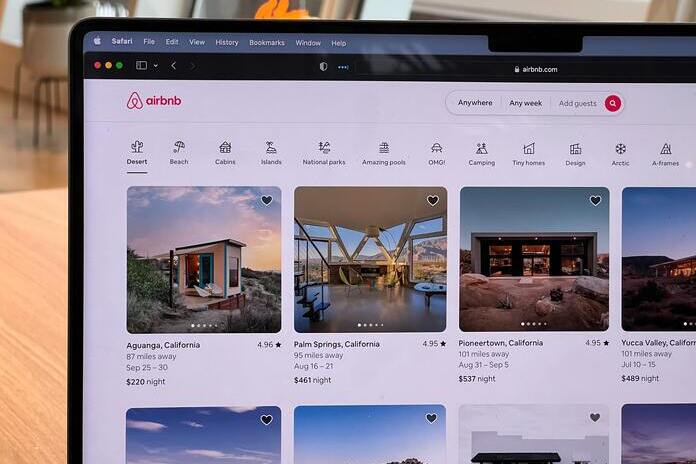

Featured Image: Unsplash